Company Overview

The company, ZAK Venture Private Limited, focuses on the planning and development of city gas distributions (CGDs) within the energy infrastructure industry in India, as well as executing natural gas pipelines and laying out related infrastructure. ZAK will provide the necessary technical solutions for these types of projects by laying down Auto LPG systems, gas dispensers and offering technical assistance, etc. The majority of ZAK's work is dependent on project contracts; hence, ZAK's revenue is dependent on the awards of these contracts, their timely execution and the amount of money spent within the Indian oil and gas sector to support CGDs, etc.

Business segment

ZAK Venturing is primarily active in the following sectors:

- Transportation of natural gas and LPG

- Gas dispensers,

- Automated Leak Detection Systems,

- Consulting/Technical Support Services,

The company's business is project-driven; revenue comes from the contracts they obtain (in-bound orders), how long it takes to execute them, and their our customers (generally public sector undertakings) will pay for services rendered

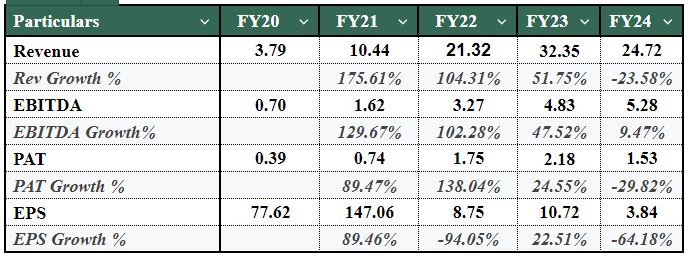

Financial Overview

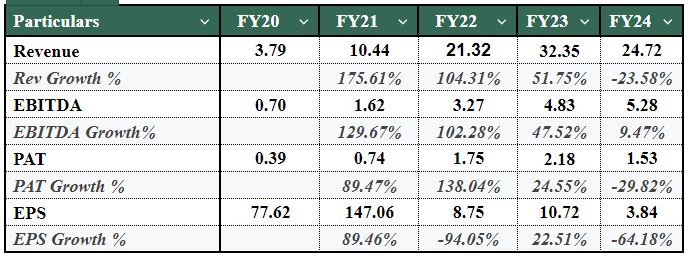

- From FY20 through FY23, ZAK Venture experienced phenomenal growth, with an increase in Revenue from ₹3.8 Crores in FY20 to ₹32.5 Crores in FY23 (+ ~8.5 times greater).

- The "growth trajectory" was primarily due to ZAK Venture's outstanding execution of Gas Pipeline and CGD projects.

- However, during FY24, ZAK Venture experienced a 23.7% YoY drop in Revenue (~₹24.8 Crores), which represents the first significant drop-off from its growth pattern.The drop is indicative of the cyclical nature and execution sensitivity that is typical in project-based Infrastructure Businesses.

- The collapse of Product Sales was a significant contributing factor to ZAK Venture's Revenue decline in FY24. The decline of Revenue from Products in FY24 was 75%. The decline from Revenue generated through Product Sales dropped from ₹5.36 Crores in FY23 to ₹1.34 Crores in FY24.

- Even though Pipeline Services remains the "core" Revenue Driver for ZAK Venture, the drastic decrease in Product Sales also calls into question ZAK Venture's ability to continue developing demand for its Product offerings and suggests a lack of diversification in this Segment.

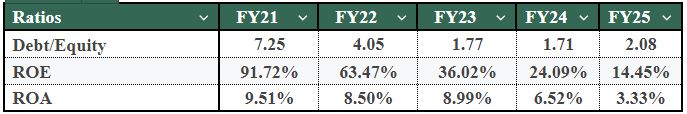

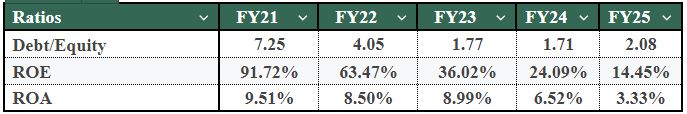

- Up to FY2023, ZAK Venture's profitability grew at the same pace as revenue with operating leverage. As of FY2024, however, there are structural pressure points highlighted: a 30% drop in profit after tax resulting in a reduction from Rs 2.19 crores to Rs 1.54 crores; and, the increase in the ratio of FINANCING costs was almost double due to borrowing increasing. As a result of declining revenues and higher FINANCING costs, ZAK Venture's Net Profit margin has become severely compressed.

