15 Days Price Change

Summary

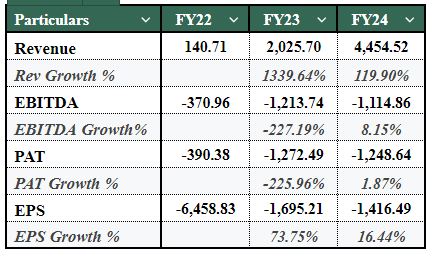

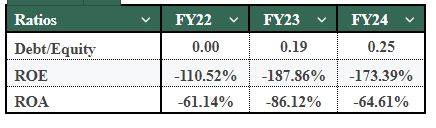

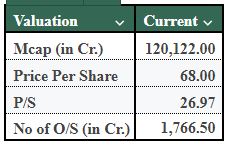

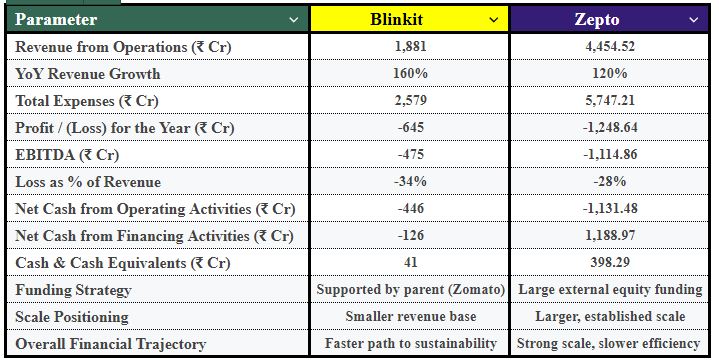

Zepto has rapidly scaled into one of India’s leading quick-commerce players, with revenues growing over 30x between FY22 and FY24. While the company remains loss-making due to its growth-first strategy, declining losses as a percentage of revenue signal improving unit economics. Zepto leads peer Blinkit on scale but trails on cost discipline and governance, as highlighted by its FY24 qualified audit opinion. Backed by strong investor funding, Zepto remains a high-growth, high-risk business, with long-term success hinging on converting scale into sustainable profitability and stronger governance.

As India's quick commerce market continues to grow rapidly, it has also become increasingly competitive and therefore requires large amounts of capital to be able to support businesses operating within this space. The primary focus of the new and rapidly growing industry is to provide consumers with ultra-fast and convenient delivery of their daily essentials. Zepto is one of the most successful participants in this rapidly growing sector of the marketplace and is quickly becoming one of the top competitors within the quick commerce industry.

This provides an overview of the financial and governance aspects of Zepto. The purpose of the analysis is to provide a clear view of Zepto's growth path, long-term viability, maturity of governance practices, and forecast for the future based on empirically derived statistical data rather than informal market speculation regarding growth or success.

Kiranakart Technologies Pvt Ltd was established in 2020 to participate in quick commerce by delivering groceries and essential everyday items directly to consumers using the internet. Zepto has built its model on technology and is structured for last-mile delivery within minutes by establishing a system for managing inventory as well as a network of dark stores. The main component of Zepto's inventory-based delivery system is that dark stores are where the products are held for the customer. The ability to store products in dark stores gives Zepto greater control of how quickly it can ship and deliver each customer's order. However, by utilising dark stores, Zepto will need to make major capital investments in warehouses, the purchase of inventory, and its delivery network.

Beyond the retail delivery component, Zepto is also expanding into warehouse distribution services, thus creating an opportunity to increase its supply chain efficiency through increasing its ability to scale. With Zepto's rapid growth, customer acquisition and market presence, Zepto's financial success is an excellent example of the financial returns generated by a venture-backed company with a hyper-growth trajectory.

Zepto has established a corporate structure consisting of three levels, which enables centralised management over the company's operations, capital funding, and economies of scale.

The highest level of this corporate structure is the holding company, Kiranakart PTE Limited (Singapore). This company owns 99.99% of Kiranakart Technologies Private (India). As the holding company, Kiranakart PTE Limited controls the overall long-term strategy, capital allocation, and equity funding (through the above-mentioned companies) and has provided financing support to Kiranakart Technologies Private so it continues to operate successfully in India.

At the lowest level is Kiranakart Technologies Private (India), which is the operating company of the Zepto brand. This company is responsible for operating the Zepto platform (dark stores) and last-mile delivery service, as well as managing customer service operations for both retail and e-commerce customers.

