15 Days Price Change

Summary

RRP S4E Innovation is a fast-growing electro-optics and defence-tech company delivering advanced weapon sights, thermal imagers, surveillance systems, and drone-based payloads for India’s modernising security forces. With strong industry tailwinds, high-precision in-house manufacturing, and rising demand for indigenous defence systems, the company has delivered robust financial growth, 50%+ EBITDA margins, and low leverage. Peer comparisons show competitive efficiency and attractive valuations relative to larger defence-tech players. With FY30 projections indicating 2–3× value potential, RRP S4E stands out as a high-visibility defence-tech compounder in the unlisted market. Through SharesCart, investors gain early access to this emerging leader ahead of broader market recognition.

RRP S4E Innovation is an electro-optics and defence-technology next-generation startup, founded in 2018, specialising in the development of advanced weapon sights, thermal imagers, long-range surveillance systems, and drone-based optical payloads to the armed forces and security services of India. The company has full-scale in-house competence in optics design, nano-machining, precision component production, assembly, and testing and develops fully indigenous solutions in terms of small arms, border surveillance, counter-insurgency operations, and tactical UAV platforms.

The difference about RRP S4E is the level of engineering, 1-micron level precision machining, nano-level level optical finishing, and diversified product line-up with defence-ready, which are in line with the strategic objective of self-reliance of the Indian state. With the country gaining momentum in the process of modernising its surveillance, night-vision, and drone ecosystems, RRP S4E is becoming one of the most promising and strategically important innovators in the field of electro-optics, in a nation that is poised to experience the revolution in defence-tech.

Vision - To become the number one electro-optics and defence-technology firm in India with a reputation of technical excellence, innovation and mission critical engineering. RRP S4E has a vision of enhancing the defence system of the country through the development of new and modern technologies that could protect borders, empower armies and forces, and work towards the international security.

Mission - To provide a combination of innovative, reliable and cost-effective electro-optic solutions to the India and international defence markets. RRP S4E is dedicated to providing the security forces with the latest technology to contribute to the increased efficiency of the operation, better safety, and mission success and the maintenance of the highest quality, ethics, and customer relationships in the long term.

RRP S4E Innovation is a comprehensive electro-optics and defence-tech firm - covering the entire range of design, manufacturing, assembly/test.

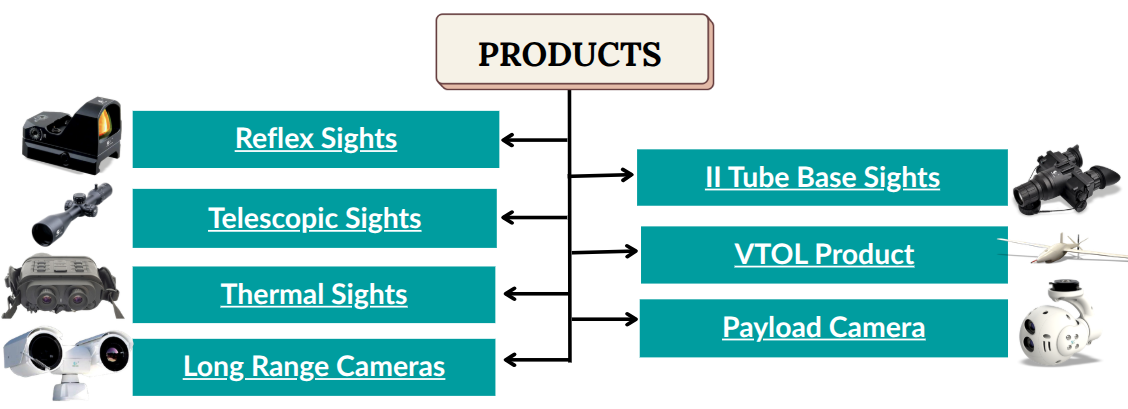

The product portfolio that they have diversified in, includes reflex sights, telescopic sights, thermal imaging sights, night-vision (II-tube) sights, long-range surveillance cameras, VTOL and drone payload cameras - providing infantry, surveillance units, border security forces, and UAV/drones with the latest optics and imaging solutions.

In addition to the production of new optics and sight systems, RRP S4E has its own repair-and-upgrade wing, the Dedicated Electro Optic Repair Centre (DEORC) that services, retrofits and upgrades electro-optic systems fitted on tanks, platforms, handheld equipment, and independent deployment.

This two-fold model, both manufacturing high-precision indigenous defence optic and also providing maintenance/upgrade services, provides RRP S4E with a business diversified advantage. It guarantees recurrent income (after-market services) and also established its role as an integrated, trusted optics companion, which is in compliance with the Make in India initiative of India, which is concerned with self reliance in manufacturing defence products.

India Aerospace and Defence market is estimated to be 27.1 billion US dollars in 2024 and 54.4 billion US dollars in 2033, with a CAGR of ~7%.

