Company Overview:

BoAt is a name you know; however, the audio brand has become so much more than that in less than a decade. In a short period, boAt has grown to become one of India's best-known tech lifestyle companies and the leading audio accessory company. Initially positioned as a challenger brand in earphones and headphones, boAt now has multiple product categories that fit together to create a diversified, multi-product ecosystem; these include wearables, audio products, and other tech products aimed primarily at youth.

In this report, we detail how boAt is strategically positioning itself, not just as a product company, but rather as a powerful lifestyle-tech ecosystem grounded in brand awareness, a customer-focused price point, and a scalable business model.

Brand Identity: Built for India’s Youth

boAt is not lucky; it has been created by the use of engineering

- Targeting of youth

- Focus on aggressive digital marketing

- Use of celebrity endorsements & targeting of pop culture

- A strong, relatable/connected to the community

Whereas traditional electronics manufacturers sell based on specifications only, boAt sells based on identity. It sells aspiration, lifestyle, & value altogether.

What Have They Created? An accessible, trendy, and Indian brand.

Product portfolio

boAt has diversified from its core audio segment into fast-growing adjacent segments as follows:

🔹 Audio (Core Strength)

- TWS

- Neckbands

- Headphones

- Bluetooth Speakers

🔹 Wearables (Growth Driver)

- Smartwatches

- Health-Focused Wearables

This diversification enables boAt to de-risk its dependence on a single category of products and allows for cross-selling amongst all products within the ecosystem.

boAt’s Proposition is clear: Get the entry-level consumer and eventually ascend to higher-priced products within the same brand.

Business model

An advantage for boAt is its asset-light model (10-20 per cent), removing overhead in manufacturing.

They rely on:

- Third Party Manufacturers (Supply Chain Outsourcing)

- Strong Relationships with Vendors

- Branding / Distribution Focus

- Working Capital Efficiently

boAt uses low-level investments in Manufacturing to enable fast product delivery at a low cost to fulfil consumer demand quickly and competitively based on market trends.

Financial Performance

Revenue moderation post-peak growth

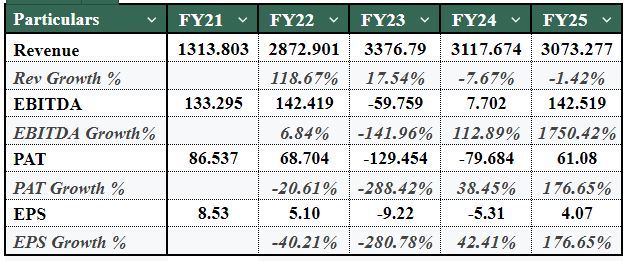

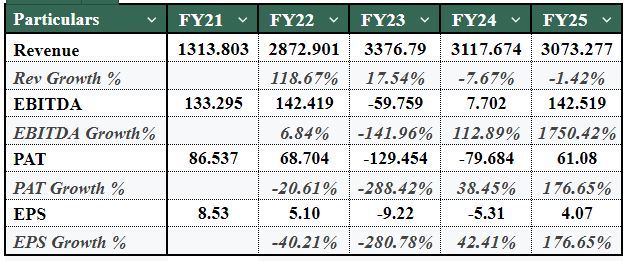

- boAt's phenomenal growth during FY22 saw revenue increase by 118.67% to ₹2,872.90 crores from ₹1,313.80 crores during FY21 - demonstrative of aggressive expansion for the brand, driven by strong demand for audio wearables. However, the size of growth in FY23 has been almost halved (17.54%) before continuing to contract in terms of revenue by -7.67% in FY24 and -1.42% in FY25.

- From FY23's revenue of ₹3,376.79 crores to FY25's figure of ₹3,073.27 crores indicates market saturation, price pressure due to competition and a significant slowdown in categories such as wearables. There are two consecutive years of decline, indicating that these are structural issues, rather than temporary fluctuations.

EBITDA and margin swing.

- While EBITDA was positive in both FY21 and FY22, it moved sharply negative in FY23 (- ₹59.76 crores), indicating significant operational stress. FY24 saw marginal improvement (₹7.70 crores) while FY25 saw a significant bounce-back to ₹142.52 crores - a growth in excess of 1750.42%.

- The extreme events would indicate that there have been issues with the Earnings operating on a stable basis and not based upon an operating Basis. The gain realised in FY25 would tend to indicate operational efficiencies and non-recurring adjustments as opposed to significant revenue growth.

