15 Days Price Change

Summary

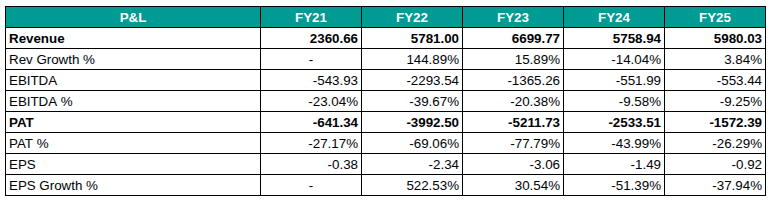

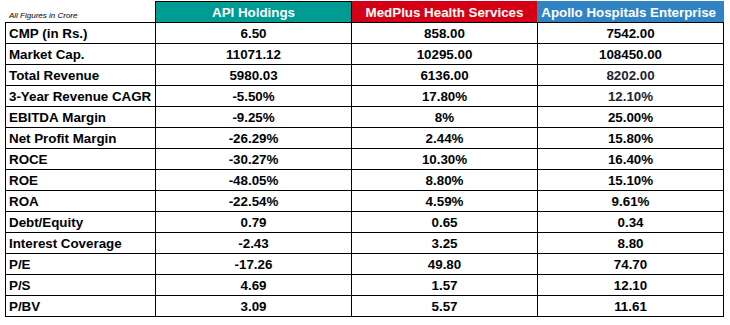

API Holdings Ltd, parent of PharmEasy, is a leading digital healthcare platform operating across e-pharmacy, diagnostics (Thyrocare) and B2B healthcare distribution. The company has scaled rapidly, with revenue rising from ₹2,361 Cr (FY21) to ~₹5,980 Cr (FY25).

While profitability remains elusive, losses have narrowed significantly due to cost optimisation and operating leverage. With PharmEasy at the core, API Holdings is focused on building a full-stack healthcare ecosystem, positioning itself as a long-term play on India’s digital healthcare growth.

One of the health technology companies with the fastest rate of growth in India is API Holdings Ltd. Serving customers, pharmacies, healthcare providers, and institutions nationwide, it runs an integrated, end-to-end digital healthcare ecosystem that blends e-pharmacy, diagnostics, telehealth, and healthcare supply-chain services. One of the top digital healthcare marketplaces in India, PharmEasy, is its flagship consumer-facing brand.

API Holdings was formally founded in 2019 by combining previous businesses that date back to 2012. Since then, it has expanded quickly through both organic growth and strategic acquisitions, including Medlife (2021) and a majority stake in Thyrocare (2021).

The mission that API Holdings is striving to achieve is to create the most complete digital healthcare ecosystem in India using technology, logistics and healthcare data to provide affordable, convenient and accessible care to millions. Its own-designed platform links several stakeholders, such as consumers, pharmacies, doctors, clinics, diagnostic labs, wholesalers and manufacturers.

1. E-Pharmacy and Healthcare Marketplace (PharmEasy).

Allows customers to make orders through app and web on medicines, healthcare goods and wellness products.

Provides tele consultancy service, e-prescription and medication ordering.

Transaction commission and logistic fees and charges in the marketplace are revenue drivers.

2. Diagnostics Preventive Health (Thyrocare)

A significant diagnostic services company that has tests in the country.

Empowers the ecosystem by integrating diagnostics and pharma and telehealth services.

3. B2B Distribution and Supply Chain (Retailio and other websites)

Pharmacist and healthcare retailer digital procurement tools that help enhance inventory and ordering management. The services are wholesale distribution, practice management software and hospital supplies procurement.

API Holdings was not established as a one-stop platform. it was based on previous projects:

2012-2014: Founders created Dialhealth (delivery of medicine), pharmacy networks and supply-chain services.

2015: PharmEasy marketplace was launched in its initial form, which had on-demand home delivery.

2017-2020: The Retailio was created to digitalise drug distribution and pharmacy procurement.

2020: API Holdings consolidated all the businesses.

2021: 33 percent majority stake of Thyrocare, acquisition of major e-pharmacy Medlife, to construct a more holistic health platform.

