15 Days Price Change

Summary

MSEI is positioning itself as a fresh challenger to NSE and BSE, aiming to revive operations with a lean, tech-driven model. Backed by regulatory approvals, new product launches, and a focus on niche segments, it’s betting on cost efficiency and innovation to carve market share. While hurdles like liquidity and investor trust remain, MSEI’s turnaround story could make it India’s next serious exchange contender if execution stays on track.

For decades, India’s capital market has effectively been a two-horse race. The trading volumes, listings and investor mindshare are dominated by the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). However, over the last few weeks, an old name has just re-entered the limelight and that is Metropolitan Stock Exchange of India (MSEI).

Share prices that were not listed have almost increased several times over in a few days. Shareholder discussions are rising sharply. Regulatory developments are quietly moving toward MSEI.

No longer the question is “what is MSEI?”

Now it is: Can MSEI ever become the third serious stock exchange in India?

We can break down the opportunity, the business model, the numbers, and the risks.

Metropolitan Stock Exchange of India Limited (MSEI) is a stock exchange that was established in 2008 as MCX-SX and is a SEBI-approved stock exchange. Financial Technologies (FTIL) and various institutional investors, which was promoted by them, had the vision of developing a competitive alternative to NSE and BSE.

MSEI once operated:

Equity cash segment

Equity derivatives

Currency derivatives

Debt segment

The exchange however, lost volumes gradually due to poor liquidity, regulatory issues as well as intense competition with NSE. By the middle of 2010s, the majority of its trading business had been effectively fried up.

MSEI has been a dormant market infrastructure institution over several years of its existence: licensed, regulated, commercially idle.

That is now changing.

MSEI with new capital, regulatory aid and a profile of a roadmap to restart is trying what few exchanges globally have achieved: a second life.

In case MSEI re-initiates, it will have the same revenue model as any contemporary exchange.

1. Transaction Fees

The core revenue driver.

MSEI makes little profit on each trade conducted on its platform. Small volumes could produce a significant revenue with scale.

2. Listing Fees & Annual Charges

Companies pay:

Initial listing fees

Compliance/maintenance fees per year.

Provided MSEI can secure even a minor steam of new listings (primarily SMEs), this is a predictable and high-profit revenue stream.

3. Membership/ Connection charges.

Brokers and trading members pay:

One-time membership fees

Annual subscription fees

Data feed and connection charges.

This is a recurring revenue which is not as sensitive to the daily trading volatility.

4. Market Data and technology Services.

With increased volumes, exchanges become monetized:

Real-time data feeds

Historical data

APIs for algo trading firms

Co-location and technology services.

This is where operating leverage becomes strong.

5. Future Optional Segments

In the long run, MSEI may be expanded to:

SME platforms

Bond trading

Commodity-linked instruments

New derivatives

International products associated with GIFT City.

Hype is not the only thing that is making MSEI relevant again. Four tangible developments are driving it.

1. Operational Milestone: MSEI goes online with its Trading Infrastructure.

MSEI has come out with an official circular that requires its members in the Equity Capital Market segment to upgrade their trading software (Version 25.0.5.0) on a mandatory basis.

Key highlights:

Trader Workstation (TWS) and Member Admin Terminal (MAT) are released in new versions.

Compulsory installation among the members.

The systems will be launched after January 27, 2026.

Full production trading infrastructure revealed.

This is not a test rollout. It is a system launch of production grade which is a clear indication that broker onboarding is in progress and live trading is real.

To the investors, this is a hard execution evidence that the MSEI recovery is no longer on paper but on the ground.

2. Trade Restart Plan (Target: End-Jan 2026)

MSEI announced it is about to resume equity trading which will commence with approximately 130 stocks.

This is a pivotal shift.

A trading-free exchange is no more than a shell. Leaving again, MSEI will be able to regain income as a result of:

Transaction charges

Listing fees

Membership subscriptions

Market data services

Even low initial volumes would change MSEI’s status from inactive to operational. That is exactly what markets are now pricing in.

3. SEBI- Approved Liquidity Enhancement Scheme (LES).

The biggest problem facing any revived exchange is liquidity.

The fact that MSEI Liquidity Enhancement Scheme (LES) would be approved by SEBI is thus a significant win in terms of credibility. Under this program:

Designated market makers will give quotes in both directions.

Bid-ask spreads will remain narrow.

Order books will be more detailed and dynamic.

This minimizes the danger of MSEI looking dead-on-arrival whenever trading restarts.

Liquidity attracts liquidity in exchange businesses - and LES is intended to get that virtuous cycle going.

4. 1,240 Crore Capital Infusion = Survival + Growth Runway.

Widely discussed, MSEI has already secured funds in the order of 1240 crores, changing its financial stance.

This funding allows MSEI to:

Improve trading and surveillance technology.

Enhance compliance and government systems.

Incentives in fund liquidity LES.

Recoup operating losses in the initial ramp-up period.

In simple investor terms:

MSEI now has time, capital and regulatory support to make a serious comeback not a cosmetic one.

