Summary

Arohan faces inherent microfinance risks stemming from borrower vulnerability to economic and climatic shocks, alongside regulatory sensitivity highlighted by the 2024 RBI intervention. Rising competition may compress margins, while rapid digital expansion introduces execution and cybersecurity challenges. Geographic concentration in rural markets further elevates exposure to localised disruptions. Effective risk management, strong governance, and disciplined credit practices will be critical to navigating these challenges and sustaining long-term growth.

Company Overview

Arohan Financial Services Limited is a leading Non-Banking Financial Company (NBFC) that provides Microfinance services in India. The Aavishkaar Group has promoted this organization, which is regulated by the Reserve Bank of India (RBI) and based in Kolkata, with over 800 branches in 17 states serving 2+ million clients (approx. 98% of whom are Women Borrowers). Arohan’s primary business model focuses on providing income-generating credit to low-income households (underserved) that create multiple jobs due to increased economic mobility, allowing them to create businesses to generate income at the grassroots level. As an NBFC, Arohan has access to large global institutional investors such as TIAA, FMO (Netherlands), Maj Invest (Denmark), and IFU (Denmark), which provide Arohan with a strong governance framework and long-term capital backing. Arohan has positioned itself as a technology-driven platform for financial inclusion that delivers scalable microcredit services leveraging disciplined risk management practices and digitally enabled service delivery.

Business Segments

Arohan has four ways to operate that create diversified growth and are interrelated.

- The principal micro-finance vertical forms the basis of the business by providing Joint Liability Group loans from ₹25000 – ₹75000 to female entrepreneurs from lower incomes, enabling stable cash generation and retaining customers for a long period of time.

- The other two segments of the Micro-Enterprise segment and the Bazaar loan segment together cover the needs of smaller businesses as well as fill the gap for the “missing middle” by providing loans between ₹25000 and ₹1.5 Lakh, thus diversifying businesses but also providing support to larger scale business.

- Arohan's app, ArohanPrivilege, provides its repeat users to both originate and service their loans 100% digitally using their mobile application, provides instant loan funding, and reduces operational costs, resulting in digital being the primary lever driving the scalability of all of Arohan's businesses.

- There is also an inorganic and institutional business which originates term loans to smaller MFIs and will include, but notbe limited to, securitisation and partnerships to secure the financing Arohan will provide, thus allowing for improved capital efficiencies and lower concentration risk.

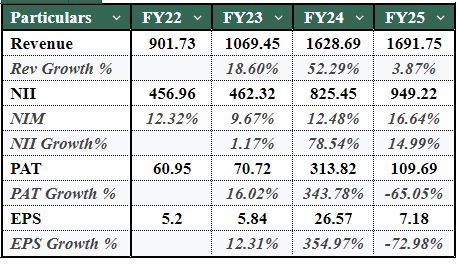

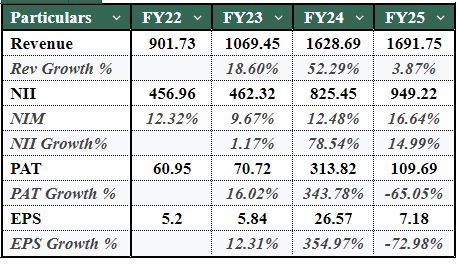

Financial Overview

- During FY22-FY23, revenue growth and net interest income were only modestly positive due to healthy loan growth with limited pricing power. The loan pricing power was affected by intense competition in the microfinance sector, and increased funding costs led to compressed margins; as a consequence, net interest margins declined from 12.32% to 9.67%. Therefore, although the total size of the loan book increased, additional (incremental) interest income generated from this growth was essentially offset by higher funding costs and higher operating expenses, which explains why net profit after taxes (PAT) and return on equity (ROE) grew only marginally in FY23 despite an increase in balance sheet size.

- Treasurer, however, during FY24, reversing this trend sharply was the result of increased revenues through faster disbursements/reprices of loans combined with the existence of operating leverage on a larger portfolio. Net interest margin rebounded sharply due to an increase in yield on microfinance loans relative to the cost of funds, while credit risk remained benign (meaning that credit risk exposure was low). Additionally, as operating costs did not rise in proportion to the increase in revenues, incremental income generated from increased revenues flowed directly to net income (PAT), earnings per share (EPS), return on assets (ROA), and return on equity (ROE), resulting in the outsized increase in these metrics.

- The strong FY24 profitability raised red flags, leading to scrutiny by regulators. The RBI viewed Arohan's margin expansion and profit growth to be out of line with industry trends and issued a Cease & Desist order in late FY24 causing disruptions to disbursements and slowing balance sheet growth into FY25, which explains the decline in revenue growth rate to under 4% (even though NII continued to increase on a larger outstanding book) due to those disruptions.