- While ZAK Venture's absolute profits have been increasing during previous years, Earnings Per Share (EPS) has exhibited considerable volatility due to consecutive EQUITY DILUTION.

- The number of shares outstanding has increased dramatically since FY2021. While ZAK Venture's profits have been growing, its EPS has declined, thereby reducing per-share VALUE CREATION. Long-Term investors must view this potential dilution with concern.

- In FY2020 total assets increased dramatically from ₹4.1 Crores To ₹45.9 Crores by FY2024. However, when looking at the way the assets are structured in FY2024 there are some red flags- Inventory has increased by more than double in the year of declining revenue. Inventory and receivables represent approximately 70% of the total assets. This raises concerns regarding: (1) the company's ability to forecast demand accurately, (2) execution issues with projects and/or (3) stalled projects which would result in having capital tied up in assets that are not producing a return.

- The company expanded using both debt and equity financing. The company’s total liabilities in relation to equity increased to 2.08 times as of FY2024. Short term debt has increased dramatically to provide cash for working capital needs. The combination of these two increases has created a situation where the company has greater liquidity risk and could potentially be put under pressure to refinance during economic downturns.

Future outlook

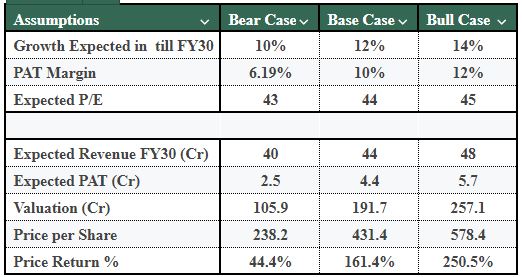

ASSUMPTIOMS

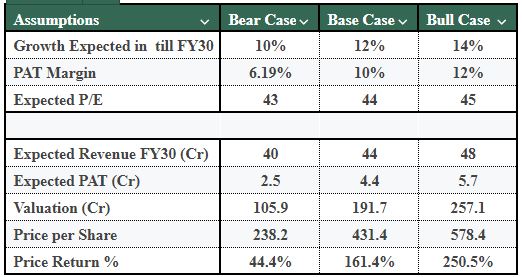

- The evaluation of ZAK Venture's prospective financial performance is based on the assessment of various scenarios while taking into consideration the trends for the industry and ZAK Venture's ability to execute on those trends. Within the natural gas and CGD sectors in India, it is reasonable to expect a CAGR for the industry to be between 6%-9% (according to IBEF sources), however, through its ability to execute on its pipeline and being exposed to Government owned companies, ZAK Venture is expected to achieve revenue growth of 10%, 12% and 14% on a CAGR basis under bear, base and bull cases respectively.

- Profitability will gradually improve as economies of scale and operating efficiencies develop over time. Under the three different scenarios, ZAK Venture is assumed to achieve 6%, 10% and 12% profit after tax (PAT) margins, respectively, supported by better management of costs, and year-over-year margin expansion resulting from execution.

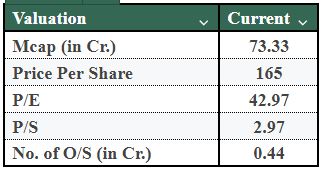

- Valuations for ZAK Venture are anticipated to be based on forward P/E multiples of 43X-45X, associated with improvements in profitability and confidence of investors.

Based on these assumptions, ZAK Venture may be valued between approximately ₹106 crore to approximately ₹257 crore for FY2030, thus presenting investors with significant upside potential, provided that ZAK Venture can execute in an orderly manner and continues to improve its profitability through cost discipline. The projected values should be used only for illustrative purposes and viewed as potential outcomes of varying scenario's execution.

