15 Days Price Change

Summary

Spray Engineering Devices Ltd (SED) is a core industrial and sustainability-focused process engineering company serving sugar, ethanol, water, and allied industries across 40+ countries. With strong engineering capabilities, a growing patent base, and solutions aligned to energy efficiency, water conservation, and environmental compliance, SED plays a critical role in modern industrial infrastructure.

While the business is cyclical and project-driven, leading to short-term volatility, it offers structural long-term potential backed by ethanol blending, sustainability norms, and industrial upgrades. Best suited for long-term, research-led investors, Spray Engineering is an unlisted industrial depth play worth tracking on Sharescart rather than a short-term trading opportunity.

The modern industrial plants have to save on energy, minimise on water, and adhere to high environmental standards, particularly in sugar, ethanol and process industries.

Spray Engineering Devices Ltd (SED) is an organisation that specialises in offering the specialised technologies and engineered systems required to enable these improvements in order to assist clients to be efficient and sustainable in their operations.

Spray Engineering started off as a small-roadside fabrication company that specialised in the sugar business, then graduated to a comprehensive process-engineering solutions company. The company has its head office located in Mohali and several advanced manufacturing plants located in Baddi, Himachal Pradesh.

This presence in the global footprint makes SED one of only a few Indian process-engineering companies that have a global presence in technology, the Made in India label.

1. Expensive steam, energy, and water prices.

2. Zero Liquid Discharge (ZLD) regulatory pressure.

3. Requirement of process upgrades which are cost effective.

✔ Decrease the use of steam and energy.

✔ Enhance the effectiveness of evaporation and heat transfer.

✔ Sustainably treat industrial wastewater.

✔ Water reuse and recycle, reducing the costs of operations.

The products of Spray Engineering meet the basics of industry requirements:

Falling film evaporators

Multiple-effect evaporators

Low temperature MVR-based evaporators

These systems also reduce steam and energy use within sugar and ethanol plants to a great extent.

Heat exchangers

Condensers

Flash vessels

They assist clients in capturing and reusing heat to better the economics of the plants in general.

Continuous & batch vacuum pans

Crystallisation systems for sugar processing

These solutions improve the sugar yield and quality.

Treatment of industrial waste water.

Custom ZLD configurations

These assist in adhering to the stringent environmental laws as well as water conservation among plants.

In addition to hardware services, SED offers engineering, fabrication and commissioning services that are unique to individual plants.

The board of Spray Engineering has engineering, financial, and operations experience:

Mr. Vivek Verma – Managing Director

Mr. Vimarsh Verma – Director

Mr. Shridhar Venkatesh – Nominee Director

Ms. Arshdeep Kaur – Independent Director

Ms. Niveta Sharma – Independent Director

Mr. Rinkal Goyal – Company Secretary & Compliance Officer

This leadership mix is very strong as it is a mix of technical, operational, and governance skills.

Promoters & Promoter Group: ~70.28%

Mr. Vivek Verma (CMD): 48.59%

Mr. Prateek Verma (WTD): 21.69%

Non-Promoter / Public Shareholders: ~29.72%

Includes Klondike Investments Ltd.: 11.25%

Other public and non-promoter entities: 18.47%

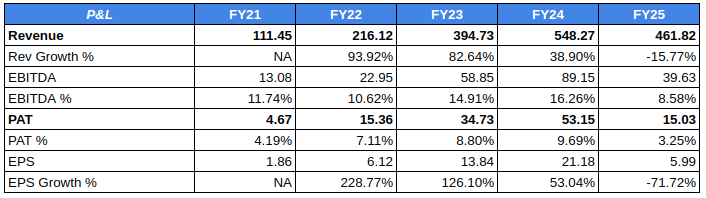

The growth in revenues was high, with the increase in FY21-FY24 with 111.45 Cr to 548.27 Cr, due to high volumes of order and performance.

During FY25, revenue decreased by an estimated 16% YoY to 461.82 Cr, which is an indication of project deferrals, reduced execution pace, or an unfavorable environment of orders.

EBITDA has grown consistently until FY24, and the margins were maximized at 16.26, which is an indicator of operating leverage.

During FY25, EBITDA margin declined drastically to 8.58 %, which is a sign of cost pressures, less absorption of the fixed costs, or less profitable projects.

PAT increased steadily until FY24 ( 53.15 Cr) but fell drastically to FY25 to 15.03 Cr, contracting the margin of PAT to 3.25%.