- In FY25, PAT decreased sharply, as many headwinds came together to halt growth, keep fixed operating costs intact, and take a more conservative approach to provisioning and compliance costs. A self-imposed cap on margins reduced any additional upside from a pricing standpoint, and the increased level of equity diluted return ratios. These contributing factors compressed profitability, but there were no signs of degradation of asset quality.

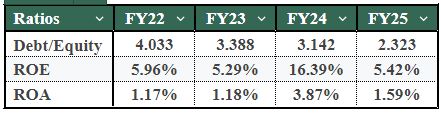

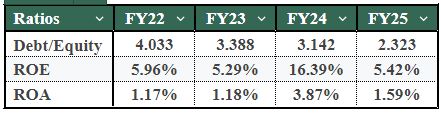

- The debt/equity ratio declined consistently throughout this entire period, mainly due to the large equity issuance and retention of earnings rather than the elimination of debt. The equity raise significantly improved the balance sheet, enhanced regulatory comfort, and improved the capital adequacy ratio, but mechanically lowered the ROE in FY25 as there was an increase in equity when profits returned to normal.

- Arohan concluded FY24 with ROA and ROE at their highest levels as profit growth exceeded asset and equity expansions. This resulted in a normalisation of both metrics in FY25 due to decreases in net income while capital increased. The observed volatility in Arohan’s results reflects not only the cyclicality of microfinance earnings during periods of fast growth and regulatory reform, but also demonstrates how the microfinance sector is subject to changes based on macroeconomic conditions (i.e., interest rates and inflation).

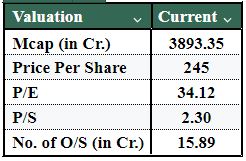

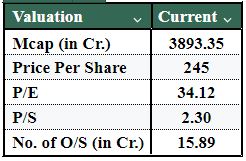

- Arohan's P/E ratio at the end of FY24 was at the higher end of recent years due to investor expectations of an earnings trough in FY25 versus a normal high level. Investors seem to be able to look beyond the current regulatory disruptions experienced at Arohan and value Arohan using a multiple that reflects its potential to generate steady earnings, the strong capital position of Arohan, and its history of generating consistent and high returns when operating in a normalised environment.

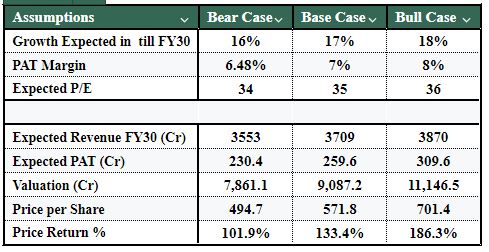

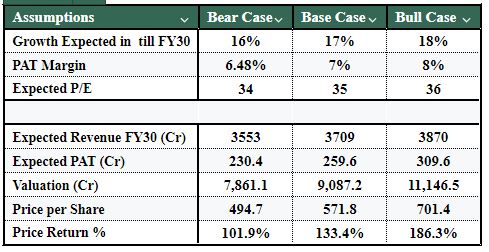

Future Forecast With Assumptions

Arohan Financial Services exhibits significant upside in both conservative, bear case (102%) and base case (133%) scenarios of potential total return (share price of ₹571.80), with strong loan growth and normalizing margins leading to 133% upside in a bull case (share price of ₹701.40) due to continued growth in digital adoption and profitability.

The loan book has historically compounded annually at approximately 17%-18%. This growth is expected to continue through expanded geographies and increased repeat digital customers, along with margin improvement due to operating leverage and more micro-business lending.

Additionally, Arohan has a strong capital adequacy ratio, giving it enough capacity to grow through additional loans. The technology-based business model also offers Arohan the opportunity to grow through scalability and reduce costs from technology integration.

Finally, Arohan has multiple structural tailwinds in financial inclusion, which will continue to drive strong demand for its products and, as such, represent an attractive risk and return for investors and a potential long-term compounding investment in the NBFC-MFI marketplace.