In addition to these two companies, there is also Kiranakart Wholesale Private (a subsidiary and wholly owned subsidiary of Kiranakart Technologies Private) that is focused on purchasing goods in bulk for wholesale distribution. Kiranakart Wholesale Private is designed to improve supply-chain efficiency and thereby increase margins through increased buying power. It is common for venture-funded businesses to operate in this manner, as it facilitates strategic control by the parent/holding company and financial dependence on the parent/holding company.

India's Quick Commerce Industry is characterised by a high frequency of small quantity orders at low prices, and extremely low margins, which means companies are competing aggressively to grow their share of this market. This means companies have to focus on building logistical density (lots of stores close together), dark stores (warehouses), and marketing efforts to remain competitive in the market. Achieving profitability does not come from selling a single order, but rather from the scale, repeat usage, and the efficiencies created through operational excellence.

Due to these characteristics, the Indian Quick Commerce Industry tends to favour companies that have large amounts of available capital and are willing to invest in and support their operations for an extended period of time as they grow and optimise their unit economics. Therefore, Zepto should be evaluated relative to the industry context, as it is pursuing growth while accepting that it may incur losses in the near-term.

The Company continues to prepare its financial statements on a going concern basis. This is primarily reliant upon a formal commitment from its timber-related Singapore Holding company to provide continuing financial support to the Company. At the end of FY2024, Zepto had a positive cash position (positioning) of ₹3,983 million; however, Zepto's continued long-term survival is directly dependent on the ongoing confidence of its investors and the availability of liquidity.

Auditors provided unqualified audits (opinions) on the consolidated financial statements for the years ending FY2023 and FY2024; this indicates that the Company’s financial statements represent a true and fair view of the Company's financial conditions, according to Indian Accounting Standards.

In FY2024, through the course of the audit, a major governance issue arose and was identified by the auditors as a qualified opinion regarding the internal financial controls. The audit discovered material office weaknesses in the information (IT) general office controls with respect to user access control, system alterations and IT operations.

Due to the lack of available standalone financial data from the quick-commerce space in India, Blinkit (owned by Zomato) is the only company that is comparable for comparison purposes to Zepto, since both companies operate using an ultra-fast delivery model and dark-store infrastructure to provide delivery services for customers while focusing on scaling the business rather than focusing on making a profit in the short term. However, they differ materially regarding scale, level of efficiency and the types of funds utilised to support their business.

Zepto faces many significant risks, including its ongoing inability to sustain itself with cash (due to its high cash burn), its ongoing reliance on outside capital to fund its operations, significant execution risk associated with scaling up its operations, and several sustainment issues highlighted in the qualifications made by its independent auditors. In addition to these primary risk factors, Zepto faces challenges related to increased competition and decreased margins.

Opportunities for future growth on the part of Zepto will be based on higher penetration in the current city locations, the continued productivity improvements of the dark stores, the aggressive introduction of high-margin private-label products, as well as the advanced optimisation of costs using technology. Maintaining operational performance whilst achieving further growth will be important.

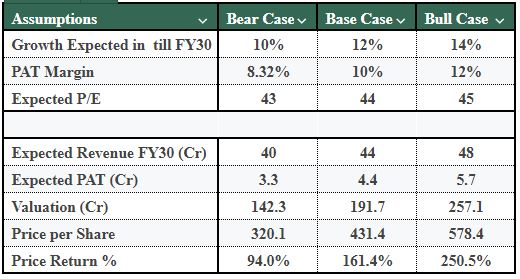

In conclusion, Zepto presents a high-growth/high-risk opportunity for long-term investors willing to accept volatility and delayed profitability.

The rapid rise of Zepto as a fast-growing Quick Commerce company in India presented a great opportunity to develop a successful business model based on revenue generation and operational efficiency. However, Zepto has only just begun to develop its business and will now focus its efforts to ensure that it grows responsibly with discipline and governance, as well as through financial integrity, which is critical to the long-term success of the company. How well Zepto meets these new challenges will ultimately dictate whether or not it continues to find success as an innovative, entrepreneurial organisation or becomes an established institution in the marketplace. For investors seeking exposure to Zepto’s growth story, the company is now available on Sharecart, providing access to this emerging opportunity.