15 Days Price Change

Summary

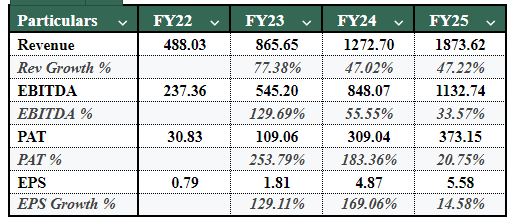

InCred is one of India’s fastest-growing, technology-driven NBFCs, operating across retail lending, SME finance, investment banking, and wealth management. Its AI-led underwriting, diversified revenue streams, and strong execution have helped it achieve exceptional financial growth, with revenue rising from ₹488 crore in FY22 to ₹1,874 crore in FY25, and PAT growing over 12x in the same period. With consistently improving ROE, expanding loan books, and rising profitability, InCred is now positioned as a scalable national NBFC platform

As one of India's fastest-growing financial services groups, InCred is using technology to meet the real needs of borrowers while delivering fast and effective solutions. Strong execution and measurable results have enabled InCred to deliver record revenue growth across all three areas of its business: lending, advisory, and investing.

Its business model is based on an innovative technology-first approach, with a focus on digital underwriting, data analytics and customer-focused technology. This strategy has enabled InCred to maintain the highest level of customer satisfaction in all its products, and it has therefore developed a strong position in the non-banking financial company (NBFC) space.

It is a Diverse Financial Services Platform. InCred Holdings Limited (IHL) is an Indian-based company that operates multiple verticals of financial services. They include:

Although IHL's loan book is the primary source of revenue and profit for the company, it is its diversified business model that allows IHL to act as a complete financial services platform for its customers in the retail and MSME segments.

The operations of InCred span four vertically growing businesses:

Retail loan, education loan, and consumer credit products, characterised by their robust digital origination process and analytics-driven credit risk assessments, comprise this segment.

This vertical supports India’s rapidly expanding micro, small, and medium enterprises (MSMEs) by offering customers working capital and structured loan solutions.

This vertical not only supports the provision of back office support, business intelligence services, and financial advisory services but also works to create operational efficiencies for businesses through cross-selling service offerings.

The Merchant Banking and Investment Services vertical includes activities conducted through entities registered with the Securities and Exchange Board of India (SEBI). These entities offer investment banking, Alternative Investment Fund (AIF) management, and investment advisory services.

The organisation employs a multi-engine business model that creates stable revenue streams and reduces InCred's reliance on any singular business segment.

InCred Group operates a disciplined holding–operating company model, allowing for clean regulatory lines of communication and focused execution.

The above structure is intended to permit InCred to operate a fully integrated, technologically-enabled, and comprehensive financial services organisation, in which the core business operation is lending.

The financial performance of InCred Financial has shown a strong growth trajectory with significantly improved profitability, much improved efficiency ratios, and an overall well-managed balance sheet. These positive trends illustrate that InCred Financial has built a strong foundation from which to continue to evolve, position itself for future growth, and ultimately expand significantly in the Non-Banking Financial Company (NBFC) space.

InCred Financial has a high likelihood for growth in the near future because of its significant business momentum and profit improvement, and it can scale more easily across the various lending verticals. Consequently, InCred Financial should experience higher than average growth than many of its larger peer companies. Its smaller size, technology-enabled underwriting and narrow focus on product strategy are expected to help InCred Financial achieve its long-term objective of increased market share. In addition, as the loan portfolio expands and the operating leverage of InCred Financial improves, it is anticipated that InCred Financial will achieve higher profitability margins, along with improved earnings visibility, making it a key player in the NBFC sector going into the fiscal year 2030.

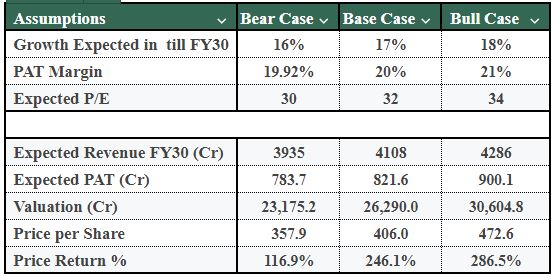

The projected income statements for FY2030 have been created using conservative-to-aggressive scenarios, with three main assumptions included within those scenarios: revenue growth, PAT margins, and valuation multiples.

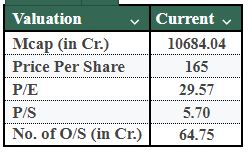

The expected revenues of InCred range between ₹3,935 crore and ₹4,286 crore for FY2030, while its PAT (profit after tax) is expected to be between ₹784 crore and ₹900 crore under three different scenarios. Valuation outcomes for InCred are expected to range between ₹23,175 crore and ₹34,205 crore, and its share price is estimated to be between ₹358 and ₹528 by FY2030. This potentially represents a return on investment for investors of between 117% and 320% based on current valuations.

Overall, InCred Financial holds a very positive outlook for its future performance. The strong historical growth, increasing level of profitability and improvement in return on capital metrics give InCred a significant opportunity to create value for shareholders over the long term. Incred has a scalable lending model, prudent risk management practices and a growing base of investor confidence, which creates a significant opportunity to more than double or possibly even triple InCred's valuation by FY2030.