Revenue and Operating Profit After Tax rebounded, but net profit remained negative in both, as PAT decreased in FY24.

- PAT decreased (-₹129.45 crore) compared to FY23 and showed a slower decline in FY24 (-₹79.68 crore) and improved in FY25 with a net profit of ₹61.08 crore.

- The 176.65% increase in PAT in FY25 appears favourable on the surface, but this must be viewed in context - the previous two years of losses and a much lower revenue base supporting that level of growth indicate stability, rather than any indication of a profitability strength.

Earnings per Share (EPS) Performance:

- EPS fell significantly from ₹8.53 (FY21) to -₹9.22 (FY23) and -₹5.31 (FY24) respectively, and recovered in FY25 to ₹4.07. Therefore, EPS is still significantly below FY21 (EPS growth FY25 176.65%), which indicates that shareholders are not creating value that had previously been attained before the company became profitable.

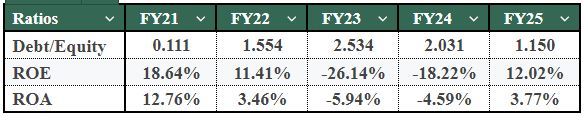

Dependence on Debt for Leverage and Capital Structure Concerns:

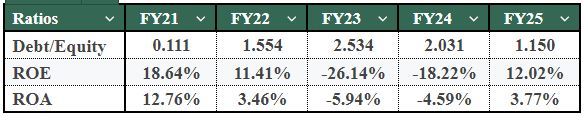

- Debt-to-equity ratios have dramatically increased from 0.11 (FY21) to 2.53 in FY23; therefore, the business has grown dependent on borrowing to finance its operations through challenging times. Debt-to-equity ratios have decreased to 1.15 (FY25); however, leverage remains too high compared toFY21.

- This indicates that the business has relied on borrowing as a way to support working capital needs during downturns, and while the business has begun to reduce its debt, there is still a risk of using too much debt for financing.

Efficiency under pressure: ROE and ROA volatility

- Both ROE (Return on Equity) and ROA (Return on Assets) experienced significant declines from FY21 until FY23 (ROE down from 18.64% to -26.14% FY23) and FY24 (ROE -18.22%). Both returned to positive results in FY25 (ROE 12.02% and ROA 3.77%). However, even with the positive results in FY25 (ROE/ROA), both remain below the previous benchmarks. This is indicative of reduced asset efficiency and reduced capital productivity compared to the company's growth phase.

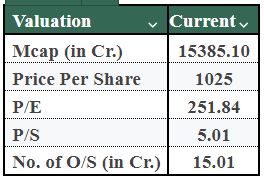

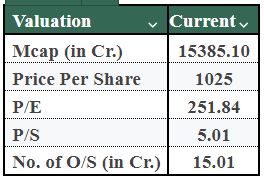

Valuation Summary: Price via volatility

- With a valuation of ₹15,385.10 crore and a stock price of ₹1,025, this company has a P/E of 251.84 and a PS of 5.01. A P/E of greater than 250 indicates that the market expects aggressive growth in future earnings. Given the decline in revenues and the erratic earnings during the FY23 - FY25 period, this high valuation implies that the market has very high expectations for this company, with little to no room for error in operation.

- A financial evaluation has identified three distinct operating stages within the company: Excessive Growth Stage (FY21-FY22), Distressed Stage (FY23-FY24), and Stable Stage (FY25).

- Although FY25 will see the company recover from operational distress and improve its financial performance, the revenue decline, high prior leverage levels, and wide ranges of return ratios demonstrate that the company is not yet experiencing significant growth.

- The balance sheet shows the company has been able to decrease its debt as of FY25. However, the company is still not back to its peak level of profitability before these losses. Also, investors have priced the stock based on what they see as a recovery to stable operating conditions.

Overall, the company has made progress and is on its way to a stable and sustainable level of operations, but the company still does not have steady and scalable profitability to justify premium valuation multiples without a steady increase in revenue and profit margins.

