15 Days Price Change

Summary

Hero Motors is a capex-heavy auto ancillary transitioning from commodity components to EV drivetrains and premium, export-focused products. While it has strong strategic assets and global exposure, current margins, ROCE, and utilisation remain weak due to aggressive expansion and high leverage. The stock trades at rich valuations, already factoring in a turnaround that is yet to fully materialise. It remains a high-risk, high-optionality bet where execution and EV scaling will determine long-term returns.

Whenever the majority of investors mention the name Hero, people would instantly associate with motorcycles and Hero MotoCorp.

But off the record, another Hero group company is constructing something quite different i.e. a global auto-parts portal with EV aspirations, enormous capex and a valuation that already includes a glimmery future.

The name of that company is Hero Motors Limited.

Hero Motors is at a very crucial crossroad today.

Its returns are low, its profits are low, and leverage is high but its asset base has been tripled, EV alliances exist, it has strong exports, and a post capex rebound earnings would actually change the story.

Is Hero Motors a high-conviction turnaround opportunity -or a valuation trap?

Let’s break it down.

Hero Motors is a B2B manufacturer of auto-components whose focus is:

Digital components of powertrain and drive.

Accurate manufacturing components.

High quality two-wheeler parts.

EV drivetrain solutions

It delivers to the major two-wheelers, three-wheelers, passenger car, and EV OEMs in India and abroad.

What is unique to Hero Motors and an ordinary auto ancillary is its strategic change:

Out of commodity auto parts.

To high value, technology-based products, in the form of drives and EVs.

Hero Motors manages a few businesses that are considered strategic:

1) HYM Drive Systems (90% owned)

Manufactures EV hub motors. A 10 percent share, which is a big strategic affirmation, belongs to Yamaha Motor Co.

2) Hewland Engineering (UK)

Motorsport and high-performance EV transmission specialist. Provides Hero Motors with niche international publicity.

3) Spur Technologies (acquired FY24)

Niche suspension systems, wheels, and handle bars to high-end markets.

This combination is a rare combination which Hero Motors has in this portfolio:

Local size of manufacturing.

Global niche exposure

EV optionality

High end product placement.

Hero Motors has a multi-stream auto ancillary model that generates revenue:

1) OEM Component Supply

Its core revenue driver. Distributes powertrain, drives and accuracy components to local and international OEMs.

Margins volume elastic and scale advantageous.

2) Premium & Niche Products

Greater margins through Spur Technologies and Hewland engineering.

They are less commoditized and more technology-focused segments.

3) EV Drivetrain Solutions

UB motors and EV drives via HYM Drive Systems.

This remains a minor contributor in the current day but has a long term margin and valuation optionality.

4) Exports (~40% of Revenue)

Export business will diversify the revenues not based on the Indian auto cycle, as well as, enhance pricing power.

This also puts Hero motors in the position of global motorsport and niche EV.

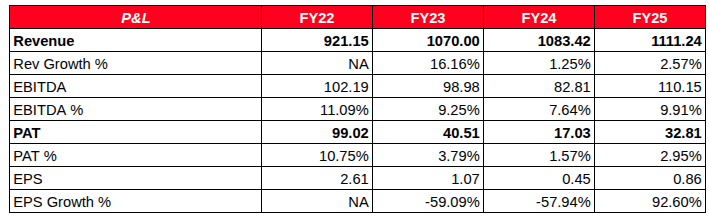

At first glance, Hero Motors’ financials look underwhelming.

₹914 Cr → ₹1,111 Cr

3-year CAGR: ~6.5% (far below sector leaders)

EBITDA margin: ~9.9%

Net profit margin: ~3.0%

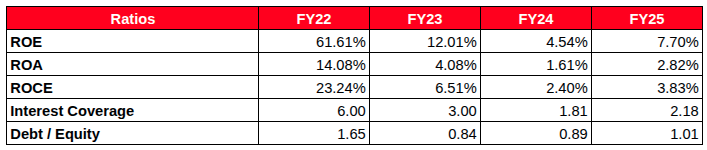

ROCE: 3.8%

ROE: 7.7%

Debt/Equity: ~1.0x

Interest Coverage: 2.18x

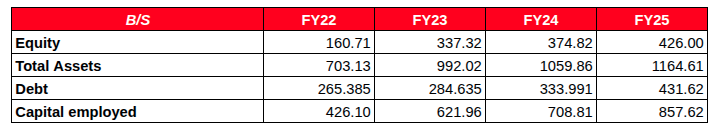

Hero Motors is currently in the midst of ruthless capacity and technology growth.