This expansion strategy made API Holdings the biggest digital healthcare company in India based on gross merchandise value (GMV).

Key takeaways from financials:

✅ Early years saw strong top-line growth, fuelled by acquisition synergies and market penetration.

✅ Revenue grew modestly in FY25 after plateauing in FY24, a sign of competitive dynamics and market pressure.

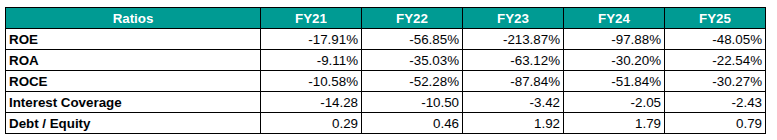

✅ Reduction in losses: As operations grow, margins have improved steadily, with the EBITDA margin rising from -39.7% to -9.3% over the course of three years.

Intense customer acquisition efforts, logistics expenses, and supply infrastructure investments—all typical characteristics of high-growth tech platforms—are partially to blame for API Holdings' high costs.

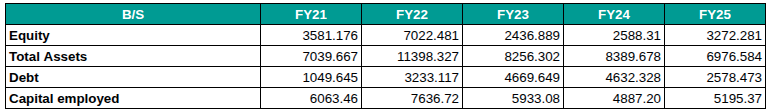

The evolution of the company's balance sheet reveals:

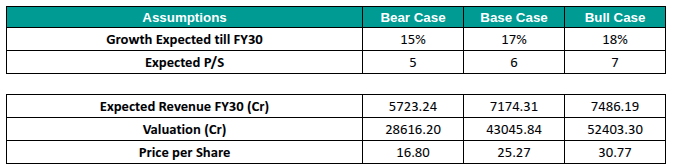

Revenue growth of 15-18% is assumed upon assessment of the historical performance of API Holdings which normalised its growth after the hyper-growth of FY 22 and the median growth of the past five years is 8-9%. In this regard, the forecast is adjusted to the growth trends in the industry, but not outstanding pandemic-based years.

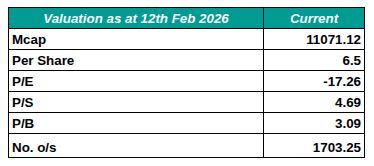

It is valued at a Price to Sales ratio of 5x-7x since the earnings are still negative. The multiple will be pegged to the existing trading range of the company of 4-5x P/S, and a calculated premium will be taken in view of increasing scale, better operating margins, and leadership in digital healthcare and will still take into consideration the risk of execution and profitability.

According to these assumptions, the FY30 revenue is estimated at 5723-7486 Cr meaning that the valuation may vary between 28616-52403 Cr and per share will be 16.80-30.77. Long-term growth visibility is further supported by the fact that the EBITDA and PAT losses show a steady decrease.

API Holdings faces a number of structural obstacles in its complex operating environment.

✔ Wide Ecosystem Integration

Integrating pharmacy, diagnostics, telehealth and B2B supply chain, API Holdings develops cross-selling and stickiness between the services.

✔ Brand Equity

PharmEasy has good recall particularly in the Tier I and II cities as it facilitates customer acquisition and retention.

✔ Investor Backing

The company has brought on board marquee international investors (e.g., Temasek, Naspers, TPG) that bring financial power as well as strategic acumen.

✔ IPO Potential

The API Holdings has made some stride towards the public listing, which is capable of creating long-term value of the early investors.

API Holdings is developing a full-stack digital healthcare ecosystem that includes B2B distribution, diagnostics, medication delivery, and technology-enabled healthcare services. It is much more than just an e-pharmacy. Platform-led network effects, consistent supply chain and logistics investments, strategic acquisitions that expand service offerings, and a discernible increase in operating efficiency as losses continue to decline are the main drivers of its unique approach.

The company's emphasis on scale, ecosystem integration, and margin discipline positions it well for long-term relevance, even though short-term profitability is still a work in progress. For investors and industry watchers, API Holdings is a structural play on how healthcare consumption is changing in India, where the future will be shaped by convenience, digital access, and integrated services.

In the unlisted market, API Holdings is still attracting interest from investors who follow these opportunities on research-driven platforms like Sharescart.