Peer Comparison:

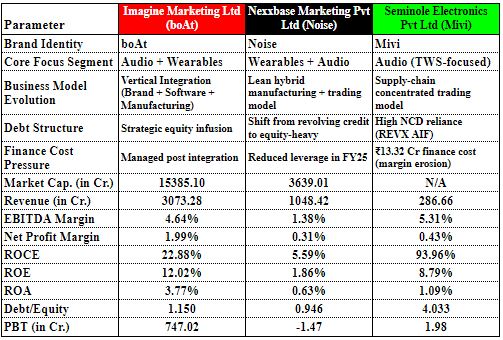

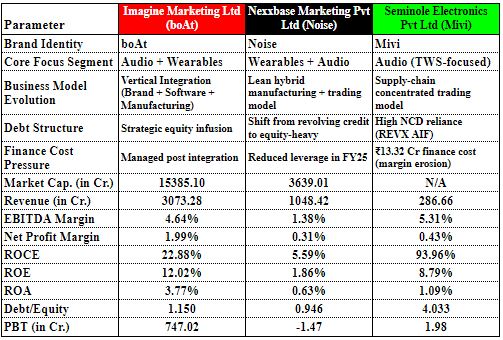

- An analysis comparing the three companies - Imagine Marketing Ltd (boAt), Nexxbase Marketing Private Limited (Noise), and Seminole Electronics Private Limited (Mivi) - reveals each brand has its own unique positioning, strategy and business model operating in India’s consumer electronics marketplace.

- In terms of brand positioning and segment focus, boAt represents itself as a diversified lifestyle technology brand that incorporates both audio and wearable technologies, and has an aspirational approach toward youth. As such, it enjoys very strong brand recognition from consumers. On the contrary, while Noise is primarily focused on the wearable category - especially smartwatches - it also sells some audio products (which tend to act as a secondary). Thus, it has positioned itself as purely functionality/performance-based. Mivi has much narrower product diversification than either boAt or Noise (with the majority of its products in the audio category, mainly TWS) - indicating a more niche-oriented strategy. The three brands each take on different approaches to market growth: diversification via boAt; emphasis on dominance in wearables regarding Noise; niche dominance via Mivi (with primarily being a manufacturer of audio products).

- The analysis of return ratios provides additional insight into differences in capital efficiency between companies. boAt demonstrates a strong ability to efficiently utilise capital with a Return on Capital Employed (ROCE) of 22.88% and a Return on Equity (ROE) of 12.02%, which suggests that the company has created shareholder value at a relatively balanced rate. In contrast, Noise has generated weaker returns, with a ROCE of 5.50% and a ROE of 1.86%, indicating that the company has deployed capital less efficiently than boAt. Also noteworthy is Mivi's exceptionally high ROCE of 93.06%, which is likely reflective of a leaner capital base and not a larger operational presence. While the company's high ROCE demonstrates an efficient use of capital, it also has a low asset base compared to boAt.

- The companies exhibit contrasting profiles of financial risk through their debt structures. boAt's debt-to-equity ratio of 1.15 exhibits moderate leverage that is at an acceptable level considering the company's revenue volume. Conversely, Noise's relatively low leverage of 0.946 indicates that the company is much more conservative in terms of borrowing. Mivi, with a debt-to-equity ratio of 4.033, has a significantly higher degree of financial leverage and, therefore, also higher exposure to financial risk because of its reliance on non-convertible debentures. Increased leverage will amplify the impact on Mivi during periods of softening demand or declining gross margins.

- Examining the profit before tax (PBT) number demonstrates boAt's ability to generate significant earnings with a reported PBT of ₹747 crore, thus reinforcing its position as the earnings leader among the three companies. In contrast, Noise has generated a negative PBT number and will therefore face continued challenges to generate positive earnings. Mivi has also generated positive PBT, but its only reported PBT of ₹1.98 crore will not allow the company to achieve operating scale for the foreseeable future.

- In broad terms, there are three uniquely different methods of competition within this same market. boAt has the greatest amount of revenue across its various product categories. The company also has the best level of capital efficiency. Noise is a smaller but well-supported player that focuses on creating a good quality product while dealing with margin pressures. Finally, Mivi is an even smaller and less successful player than Noise but has had significant success growing its business at a rapid pace and growing profits as well, but this comes with a greater level of leverage risk compared to its competition. Overall, boAt is by far the best example of a company that has found an effective balance of scale, brand strength and financial stability in the growing consumer electronics marketplace in India.