Capital Investment

₹164 Cr (FY22) → ₹495 Cr (FY25) — nearly 3x in 3 years

Capex Deployment Includes

R&D Spend

Short-Term Impact

Better still, the utilisation remains very low:

That is why the current returns are unattractive, as well as why the operating leverage may be effective in the event of volume growth.

The EV story of Hero Motors is not merely a marketing gimmick.

HYM Drive Systems

Why this matters:

Additional EV-Linked Assets

Hero motors is evidently trying to make a structural change:

of manufacturing parts of commodities to technology-based mobility parts.

Export amounts to around 40 % of the revenue of Hero Motors.

It is an important advantage:

This is an exceptionally good export mix in case of a mid-cap Indian auto ancillary.

Key Observations

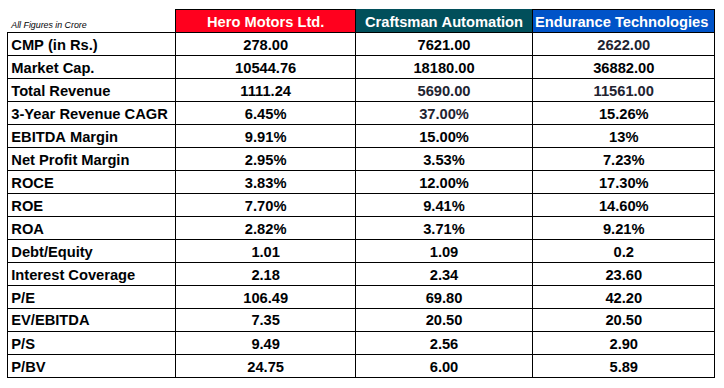

Hero Motors has:

Yet it trades at:

The EV/EBITDA is the sole value that appears to be cheap, however, EBITDA is depressed during the capex stage, so this would be misleading.

In simple terms:

The stock has been valued to include a turnaround that is yet to occur.

The company is owned by promoters and promoter group with a share of about 85.25.

Pros

Cons

This is a classic trade-off:

control premium - governance discount.

Hero Motors is an unsafe compounder.

Capex based turnaround + EV optionality story.

The result of your action is only determined by whether:

Should such occur, the current valuation may appear sensible in retrospect.

Otherwise, the stock is susceptible to vicious de-rating.

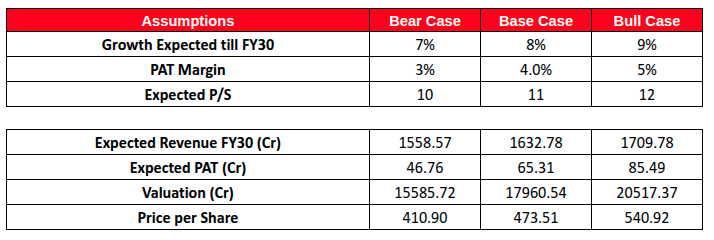

Bull Case (High Reward)

Base Case (Moderate Outcome)

Bear Case (Capital Risk)

This is not a low-risk story.

1) Execution Risk

New capabilities should increase gradually. Any under-utilisation or delay increases losses and stresses to the balance sheets.

2) EV Adoption Risk

EV orders can increase at a slow rate. EV components remain a small base business.

3) Leverage Risk

The Debt / Equity of approximately 1x does not allow much leeway to make errors in operation.

4) Valuation Risk

Already, expectations are high at the current prices. Sharp de-rating can be caused by any disappointment.

5) Governance & Liquidity Risk

The promoter encourages high control and minority influence, and free float liquidity.

Hero Motors is not a good growth story today.

It is an investment concentrated on infrastructure which is heavy on capex in the auto ancillary category.

It is a combination of a regulatory-compliant scale of manufacturing, EV alliances, exposure to exports, and technology pivot-long-term.

Conclusion :

Hero Motors (unlisted) is a capex-led turnaround story with strong EV optionality, export strength, and strategic partnerships, but current returns and margins remain weak. The valuation already factors in future improvement, making execution the key trigger for value creation. For investors tracking this opportunity in the unlisted market, including platforms like Sharescart, upside depends on utilisation, EV scaling, and margin recovery — otherwise, downside risk remains.

Disclaimer:

This analysis is for educational and informational purposes only. Investors should conduct their own research and consult a financial advisor before making any investment decisions.