Peer comparison

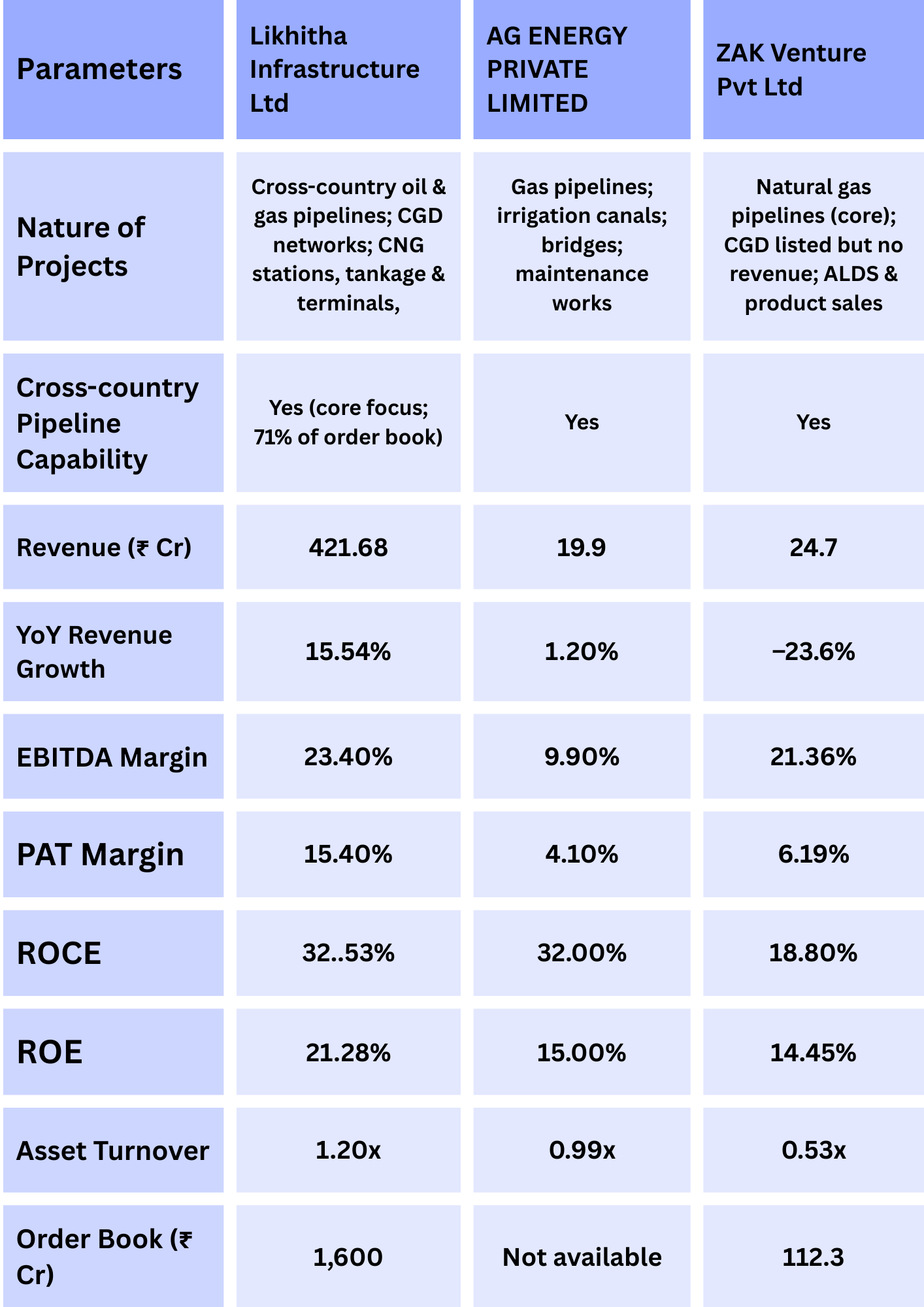

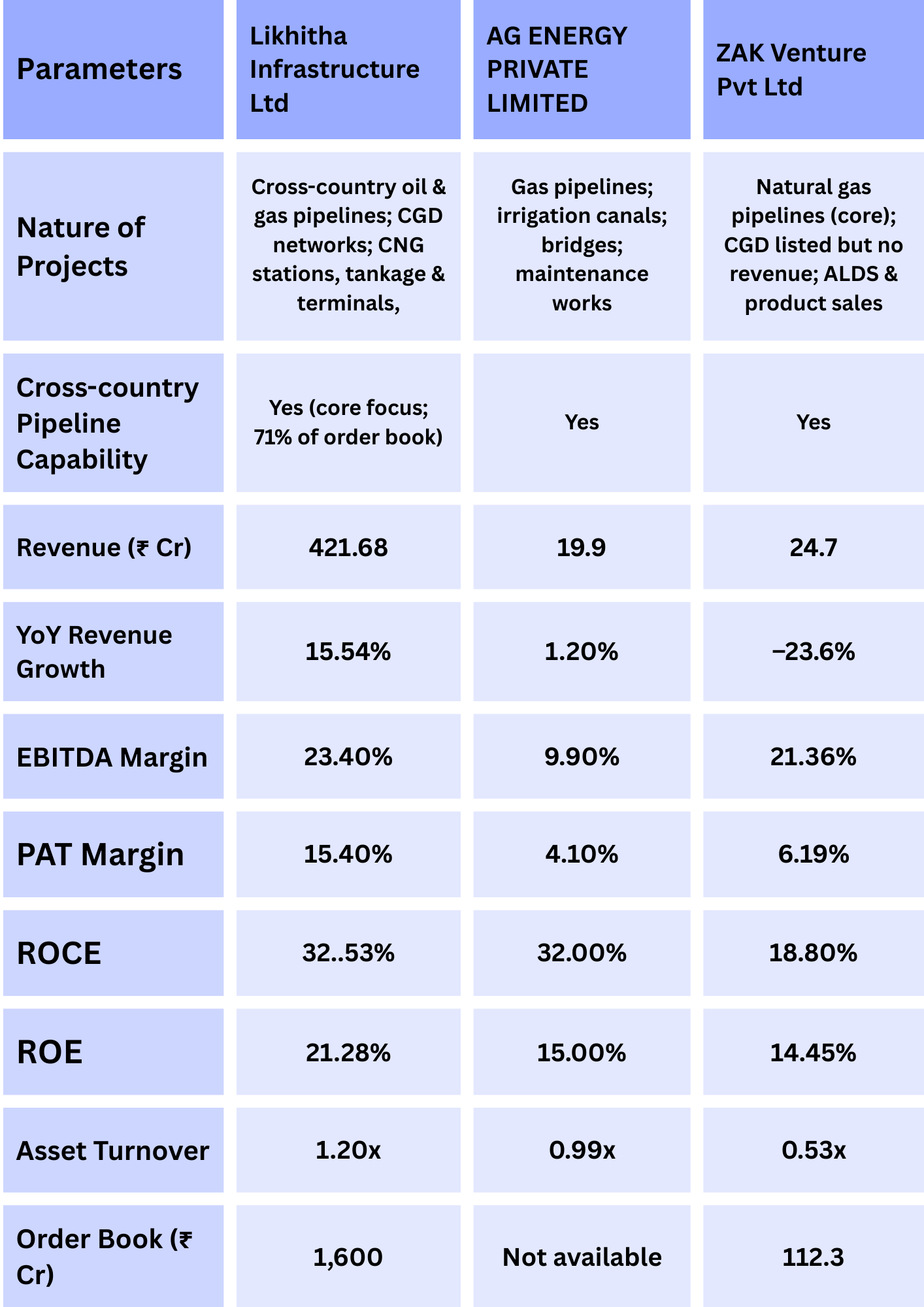

ZAK Venture Pvt Ltd's peer comparison with Likhitha Infrastructure Ltd and Aargee Pipeline Services Pvt Ltd highlights the fundamental differences in their business models even though all three companies are actively involved in providing pipeline infrastructure and oil and gas EPC services.

- In terms of comparison, Likhitha Infrastructure leads its peers by a large margin with a projected revenue of approximately ₹422 Cr and projected YoY revenue growth of approximately 20% in FY24, as reflected in its (Likhitha's) large (diversified) project mix, solid EBITDA margins (roughly 23%) and PAT margins (roughly 16%), solid returns generated from successful deployments as well as its comprehensive debt-free balance sheet and a very healthy order book (approximately ₹1,600 Cr or approximately 3.8 times its revenue) and represents an example of a mature and sophisticated EPC model.

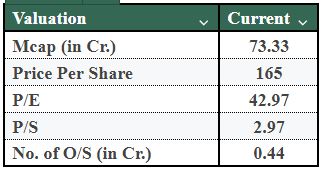

- Additionally, ZAK Venture's revenues (~₹25 Cr) are at a much lower scale than that of Likhitha, and ZAK experienced significant declines in FY24 revenues (24% decline) primarily resulting from recent business model changes in line with its previous performance history. However, ZAK's EBITDA margin is high (~21%), demonstrating that ZAK has effectively executed its core competencies at a high level; conversely, ZAK's PAT margins (~6%), declining ROE and ROCE, low asset turnover, and extremely heavy working capital requirements (approximately 300-day cash cycle), present significant challenges to ZAK achieving top-line revenue performance. Despite the difficulties ZAK is currently facing, ZAK does have a large order book (~₹112 Cr) and represents a tremendous upside opportunity for ZAK, primarily due to ZAK's ability to execute and liquidity risk associated with its capital structure.