Future forecast

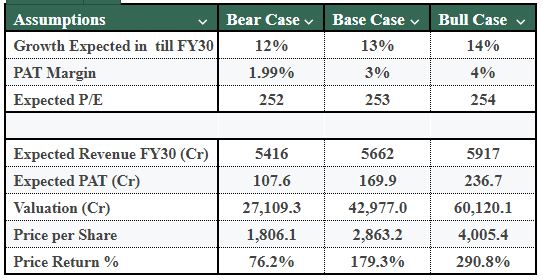

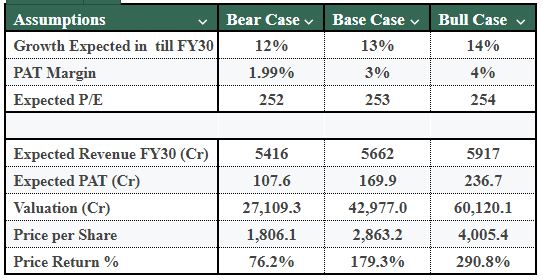

- The forecast for boAt (Imagine Marketing Ltd.) through FY30 is based on three different scenarios — Bear, Base, and Bull — which all have varying rates of revenue growth and profitability. In the Bear case, the company is projected to experience annual growth of 12%, which could indicate moderate growth or slow growth/some impediments as a result of increased competition and pricing pressures. The Base case assumes a 13% annual growth rate, indicating continuing brand traction/acceptance and stable demand. In the Bull case, the growth rate is projected to be 14%, indicating an increase in the number of new customers, premiumization trends among customers, and greater consumer expenditure on audio and wearable devices.

- The profitability components play an integral part in the overall estimate. The PAT margin in the Bear case is only 1.99%, which reflects a low PAT margin due to a much more considerable amount of competition. The PAT margin is projected to increase to 3% in the Base case due to the assumption of more efficient operations and better cost controls. The PAT margin in the Bull case is projected to be 4.0%, which assumes that operating leverage and pricing power will be much more significant factors. Additionally, an increase of even 1% in earnings results in a significant increase in total earnings due to the effect of compounded interest over time.

- The table above summarises the various revenue forecasts for the US financial, The company estimates it will generate total revenue of 5416 cr, 5662 cr, and 5917 cr, respectively, till FY30, based on assumed scenarios. Most of the difference in forecasted annual gross profit and revenues is explained by the projected annual gross margin assuming different levels of growth and profitability.

- Finally, valuation projections amplify this differential as use of a P/E ratio (252-254 range) yields different values for the projected company’s market capitalisation, producing equity price estimates of 1,806, 2,863 and 4,005, respectively, based on conservative, realistic and optimistic growth assumptions.

- If the share price estimates are accurate, the potential returns on investment would be 76.2%, 179.3% and as high as 290.8% for Bear, Base and Bull scenarios, respectively. The overall forecast shows that boAt's valuation over the long term measures greatly depending on slight changes in growth rates and profit margins, because of operating leverage and brand strength being the main contributors to the creation of value for boAt's investors by FY30.

Strategic Strengths

- STRONG BRAND EQUITY – boAt, as a Brand is now a Community-Driven Brand, not simply a Product.

- SCALE ADVANTAGE – High-Volume Sales Create Increased Buying Power with Suppliers.

- CATEGORY DIVERSIFICATION – Audio + Wearables = Diversified Risk.

- MASS MARKET PRICING – Affordable Luxury Positioning Creates a Broad Consumer Base.

There are several key risks and challenges associated with a growth story. The primary risk sources include:

Key Risks & Challenges

- Margin pressure driven by intense competition

- The reliance on third-party manufacturing

- Rapidly evolving technology

- The requirement for continual innovation

Sustained profitability through aggressive pricing will be an ongoing balancing act strategically between these elements.

Conclusion

To summarise, Imagine Marketing (also known as boAt), at present, seems to be in a consolidation situation (re-calibrating operations) as opposed to pursuing aggressive growth expansion like it has in the past. The brand has strong brand recall, broad distribution reach, and scale advantages over many other companies to date; however, its stock is performing less than expected due to deteriorating momentum in revenue and variance in earnings. Furthermore, the stock is trading at approximately 252 times its prior earnings, meaning that, based on current valuations, a significant portion of the expected recovery and margin enhancement has already been taken into consideration, thus lessening the margin for error associated with execution risks.

Given the above, the stock is virtually fully valued vs its near-term visibility to earnings. Therefore, investors with higher risk tolerances and a longer-term view would only want to invest in boAt stocks if they have confidence in management's premiumization strategy, operating leverage potential, and ability to generate consistent earnings over time. Alternatively, conservative or valuation-driven investors would likely prefer to wait for more observable signs of improved margin stability or increased earnings momentum before investing in boAt. This share is available with Sharescart.com.