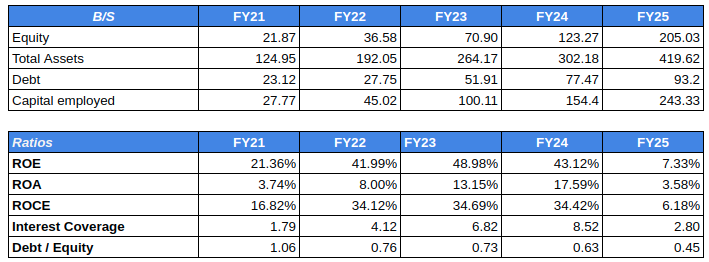

Total assets increased more than threefold over five years, showing growth in operations.

Debt rose in absolute terms but remains well managed compared to equity.

Debt-to-equity ratio steadily improved from 1.06x in FY21 to 0.45x in FY25. This indicates that the balance sheet is becoming less reliant on debt.

Capital employed grew sharply, which supports long-term growth potential.

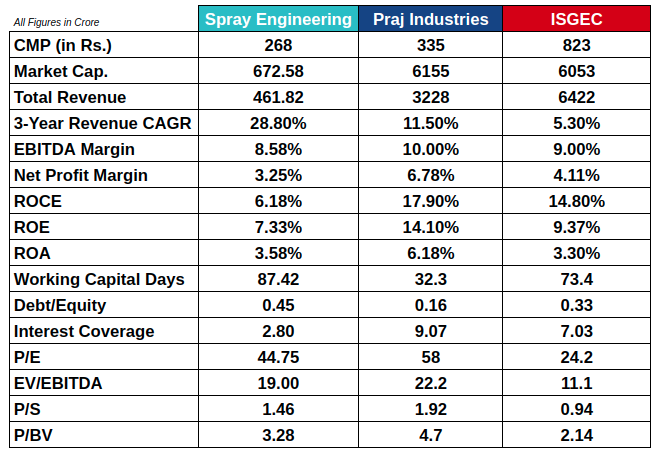

Fastest growth in peers: 3-year revenue CAGR of 28.8%, surpassing Praj and ISGEC.

Margins lag, growth leads: Lower current profitability indicates a scale-up phase, not weak demand.

Project-led working capital: Higher working capital days are typical for process-EPC businesses.

Balanced leverage: Debt to equity ratio at 0.45 keeps balance sheet risk manageable.

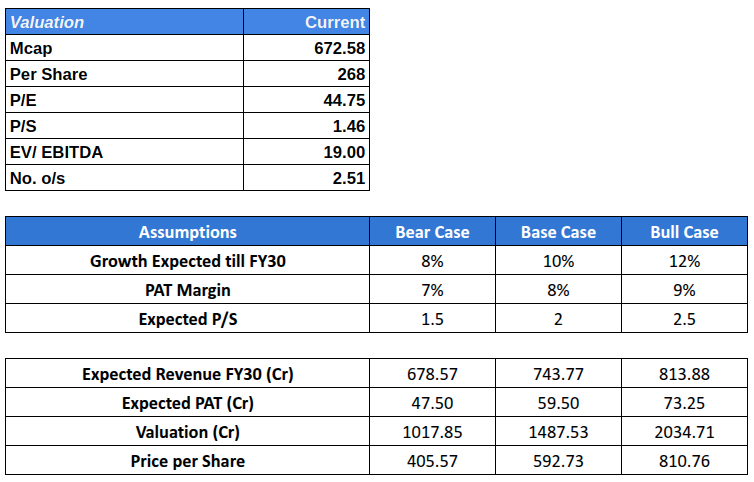

Valuation equals growth optionality: The market values Spray Engineering for its future growth, not its current margins.

Spray Engineering is not suitable for short-term investors. Its performance can fluctuate due to its cyclical, project-driven nature, which may not appeal to those seeking quick price movements or momentum-based returns.

However, for investors who can handle volatility, look beyond quarterly changes, and invest with a long-term perspective, Spray Engineering Devices Ltd (SED) is a strong industrial player. As an unlisted company, it provides access to trends like sustainability and process efficiency at an early stage.

Long-term, research-focused investors can track and evaluate such unlisted opportunities on Sharescart, where patience and fundamentals go hand in hand.

This article is for educational and informational purposes only and does not constitute investment advice or a recommendation. The content is based on publicly available information and independent analysis. Sharescart and its contributors do not have any vested interest in the company mentioned. Readers should conduct their own research and consult a financial advisor before making any investment decisions. Investments in unlisted shares carry risks, including liquidity and valuation risks.