15 Days Price Change

Summary

NCDEX, India’s leading agri-derivatives exchange with a 97% market share in the segment, is undergoing a strategic transformation despite recent losses. Backed by strong institutional investors and minimal debt, it is expanding into equity and weather derivatives to diversify revenue. With a focus on innovation, risk management, and long-term growth, NCDEX presents a compelling opportunity in the unlisted space for forward-looking investors.

NCDEX, which is also known as the National Commodity and Derivatives Exchange Limited, is a professionally regulated online commodity exchange that is based in India. It was incorporated as a recognised stock exchange under the authority of the Securities and Exchange Board of India (SEBI) in 2003. The exchange is a key player in India's financial market infrastructure, offering a platform for trading a diverse range of commodity derivatives.

NCDEX plays a very important role in the commodity market of India, as it offers an efficient price discovery and price risk management platform. It assists a broad range of stakeholders, ranging from primary producers to huge businesses, in the following ways:

Price discovery: NCDEX facilitates the prices of commodities to find their equilibrium through actual supply and demand, as buyers and sellers are brought together on a transparent and electronic platform, which serves as a benchmark for the market.

Price Risk Management: It can provide futures and options contracts on the exchange, allowing participants to protect against price movements. This cushions them against unfavourable price fluctuation, which stabilises their business.

Beyond its core functions, NCDEX is committed to the development of the agricultural sector, aiming to connect primary producers to the exchange to foster sustainable and inclusive economic growth. Its prices are widely recognized as international benchmarks for many commodities.

NCDEX offers a wide and evolving range of products. Its primary area of concentration, and where it holds a significant market share, is agricultural commodities. The main services are divided into the following:

Agri-Commodities: Product offerings in this segment are wide in the exchange.

Spices: These come in the form of actively traded contracts in spices such as jeera (cumin) and turmeric.

Oilseeds: Its major products in this segment are soybean and castor seed contracts.

Pulses: NCDEX offers a pulses trading platform, which includes pulses like Chana (chickpeas).

Other Commodities: It also has derivatives on other commodities, such as that of guar, which contributes immensely to its turnover. Cotton, and Cottonseed Oilcake

NCDEX focuses on agricultural commodity derivatives like spices and oilseeds, holding a near-monopoly with a 97% market share in this segment, making it the go-to platform for agri-related hedging and trading. On the contrary, MCX focuses on non-agricultural commodities such as metals and energy, where it offers industrial and energy markets a platform to hedge and trade, while the most important stock exchanges are NSE and BSE, where equities (stocks) and equity derivatives are traded, where companies can work on raising their capital, and stock trading among investors is carried out on the stock exchanges.

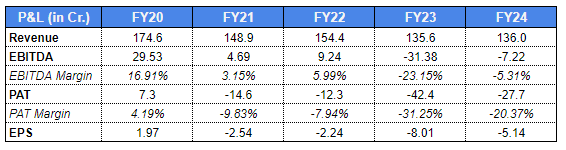

To investors looking into the future of the financial situation in India, NCDEX has good prospects, regardless of its operational losses so far. The financial result, with its negative EBITDA and PAT (e.g., -7.22 Cr EBITDA and -27.7 Cr PAT in FY24), is to be considered within the context of the exchange that is actively pursuing and investing in the strategic transformation and future growth drivers.

Investment Phase: The current negative profitability and EPS at -₹5.14 in FY24 are indicative of a company in a significant investment phase. NCDEX has been investing in bold new products, with the promise of unlocking tonnes of long-term value and revenue diversification.

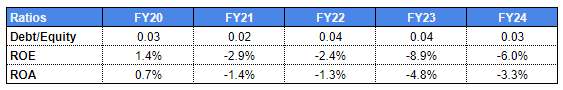

Good Financial Prudence: FCG-NCDEX has a very low debt/equity ratio of 0.03 in FY24, hence an outstanding characteristic for investors. A strong balance sheet and near-independence of external funds give it the financial strength and versatility which are essential in realising its expansion programmes without putting unnecessary risk.

Long-Term Revenue Opportunity: Historical revenue has been variable at 136.0 Cr in FY24, but the shift in certain strategies, like more volume-orientated (such as equities) and more liquid products, such as weather derivatives, will see revenue growth at the top line and later profits.

Valuation Context: A current P/E ratio is negative at -64 and indicates that it is currently unprofitable, yet in the case of growth companies, investors are generally looking toward the future earnings potential with regard to the strategic initiatives and market penetration.

To put it simply, an investment in NCDEX is a long-term bet on its visionary nature and its capability of using its stronghold in agri-derivatives to seize newer and bigger markets. The present financials are a reflection of the expense of a more diversified and sound exchange in the future.

NCDEX has an effective and independent risk governance system, which is of utmost importance to the investors who desire stability and security of their investments. Its risk management is thorough, having considered strategic, operational and financial risks, ensuring its business model remains adaptable, daily operations run smoothly, and its financial health is consistently protected against market volatility and credit exposures. Moreover, NCDEX is traditionally very attentive to the regulation and possible reputational risks, therefore preventing such risks and actively aligning to new regulatory demands, as well as protecting its image in the eyes of the market to retain the trust of investors and sustain credibility. Most importantly, as a digital exchange, it is keen on reducing its technology and cyber risks, and it consistently makes the necessary investments to maintain its expensive systems that enable smooth operations when it comes to avoiding outages, securing sensitive information, and providing a secure and uninterrupted trading experience, is this is the foundation of market integrity in all its group entities.

NCDEX is strategically positioned for transformative growth, making it a compelling investment for those seeking long-term value in India's evolving financial markets.

Huge Market: Its proposed 400-600 crore foray into equity and equity derivatives has a huge potential of new high-volume revenue streams, transforming its core agri-centric activity into substantial reliance.

Dominant Core & Innovation: NCDEX has a monopolised capacity of 97 percent in the developing market of agri-derivatives in India, and it is leading the establishment of new products such as weather derivatives, indicating good innovation and relevance.

Regional and Institutional Strengths: The increasing sphere of influence through tie-ups such as the Colombo Stock Exchange MoU constantly opens up new revenue possibilities and consolidates its regional leadership, which is further supported by a sound institutional shareholding base including LIC and NABARD.

Future Outlook: It is becoming a diversified financial market infrastructure provider, which has expansion potential to capture a leading position in the booming financial market in India and realise the long-term value.

In spite of the recent loss of operation, NCDEX is an attractive long-term investment opportunity as a result of its shift in strategy. By venturing into the bigger equity and equity derivatives market. The company is poised to dramatically boost future revenue and profitability by entering the larger equity and equity derivatives segments, leveraging its 97% monopoly in India's foundational agri-commodity market. Its market penetration opportunities are also augmented by pioneering innovations such as weather derivatives and widening of regional influence, all anchored by firm institutional shareholders.

Whether to invest now or wait depends on any person's risk appetite. Investment at this change-driven stage has the prospect of bigger rewards in the long run as compared to the risks. Waiting also has the potential to minimise the risk through a better vision of the success of the new segments, although it might imply losing out on earlier opening intervals. Investors must conduct good due diligence as per their own financial objectives. As NCDEX remains unlisted, access is limited to private unlisted share platforms like Sharescart, making timing and entry all the more strategic.