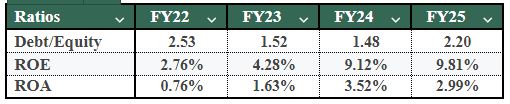

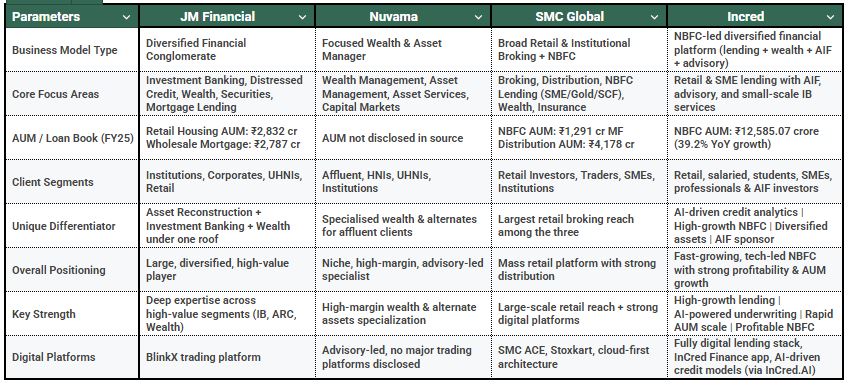

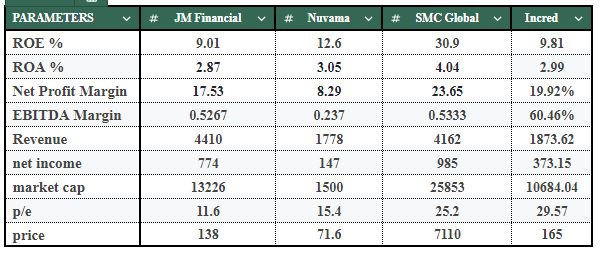

InCred uses metrics that compare other companies against them in terms of profitability, growth, and valuation. While Incred's Return on Equity (ROE) at 8.81% and Return on Assets (ROA) at 2.98% place them between SMC and JM (better than JM but below Nuvama), Incred clearly dominates the field when it comes to efficiency with an EBITDA margin of 60.46%, demonstrating better cost control, greater operating leverage and a strong lending portfolio. In terms of competitiveness, Incred also has a competitive net profit margin of 19.82% which is again ahead of most of its competitors.

Although JM Financial and Nuvama are larger revenue companies than Incred, Incred is growing faster than either company, as it continues developing its retail and SME loan portfolios. Incred's reported profit after tax of ₹373.15 Crores exceeds SMC's and has a very robust year-on-year growth of 20.7%. This demonstrates that Incred can scale both its AUM and profitability quickly.

The company's valuation also reinforces the investor's confidence; Incred's market capitalisation of ₹10,884 crore exceeds SMC and is close to JM, despite JM being a larger company. A P/E of 29.57 indicates a growth premium assigned to Incred by the market and places Incred among other high performing companies like Nuvama.

Incred differentiates itself from its competitors by employing a technology-first, AI-powered Non-Banking Financial Company (NBFC) model, allowing Incred to grow faster and operate more efficiently than traditional brokerage or wholesale companies.

AI-driven underwriting and predictive analytics, in combination with real-time tracking of an individual's behaviour/usage, have allowed InCred to evolve its processes to be faster, more efficient, and still keep high-quality portfolios. This technological foundation and credit engine will provide InCred with a means to achieve growth in a scalable and efficient manner.

InCred operates in five different segments: consumer lending, educational finance, lending to SMEs, wealth management, and AIFs. Having each of these segments helps diversify revenues from any one part of the business and thus ensures an entity’s revenue is less cyclical and more balanced.

InCred continues to show strong growth in revenue and profit through investment cycles. This increase in revenue and profit is driven by the increase in the number of loans disbursed to customers, increasing customer acquisitions, and a disciplined cost containment approach to achieve profitability on a larger scale.

The Indian market has a large opportunity for the growth of retail consumption and digital adoption (with low penetration levels of credit). InCred is well-positioned to meet the needs of salaried employees/customers, students, and small and medium-sized enterprises who are typically underserved by the traditional banking sector.

As InCred's loan book continues to grow, the company will spread its fixed costs over an increasing number of loans, thereby increasing operating leverage. The company's high-quality assets will continue to provide the company with strong returns on assets and equity through the efficient collection of interest payments from borrowers.

The use of a hybrid model that combines the benefits of digital distribution with an established and strong local presence allows InCred to rapidly scale without experiencing the same level of increase in costs that other companies typically encounter when expanding into new markets.

This enables InCred to build a sustainable, profitable national NBFC platform.

Investors must exercise caution even though NBFCs have robust fundamentals. Four main risks to be aware of:

1) Rising borrowing costs are likely to affect profit margins, as the NBFC sector is sensitive to interest rate fluctuations. Higher borrowing costs may reduce profit margins unless the company can pass higher borrowing costs along to the borrower.

2) Overall credit quality (if consumers, businesses and/or SMEs slow down on consumption, employment, and/or SME activities) will have an impact on repayment behaviours, and the need for continued vigour in underwriting and collection processes remains paramount.

3) NBFCs are subject to new regulations from the RBI, which may dictate how much capital their banks must hold, how much loan loss reserve they must maintain and what their corporate governance standards may look like.

4) Competition from our larger retail banks and new start-up fintech companies that are taking an increasingly aggressive approach in the marketplace means InCred must continue to innovate to remain competitive.

Incred has transitioned from an aggressive growth NBFC to a more stable and expansive entity with high profitability. The company has achieved exceptional historical growth, improved cost efficiency for its loan book, greater diversification of its operations, and improved risk management capabilities.

Incred is an emerging, high-growth, technology-focused NBFC that has a strong base of operations, scalable business models, and long-term upside potential. Incred operates with solid risk management practices and the continued expansion of its product line. As a result, Incred is a strong candidate for investors seeking ongoing, high-growth investment opportunities in the financial services industry. For users interested in tracking or exploring this unlisted share, it is also available on Sharescart.