The company’s unlisted shares are available for trading on SharesCart.

15 Days Price Change

Summary

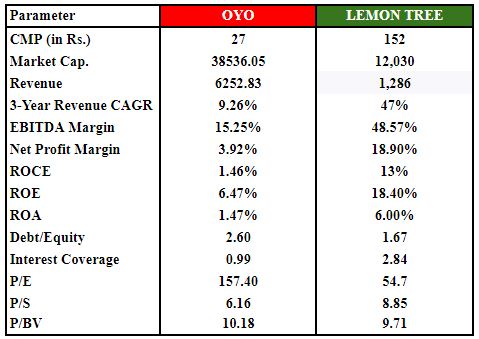

Oravel Stays Limited (OYO) has transitioned from a fast-growing, cash-intensive startup into a more disciplined, technology-led global hospitality platform built on an asset-light, two-sided marketplace model that connects fragmented hotel owners with standardized demand. The company has strategically expanded beyond budget hotels into premium and lifestyle segments under its PRISM parent brand, improving revenue quality and pricing potential. Financially, OYO has reduced losses and achieved early-stage profitability through restructuring and cost control, with revenue growth stabilizing post-pandemic, though operating leverage, margins, and return ratios remain modest. Compared to profitability-focused peers like Lemon Tree Hotels, OYO operates at far greater scale but with weaker margins and capital efficiency, making execution and margin sustainability critical. While long-term growth prospects are supported by global travel recovery, premiumisation, and technology-driven efficiencies, high valuations and ongoing execution risks mean that future shareholder returns will largely depend on OYO’s ability to convert scale into consistent cash flows and durable profitability.

Oravel Stays Limited, globally known as OYO, began its journey as a bold Gurgaon-based startup with a singular ambition to organize and transform the highly fragmented, unbranded hospitality market using technology. Over the past decade, OYO has evolved from an aggressive, cash-burning growth engine into a more disciplined, multi-brand global enterprise, increasingly focused on sustainable profitability, premiumisation, and governance rigor.

This article presents a comprehensive corporate overview of Oravel Stays Limited, covering its business model evolution, governance framework, operational strategy, financial turnaround, risk profile, peer comparison, and future growth prospects, to assess whether OYO’s transformation is structurally sustainable or still execution-dependent.

At its core, OYO operates as a two-sided technology marketplace:

Supply Side (Hotel & Home Owners):

OYO enables fragmented, unbranded hospitality assets to become digitally enabled, standardized, and revenue-optimized through pricing tools, branding, distribution, and operational technology.

Demand Side (Customers):

Customers gain access to a wide, reliable, and standardized accommodation inventory across multiple price points and geographies.

This platform-led approach allows OYO to scale rapidly while remaining largely asset-light, a defining characteristic of its business model.

While OYO initially built its identity around economy hotels, its strategy has expanded significantly. The launch of PRISM LIFE (PRISM) as a new corporate parent brand marks a critical inflection point.

Under PRISM:

OYO remains the consumer-facing brand for budget and mid-scale travel.

Premium hospitality brands such as Townhouse and Sunday Hotels are scaled.

Adjacent lifestyle verticals are integrated, including:

Weddingz (weddings & events)

Innov8 (managed workspaces)

Extended stays and luxury vacation homes

This brand stratification enhances clarity, enables premium pricing, and positions the company as a lifestyle platform for the modern traveller, rather than just a hotel aggregator.

Key governance safeguards include:

Audit Committee oversight of financial integrity

Whistleblower and Vigil Mechanism

Arm’s-length Related Party Transaction policy

Annual Board and Committee performance evaluations

These frameworks are particularly important given OYO’s complex global structure and history of rapid expansion.

OYO’s ownership is led by:

Founder: Ritesh Agarwal

Institutional Investors: SoftBank Group, Sequoia Capital, Lightspeed Venture Partners, Airbnb, and others

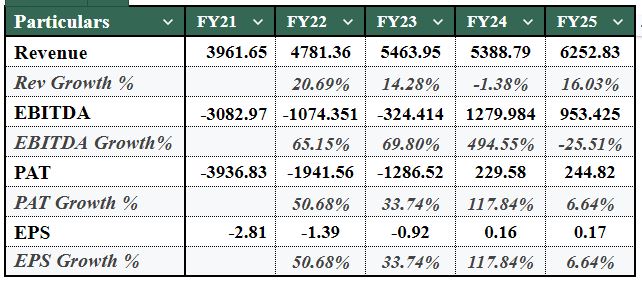

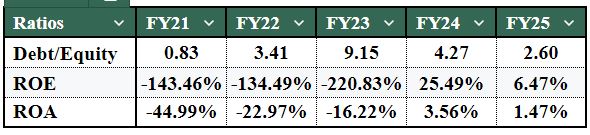

Oravel Stays Limited’s performance from FY21 to FY25 reflects a transition from deep losses to early-stage profitability, driven mainly by restructuring, cost rationalisation, and a gradual shift toward higher-quality revenue. While key metrics have improved, the sustainability of profitability remains dependent on execution discipline and operating leverage.