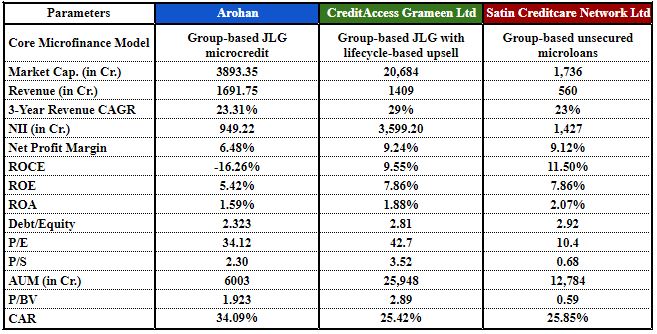

Peer Comparison

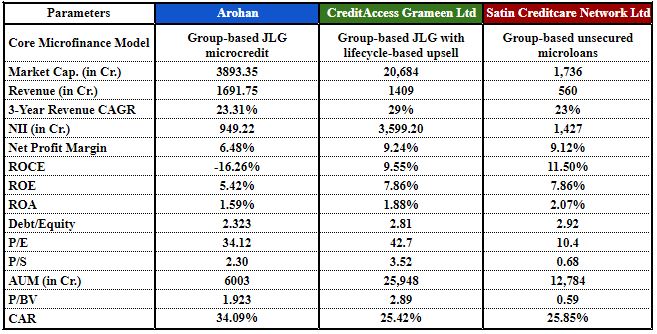

- Arohan employs an almost identical group-based microfinance model as that of CreditAccess Grameen and Satin Creditcare, concentrating on lending to lower-income individuals with a gradual move into the higher-income segments. While Arohan’s market capitalisation of approximately ₹3,893 crore is considerably lower than that of CreditAccess Grameen’s at ₹20,684 crore, it has been able to achieve a strong CAGR revenue growth rate of 23.31% over the last three years, which is comparable to the growth rates at Satin and only slightly below those of CreditAccess.

- Profitability metrics for Arohan are currently lower than the aforementioned peers. The current net profit margin for Arohan is 6.48%; for CreditAccess, it is 9.24%, and for Satin, it is 9.12%. The difference in net profit margins can be attributable largely to Arohan’s lower operating scale and higher costs associated with its earlier stage of operation. Also, ROE and ROCE ratios remain significantly lower. Arohan’s ROE is 5.42% with a ROCE of –16.26%; both of these return ratios are lower than CreditAccess’s ROE of 7.86% and Satin’s ROE of 7.86%, and, therefore, provide opportunity for improvement once the company achieves operating leverage.

- In terms of the balance sheet, Arohan is currently very strong, with a Capital Adequacy Ratio of 34.09%, which is substantially greater than CreditAccess at 25.42% and Satin at 25.85%, and which will provide the company with much greater availability of capital for future growth. However, Arohan does still have an elevated debt-to-equity ratio of 2.32x, similar to its peer companies.

- As a measure of value, Arohan's price-to-earnings ratio (P/E) of 34.12 and price-to-book ratio (P/B) of 1.92 put it right in the middle between those of CreditAccess, which has high multiples, and Satin, which has low multiples, which reflects the market's expectations for margin expansion and a normalizing rate of growth. Arohan has a strong capital cushion, an improving growth rate, and an operating model based on technology, making it an alternative to being an emerging compounder in the non-banking financial company (NBFC) microfinance industry (MFI).

Key Risk

- The segment in which Arohan operates is highly sensitive to structural changes in the economy, exposing the borrower to risks associated with an economic downturn, increased inflation, natural disasters, and other local shocks to livelihood, all of which might impact their ability to repay their loans.

- Regulatory risk remains significant, as seen by the Reserve Bank of India's (RBI) "cease-and-desist" order in 2024, reinforcing the need for sustained compliance, good governance, and increased transparency in its operations and processes. Increased competition within the NBFC-MFI segment could put pressure on both yields and the cost of acquiring customers, ultimately affecting profitability

- The company is also facing risks from executing its digital transformation faster due to technology integration issues and cybersecurity threats. Arohan also has a greater level of exposure to rural areas and semi-urban markets, which makes them more susceptible to disruptions in those areas caused by natural disasters or political instability.

- In addition, microfinance institutions have high levels of leverage on their balance sheets, which greatly increases the downside risk for them during times of stress on their asset quality. As a result, Arohan will need to have strong credit underwriting standards in place, an active risk management program, and a solid system of internal controls to ensure they are able to maintain their asset quality while growing over the long term.

Conclusion:

Arohan represents a compelling combination of the impact of social change, technical capabilities, and institutional discipline. The company is well-positioned to participate significantly in the ongoing evolution of financial inclusion in India with a diversified lending vertical, strong asset quality, extensive digital integration, and substantial backing from credible investors on a global scale. Despite ongoing regulatory and sectoral risks facing the company, Arohan has demonstrated a commitment to taking quick corrective actions, a high level of capitalisation, and a disciplined management philosophy, which have resulted in solid long-term prospects for the company. In addition to being an NBFC-MFI, Arohan is rapidly progressing toward a scalable financial inclusion platform that has developed a defined strategy for achieving sustainable growth and meaningful transformation at the grassroots level. This share is available with Sharescart.