Narrower to that, the market of India defense-electronics and surveillance-electronics, a sub-market of the electro-optics and sensor systems, is projected to be US$ 6.85 billion in 2024, and is projected to hit ≈ US$ 11.35 billion in 2032.

The basis of this growth is the growing defence budgets, push towards indigenisation under the policies of Make in India / Atmanirbhar Bharat, modernisation of border-security and surveillance infrastructure, growing adoption of drone / UAV and growing homeland security and border-defence systems.

With the defence-electro-optics and electronic surveillance systems market on the increase, there is a sudden need in precision optics, thermal imagers, night-vision devices, UAV payload optics, sensor-integrated modules all competencies of RRP S4E. The structural tailwind that is generated with the growth path and governmental impetus is directed towards domestic manufacturing.

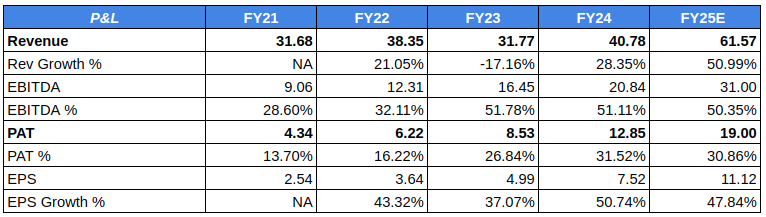

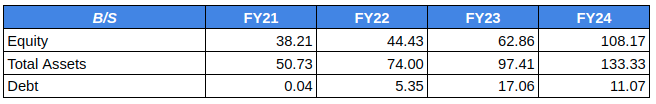

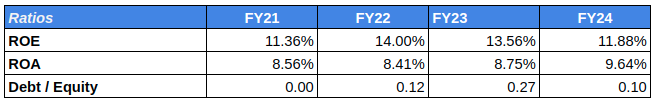

In general, the financial trend of RRP S4E corresponds to a high combination of growth, high margins, operational discipline, and scalability, which makes it one of the prospective newcomers in the Indian defence-tech manufacturing environment.

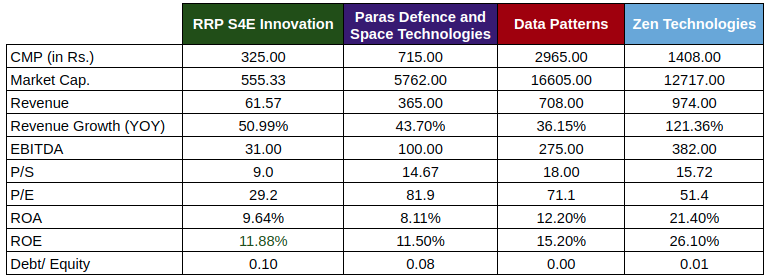

Although RRP S4E is not the size of the large competitors, it is equally profitable and efficient and this demonstrates its strength in niche such as electro-optics.

The future of RRP S4E has a solid foundation of order pipeline, growing defence demand, and an increasing pace of transition of India to local electro-optics. The company is experiencing a high-margin product, a fast-scaling manufacturing base, which puts the company in the bracket of achieving a sustained 20% growth till FY30.

20-30% growth in annual revenue due to MoD orders, EO modernisation and UAV payload demand.

PAT margins are projected to be maintained at 30-34% that are backed by localisation, efficiency and existing 50% + EBITDA profile.

Progressing valuation on 10-12x P/S, according to defence-technology counterparts.

Revenue: ₹153 Cr (Bear) → ₹229 Cr (Bull)

PAT: ₹46 Cr (Bear) → ₹78 Cr (Bull)

Valuation: ₹897 Cr → ₹1,605 Cr

Share Price Target: ₹525 → ₹940

With the most conservative assumptions, RRP S4E exhibits strong multi-year growth due to increasing use of thermal sights, surveillance optics and drone-mounted EO payloads. It boasts good margins, low debt, and has an executable order book of ₹120 Cr which is reflecting to make the company a high-visibility defence-tech compounder by FY30.

With the changing nature of the defence landscape of India, RRP S4E is on the leading edge of a new wave in the long term—where indigenous innovation, precision engineering, and high-margin technology come together to make long-term values. As the use of thermal sights, surveillance optics and UAV payload systems increases, the company is not only riding on the defence boom in India, but it is also contributing to the definition of the same.

To investors, RRP S4E is an uncommon event: a fast-growing fundamentally robust defence-tech innovator offered in the unlisted market today, long before the other market realizes its potential. SharesCart introduces plausible research and early entry into such emerging leaders, investors will be able to place themselves on the leading edge of the curve- investing in the technologies that are going to define the future of India in security.

RRP S4E provides a decade-to-decade, precisely and vision-driven sector, and this is the reason why it makes it a stand out story.