OYO’s improvement until FY23 was largely driven by cost control rather than revenue growth. FY24 profitability was mainly accounting-led, while FY25 shows early stabilization supported by revenue recovery.

However, moderation in EBITDA, PAT, and return ratios suggests that sustainable, cash-backed profitability is still evolving. Future performance will depend on operating leverage, margin improvement in premium inventory, and disciplined execution.

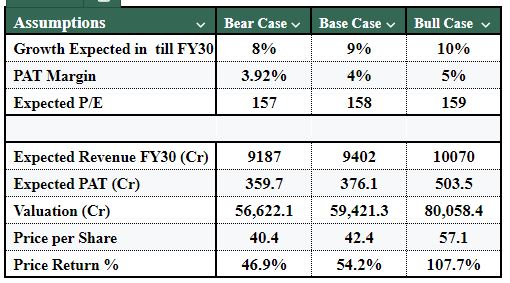

Key Forecast Assumptions

Revenue Growth Rate

OYO’s revenue is assumed to grow broadly in line with long-term global travel and tourism growth, with incremental upside from scale benefits and premiumisation of its hotel portfolio.

PAT Margin Expansion

Gradual improvement in profitability is expected as operating efficiency improves, premium and company-serviced hotels contribute more meaningfully, and recurring revenue stabilizes margins.

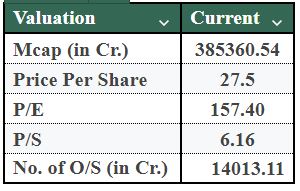

Valuation Multiple (P/E)

The valuation is based on a high earnings multiple, reflecting investor expectations of long-term growth, platform scalability, and improving profitability.

The future forecast suggests that OYO is expected to grow steadily as a business, with improving revenues and profits over the long term. However, from an equity valuation perspective, the company’s current pricing leaves limited room for upside. The model indicates that execution risk, margin sustainability, and valuation discipline will be critical determinants of shareholder returns going forward.

Oravel Stays Limited’s future growth prospects are closely linked to its ability to balance expansion with financial discipline, while managing a set of identifiable risks inherent in its business model. On the risk side, the company continues to face execution risk due to the complexity of operating a large, asset-light and geographically diverse platform, where maintaining consistent service quality and partner compliance remains critical. Ongoing legal and regulatory matters, including contingent liabilities such as the Zostel dispute, create uncertainty and potential financial outflows. Additionally, the non-recognition of deferred tax assets arising from accumulated losses highlights continued sensitivity around the sustainability and timing of taxable profits. Competitive intensity in both budget and premium hospitality segments, along with exposure to cyclical travel demand and cost inflation, also poses challenges to margin stability.

From a growth perspective, OYO is well positioned to benefit from the global recovery in travel and its strategic pivot toward premiumisation through brands such as Sunday and Townhouse, which offer higher unit economics and stronger contribution margins. Continued investment in proprietary technology, data analytics, and AI-driven pricing and demand management enhances scalability and operating efficiency, supporting long-term margin improvement. The asset-light model provides flexibility to expand rapidly across geographies, particularly in high-potential markets such as the United States, without significant capital intensity. If the company successfully converts scale into sustained operating leverage, maintains cost discipline, and strengthens cash flows, it has the potential to transition into a structurally profitable global hospitality platform with improving risk-adjusted returns over the medium to long term

OYO’s parent Prism has received shareholder approval to raise up to ₹6,650 crore through a fresh IPO, marking a renewed push to list amid improving profitability and growth momentum.

In conclusion, OYO’s evolution reflects a clear strategic shift toward financial discipline, operational efficiency, and higher-quality growth, supported by its technology-led, asset-light platform and increasing focus on premium segments. While the company has achieved important milestones in profitability and balance sheet strengthening, its valuation remains sensitive to execution and sustained margin improvement. Compared with more stable, profitability-led peers such as Lemon Tree Hotels, OYO represents a higher-risk, higher-reward opportunity. For investors, the company offers long-term growth potential driven by scale, technology, and global expansion, but returns will ultimately depend on its ability to convert this scale into consistent cash flows and durable profitability.