15 Days Price Change

Summary

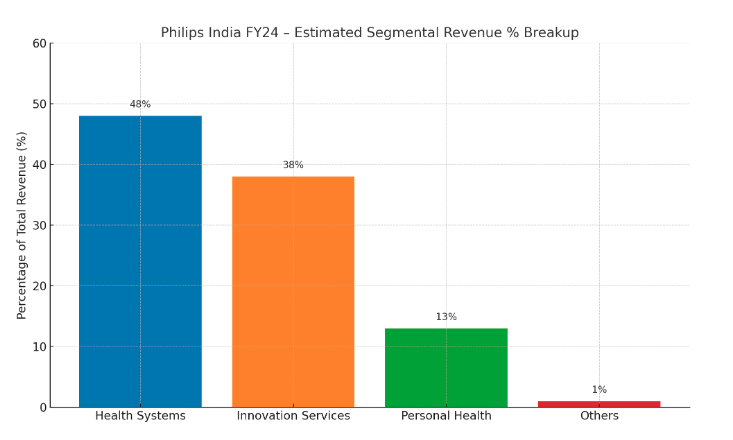

In a country where hospitals never rest and healthcare is needed every single day the Philips India Limited works silently in the background. As a part of the global Philips brand it provides life saving machines like MRI scanners, CT machines, ultrasound systems and patient monitors used in hospitals across India. It also builds smart healthcare software and digital platforms that help doctors and hospitals work better, which is not just in India but around the world. At the same time it reaches into Indian homes with trusted products like trimmers, air purifiers, baby care items and grooming tools. In short, Philips India is deeply rooted in the healthcare industry, one of the few industries that never stops even during tough times and with medical costs rising by around 13% every year in India the demand for quality healthcare keeps growing. Philips is right at the heart of this journey, steady, trusted and always ready.

Healthcare is not just an industry - it’s a lifeline. Every country depends on it because people will never stop falling sick and no nation can afford to ignore its health system. This is where Philips India Limited plays a powerful role. As part of the global Philips brand it is deeply involved in the Healthcare Industry, one of the most critical and non-negotiable sectors of India’s economy.

Philips India builds and provides essential medical machines like MRI scanners, CT machines, patient monitors and ultrasound systems tools that are used in almost every major health issue from diagnosis to surgery to post care. Here’s how they’re used in real life:

MRI Machines - Used to detect brain injuries, spinal problems or tumors without surgery. (e.g. Philips Ingenia Ambition MRI a fast and helium free MR system)

CT Scanners - Commonly used to check for heart blockages or internal bleeding especially after chest pain or road accidents. (e.g. Philips Incisive CT Scanner known for low radiation and fast results)

Ultrasound Systems - A routine tool for monitoring pregnancy and ensuring the baby's health during all trimesters. (e.g. Philips Affiniti Series , Lumify compact and handheld ultrasound devices)

Patient Monitors - Used in ICUs to track heart rate, oxygen levels and blood pressure in real time for critical patients like during surgeries or COVID-19 care. (e.g. IntelliVue MX Series)

These machines are not optional without them modern hospitals cannot function and if there’s no functioning healthcare system it’s not hard to imagine the outcome.

Philips also contributes through its innovation services creating healthcare software, cloud platforms and IT solutions that make hospitals smarter, faster and more connected.

Some real-life innovation examples include:

Tele-ICU Platforms – (e.g. Philips eICU Program) allowing doctors to monitor ICU patients remotely from command centers

AI-based Diagnostic Software – (e.g. Philips IntelliSpace AI Workflow Suite) helping radiologists detect abnormalities faster in X-rays and MRIs

Cloud-based Health Systems – (e.g. Philips HealthSuite Platform) used to store, analyze and share patient data between hospitals securely

This makes it a key enabler not just of equipment but also of digital transformation in Indian healthcare.

In addition to hospitals. Philips India is also present in personal health and wellness making everyday healthcare accessible at home. It offers products such as:

Trimmers and Shavers – (e.g. Philips OneBlade, Philips MG7715 All in One Grooming Kit) for men’s grooming and hygiene

Mother and Child Care Products – (e.g. Philips Avent Electric Breast Pump, Bottle Sterilizer and Baby Monitors)

Air Purifiers – (e.g. Philips Series 2000 and 3000 Air Purifiers) for improving indoor air quality especially in polluted cities

Electric Toothbrushes and Oral Care – (e.g. Philips Sonicare Electric Toothbrush) for advanced dental hygiene

These products are trusted by millions and make Philips a household name beyond hospitals.