- Aargee Pipeline Services Pvt Ltd is the smallest of the "big three" EPC competitors (approximately ₹20 Cr) with little to no growth or sustainable earnings (EBITDA ~10% and PAT ~4%); while the company did experience marginal improvements in terms of asset turnover and ROEs relative to other companies in this peer set, the constrained nature of Aargee's business model (limited revenues relative to its size) inhibits Aargee's ability to grow significantly in all segments, primarily due to the lack of visibility (for reported orders) from the large order book.

To summarise, Likhitha is the benchmark for scale, profitability, and strength in the industry. ZAK Venture is positioned in the middle; it has operational capabilities and will achieve significant growth in the future but has short-term financial and operational issues. Aargee continues to be a small and low-growth player with little visibility.

Future growth prospects

While there was a significant amount of both operational and financial stress placed upon ZAK Venture in FY 2024, the company has retained a number of potential growth levers which could help with recovery and stabilisation, provided that management executes with financial discipline and Improves working capital efficiency.

1. Reinvigoration of Pipeline Execution Activities

ZAK Ventures' core competency is laying gas pipelines for PSU & CGD clients. A revival in project execution, whether by way of reviving previously stalled contracts or by securing new orders can assist in the restoration of revenue momentum. Furthermore, the Government focus upon expanding India's Natural Gas Infrastructure & CGD Penetration represents a long-term structural opportunity for the business, although the timing and visibility of orders remain highly uncertain.

2. Return of Product Sales Segment to Normalcy

The fall of 75% in Product Sales experienced in FY 2024 appears to be an abnormal occurrence compared to prior performance. Should there be a return to stabilisation or recovery in Auto LPG, Dispensers or associated equipment, this represents the potential for incremental revenue streams and offsets for ZAK Ventures. In order for this to occur successfully, there needs to be increased visibility into the demand for these products along with a tightening of inventory planning in order to mitigate any increase working capital strain which may be experienced.

3. Operating Leverage Allows for Increased Profitability Via Cost Rationalisation

ZAK has a significantly expanded asset base. Should ZAK be able to grow revenue in the future there will be operating leverage generated by costs which will benefit margins. The areas of focus should be optimising Manpower Costs, Logistics Efficiencies and Overhead, all of which are essential in order to increase profitability without the need for any accompanying increases in capital investment.

4. Using Working Capital Release for Cash Flow

The next immediate opportunity is to free up cash flow by reducing inventory levels or speeding up the collection of accounts receivable. By doing so, it will be possible to improve working capital by freeing up liquidity and reducing the need to borrow money in the short term, thereby also decreasing interest expense, which would support improving net profit.

5. Repairing your balance sheet and maintaining capital discipline.

The second near-term opportunity is if the Company changes its strategy from aggressive expansion to one based on consolidation. This would allow the Company to achieve financial stability by generating cash, rather than simply focusing on scaling its business. Successful de-leveraging and controlling capital will enhance the confidence of investors and increase the sustainability of their valuations over the next several years.

Red Flags

- High levels of inventory relative to sales, creating a cash immobility situation.

- Increased short-term borrowing and escalated short-term liquidity pressure.

- Higher leverage leading to sensitivity of interest expenses.

- Reduction of shareholder returns due to dilution in consolidated EPS.

- Earnings result from project-based vision and make earnings unpredictable.

These variables cumulatively infer, and indicate that FY2024 is not merely an anomaly but rather a stress test for the company’s Growth strategy.

Conclusion

The company is in the process of moving from a period of hypergrowth to a period of recovery and stabilization, during which time it will rely more on execution quality, working capital discipline, and debt management than on the rapid expansion of its business. Going forward, any meaningful growth will rely on the company's ability to utilize its existing assets efficiently to generate revenues, rather than on the addition of new capacity.

In conclusion, the financial history of ZAK Venture Private Limited illustrates the classic risks and rewards associated with pursuing an aggressive growth strategy. The company went through a period of rapid growth between FY2020 and FY2023, whereby its revenue base and asset base grew substantially, utilizing a combination of equity and debt to finance its expansion. FY2024 is a significant turning point for the company, with a decline in revenues, reduced profitability and increasing amounts of working capital stress. As such, the company's minimal product sales, growing amount of inventory and increasing reliance on short-term loans all illustrate that the company's operations are inefficient and that the company is facing a heightened liquidity risk. The shares of ZAK Venture Private Limited are available on SharesCart. Interested investors may contact their Relationship Manager (RM) for further details.