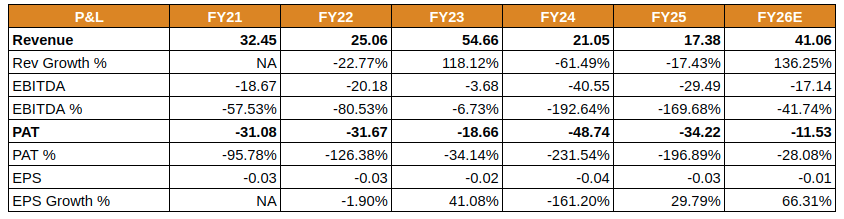

• The financial performance of the company is highly volatile and continues to suffer losses throughout FY21 to FY25, and the recovery is expected to be witnessed in FY26.

• The revenues have been volatile as it dropped to 17.38 crore in FY25, compared to 32.45 crore in FY21 although there is an acute spike in FY23. The revenue will rebound in FY26 to approx ₹41.06 crore, which shows that the growth will be 136 per cent YoY.

• EBITDA has been in the negative all along with a sharp decline in FY24 and FY25. Despite the fact that FY26 EBITDA will experience im Sharescartprovement to - 17.14 crore, the margins are acutely negative, which means that the operating efficiency is low.

• The net losses have continued to increase year after year and PAT is projected to increase to -11.53 crore in FY26 against -48.74 crore in FY24. EPS remains negative as it is likely to be positive to -0.01 in FY26.

• In general, FY26 indicates the likelihood of a recovery and the renewal of revenue, with the slight reduction of losses, however, until profitability is reached, the company will be operating at a loss and with a high level of risks.

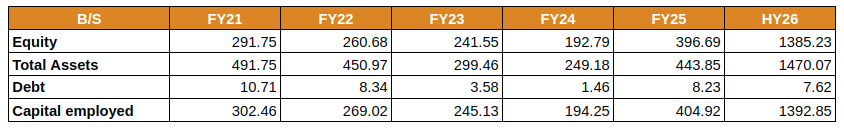

• Equity Surge in HY26: Equity remained tempered until FY24 before it shot off to ₹396.69 cr in FY25, and more to 1,385.23 cr in HY26, which is a significant capital inflow or revaluation.

• Asset Base Expansion: Total assets had gone down to ₹249.18 cr (FY24) after falling to ₹491.75 cr (FY21), and then responding strongly to 443.85 cr (FY25) and 1,470.07 cr (HY26) - indicating aggressive expansion of balance sheets.

• Low Debt Profile: Debt was low in years, decreasing to ₹1.46 cr in FY24, and only ₹7.62 cr in HY26, which is indicative of a debt-free position.

• Rising Capital Employed: The capital employed increased up to FY24 but increased sharply to ₹404.92 cr in FY 25 and 1,392.85 cr in HY 26, which indicates robust growth investment.

• Reinforcement of Balance Sheet: On the whole, HY26 represents a transformation stage as there was a steep increase in equity and assets and low leverage.

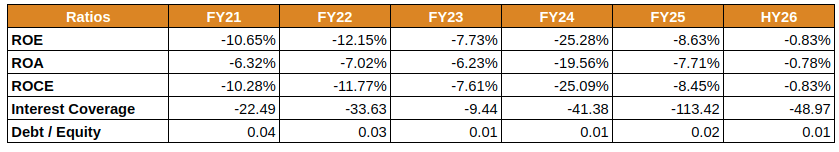

• Deep Losses to Near Break-even: ROE, ROA and ROCE plummeted in FY24 (~ -25) and then soared to an approximate of -0.8% in HY26 indicating a turnaround phase.

• Worst Stress Behind: FY24 was the least profitable and least capital efficient year of all the return ratios.

• Improving Operating Strength: The consistent returns improvement after FY24 indicates the increase in the control of costs and the stabilization of the business.

• Ultra-Low Leverage Advantage: Debt/Equity was 0.01-0.04, which made the balance sheet almost debt-free.

• Interest Coverage Remains Weak: Although the debt is low, negative coverage indicates unfinished operations recovery.

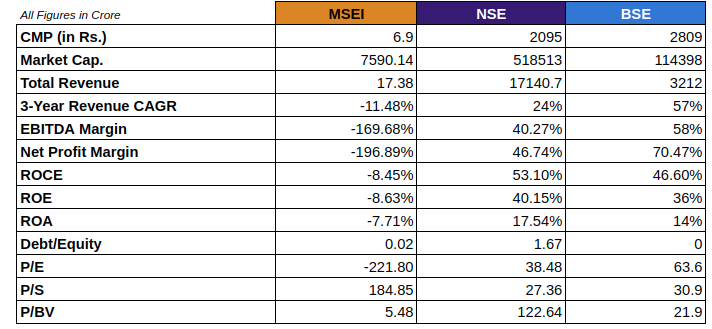

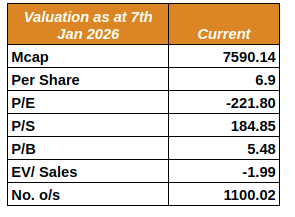

• Small Base, Big Upside: MSEI ( 7,590 cr m-cap; 17 cr revenue) is small vs NSE ( 5.2 lakh cr) and BSE ( 1.14 lakh cr) - low base gives high growth optionality.