According to the Indian Brand Equity Foundation (IBEF) the Indian medical devices market was worth ₹90,000 crore (US$ 11 billion) in 2022 and is expected to grow to US$ 50 billion by 2030 with a strong CAGR of 16.4%. This clearly shows that healthcare is not just essential it is also a fast growing and future ready sector.

In short: Philips India is in one of the most important ,fast growing and an industry that the nation simply cannot compromise on.

Financial Data (in cr.) |

||||

|

- |

FY21 |

FY22 |

FY23 |

FY24 |

|

Net Sales |

1247.6 |

1738.7 |

1780.7 |

1744.9 |

|

Total Income |

1264.4 |

1746.1 |

1795.9 |

1756.9 |

|

Net Profit |

74.7 |

137.2 |

144.9 |

120.7 |

|

Shareholder Funds |

173 |

369.6 |

370.7 |

333.2 |

|

Total Assets |

558.7 |

709.7 |

714.7 |

751.7 |

|

EPS |

12.99 |

23.85 |

25.19 |

20.99 |

-Revenue peaked in FY22, then slightly declined in FY24 – growth has stabilized.

-Profit and EPS stayed strong despite a small dip in FY24.

-Net worth jumped in FY22, then reduced slightly in FY24.

-Assets grew steadily, showing continued business expansion.

Solvency ratio |

|

|

Ratio |

Value |

|

Debt-to-Equity |

0.1% |

|

Debt-to-Assets |

0.56% |

|

Interest Coverage |

37.15x |

-Negligible debt shows the company is risk free

-56% of assets are financed through debt within manageable range.

-Philips India earns 37× more than its interest obligation indicating very low credit risk.

Liquidity Ratios |

|

|

Current Ratio |

2.21× |

|

Quick Ratio |

1.78× |

-The company’s Current Ratio above 2 suggests a strong liquidity position and has potential to meet its all short term obligations

-The quick ratio above 1.5 suggests financial health and working capital strength.

Peer Comparison of Valuation |

||||

|

Valuation Metric |

PHILIPS INDIA |

TATA ELXSI |

SIEMENS LTD |

Poly Medicure |

|

Price to Earnings(P/E) |

21.2 |

50 |

42 |

58 |

|

Price to Book(P/B) |

3.7 |

13.14 |

7.1 |

7.21 |

|

Market Cap to Sales |

0.88 |

10.1 |

6.14 |

12.4 |

The Philips India ltd is trading at lowest valuation among its peers

-Lowest P/E

-Lowest P/B

-Lowest Market cap to sales also less than 1 which suggest the company’s revenue is more than its market capitalization

India’s economy is now stepping into a more mature stage in what experts call the late expansion phase.

According to the RBI’s July 2025 Bulletin, factory capacity utilization stands at 75.4%, showing that production is running at a steady and strong pace. Meanwhile credit to businesses has grown by 16.3% reflecting ongoing investment and economic activity

This is the point in the economic cycle when things aren’t speeding up anymore, they're stabilizing and during this phase the attention often shifts toward defensive, essential sectors like Healthcare.

With medical inflation rising 13–14% every year the hospitals continue investing in advanced medical equipment and people become more conscious of their personal health needs. While growth in other industries may start to flatten, the healthcare demand keeps rising, making it one of the most resilient and necessary sectors. In times like these, healthcare doesn’t just grow, it leads quietly but powerfully.

In the end, the medical industry is one of the most important and non-negotiable sectors not just for any economy but for human life itself. No matter how the economy moves people are not going to stop getting sick and as medical technology advances the demand for better machines, faster diagnostics and smarter solutions will only rise.

What’s more, India is becoming a global hub for medical tourism with people from countries like Bangladesh, Nepal, Africa and even parts of the Middle East coming here for treatments ranging from heart surgeries to organ transplants thanks to India’s skilled doctors and cost effective yet high quality care.

This is exactly where Philips India Limited fits in offering world class medical equipment and digital healthcare solutions that power hospitals and clinics across the country and beyond.

So, as an Analyst, The view is simple:

If you believe India’s healthcare industry will grow in the future both for its people and as a medical destination then Philips India could be a meaningful long term opportunity. To explore more investment opportunities in unlisted gems like Philips India, visit www.sharescart.com where India’s next big stories begin.