• Turnaround vs Maturity: MSEI has CAGR of 3Y -11.5, NSE (24) and BSE (57) are good growers, MSEI is still in a turnaround stage.

• Margin Expansion Scope: MSEI margins are hideously negative (EBITDA -170%), whereas peers are 4058% — volumes scale sharp margin improvement is possible.

• Clean Balance Sheet: Debt/Equity only 0.02 (almost debt-free) provided MSEI with financial flexibility as compared to 1.67x leverage of NSE.

• Valuation = Option Bet: High P/S (185x) indicates future turnaround prospects, and not the present earnings.

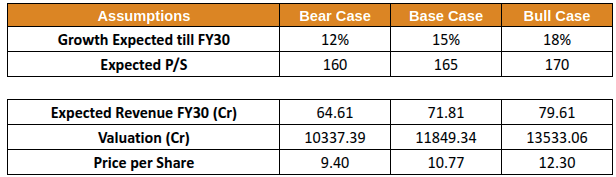

• Growth Assumptions (12% to 18%): This is based on a strong long-term growth outlook for the Indian capital market and increasing market liquidity. Industry reports and rising investor participation support this view.

• Liquidity and Business Scale-up: Improved liquidity, higher trading activity, and the financialization of savings should drive continued revenue growth for the company.

• P/S Multiple Used (160 to 170x): This was chosen because earnings are currently negative, while sales are increasing. The P/S ratio is more suitable for early-stage or turnaround businesses that show visible top-line growth.

• Valuation Outcome by FY30: Revenue is projected to be ₹64.6 to 79.6 Cr, leading to a valuation of ₹10,337 to 13,533 Cr and a price per share of ₹9.40 to 12.30 under different market scenarios.

To see what investors are enthusiastic about MSEI optionality, only one has to look at the journey of NSE unlisted.

Initially institutional investors who had purchased shares in NSE at the beginning of the 2000s at a price of 200-300 per share experienced an increase of their prices to 4,000-6,000+ in the unlisted market over the years.

That is 15x -25x in 20 years - before a public IPO.

What was behind this huge value creation?

Indeed, the trading volumes in India are on an explosive rise.

Close-to-monopoly market structure.

Good-margin exchange business model.

High credibility of governance.

Regulatory tailwinds

No. And investors cannot suppose that.

Nonetheless, it does explain the psychology of the present demand.

If MSEI captures even:

1–2% of NSE’s scale

Builds steady liquidity

Sustains regulatory trust

Cleanly executes in more than ten years.

If MSEI can capture a small share of market activity and build stable liquidity over time, it could still provide meaningful returns from current levels. It does not need to become another NSE to be seen as successful; it only needs to establish itself as a relevant and functioning alternative exchange.

Let’s be realistic.

MSEI will fail to replace NSE or BSE in the nearest future. They have enormous network effects. The concentration of liquidity is inhuman. Brokers and traders incur high switching costs.

However, MSEI does not have to beat them to win.

It only needs to:

Capture 1–3% market share

Specialization in specific segments/ time windows.

Become functionally sound and acceptable.

Maintain post launch liquidity.

Even a small portion of the capital market growth in India would warrant the valuation of MSEI in the long run.

This is not a low-risk story.

1. Sustainability Risk of Liquidity.

LES is able to jump-start volumes - it is more difficult to maintain them.

When traders quit incentives, the revenue model of MSEI is undermined.

2. Execution Risk

The process of restarting the trading is by itself a step.

Real success will be determined by system uptime, quality of order execution, compliance and broker onboarding.

3. Valuation Risk

At present prices, the expectations are already high.

Sharp corrections could be caused by any regulatory slowdown, technical malfunction, or disappointment in the volume.

4. Long Gestation Period

It is not three months of a trade but a 37-year old story.

Unlisted liquidity remains limited.

The current trading environment of MSEI is not a profitable one.

It is a heavily funded infrastructure start-up that resembles an old-order institution. This perception has not changed. It includes regulatory alignment, capital strength, and a clear operational roadmap.

If MSEI:

Successfully restarts the trading.

Builds sustained liquidity

Maintain credibility of governance.

Controls losses while scaling revenue

It would become the third useful exchange platform in India within the next decade.

MSEI represents a high-risk, high-optionality turnaround opportunity in India’s capital market ecosystem. Backed by fresh capital, regulatory support, and a clear execution roadmap, it has the potential to emerge as a credible third exchange over the long term. For investors tracking unlisted shares via Sharescart, MSEI offers exposure to a structural growth theme rather than near-term earnings visibility. Outcomes will depend on sustained liquidity, operational execution, and regulatory continuity — making it suitable only for investors with a long-term horizon and high risk tolerance.