15 Days Price Change

Summary

As the National Stock Exchange of India (NSE) turns 30, it stands as the unseen engine of India’s growth—powering how the nation invests, raises capital, and builds wealth. With unmatched market dominance, cutting-edge technology, and strong institutional backing, NSE has evolved into the financial backbone of India’s economy. Profitable, resilient, and future-ready, it remains a core investment story in India’s journey toward becoming a developed economy by 2047.

When discussing India’s growth narrative, people usually point to startups, manufacturing, and digital. However, the true force continually at the centre of all of these aspects is the National Stock Exchange of India (NSE) — it is the marketplace where the capital of India meets opportunity.

As NSE turns 30 years old, it has gone from being seen as a part of a technology disruption to the nerve centre of India’s financial ecosystem, influencing how companies raise capital, how investors create wealth, and the speed at which India advances toward its goal of becoming a developed economy by 2047.

When NSE was launched in 1992, India’s capital markets were fragmented, slow, and opaque. The Bombay Stock Exchange (BSE) — the main competing exchange since 1875 — used a manual, floor-based system. NSE disrupted that forever.

By creating the country’s first electronic, screen-based exchange, NSE created a capital market structure characterised by speed, transparency, and trust.

Its digital-first infrastructure, data platform, and technology experiences have given NSE significant advantages from its inception.

NSE processes 2,000,000,000 order messages and 294,000,000 trades in one trading day.

It runs seamlessly on over 17,000 physical servers across 6 state-of-the-art data centers.

And it has maintained a perfect record of zero data breaches—a key indicator of its 24/7 commitment to capital market integrity.

This technological resilience and scalability did not merely disrupt; rather, it has permanently transformed the Indian market ecosystem.

NSE functions as a national critical digital infrastructure with ultra-low latency and fault tolerance. The systems can withstand extreme volatility while executing trades with comparative accuracy — securing it as the default exchange for institutional and retail traders.

With 11.3 crore unique investors across 99.85% of India’s pincodes, NSE has democratised investing like never before. Retail participation now includes youth, women, and investors from Tier-2 and Tier-3 towns—something NSE coins “Bharat Participates in the Market”.

As a first-line regulator, NSE not only facilitates trades to occur—it mandates fairness and transparency. Its regular interactions with SEBI and high standards of governance establish market integrity and protection for investors.

NSE has effectively translated its superior technology and market position into remarkable financial returns—producing results that even globally comparable trading venues such as NASDAQ and LSE would aspire to.

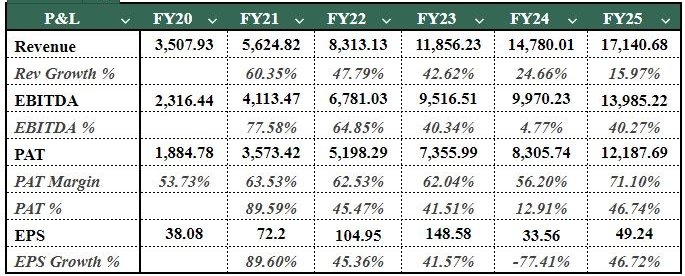

In FY25, NSE reported:

Total Revenue: ₹19,177 crore (↑17% YoY)

Profit After Tax (PAT): ₹12,188 crore (↑47% YoY)

EBITDA Margin: 77%

PAT Margin: 71% — among the highest margins globally in the financial exchange sector.

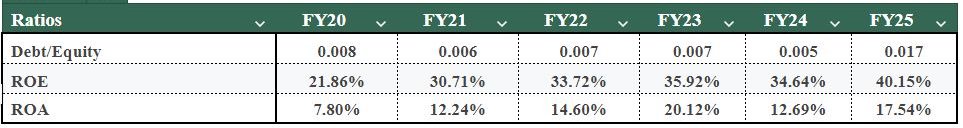

Return on Equity (ROE): 40.15%

Net Worth: ₹30,353 crore (↑27%)

These metrics indicate more than just operational efficiency — they communicate the depth of NSE's economic moat. Its transaction-based revenue model is supported by network effects, where more trading generates more volume without a proportional change in costs.

Another driver of profitability is the multiple revenue sources. Although transaction fees (71%) remain the largest share, consistent income is generated by data feeds, clearing services, index licensing, and listings. Non-operating income (10%) and limited leverage (debt-to-equity of 1.67) also contribute to consistent revenues while limiting volatility during weaker market conditions.

What is compelling about NSE, however, is the coexistence of scale and resilience. Even with a record trading day with 2,000 crore order messages processed, the exchange has maintained zero downtime and zero data breaches, furthering investor trust and institutional confidence.

This combination of operational excellence, profitability, and caution reinforces NSE’s classification as not just a market operator but as a financial juggernaut shaping India’s capital markets.

|

Segment |

NSE Market Share |

BSE Market Share |

|

Equity Cash |

93.6% |

6.4% |

|

Equity Futures |

99.9% |

0.1% |

|

Equity Options |

87.4% |

12.6% |

The NSE–BSE relationship is a dynamic one that shapes the capital markets in India, with NSE excelling in high-volume aspects and BSE occupying strategic portions in the total capital market structure.

Looking ahead, the NSE has every reason to grow – the trajectory will be firmly upward. With India's economy set to double over the next 10 years and financialisation quickly accelerating, the Exchange is very well-placed to benefit from this.

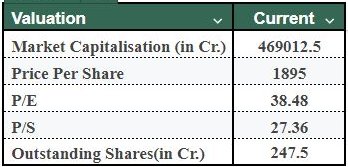

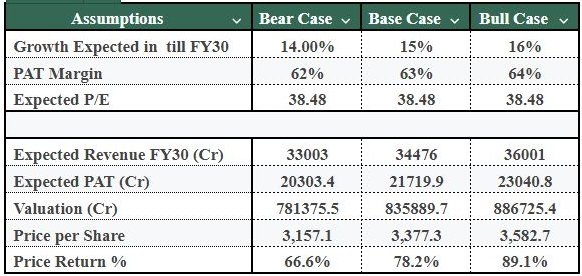

Our analysis – which is based on moderate growth as well as stable valuation assumptions – projects strong compounding potential.

ASSUMPTIONS WE MADE:

1. Revenue Growth Assumptions: We assume a base growth of 14%, which is in line with the India Briefing Report; in addition, we have included incremental upside from new product launches, global expansion through the GIFT Nifty, and also continued proliferation of retail penetration.

2. PAT Margin: We have modelled a PAT margin on a historical basis from FY20 to FY25 of ~70%, which we expect will slightly improve, reflecting higher operating leverage and efficiency.

3. P/E Ratio: We are comfortable maintaining the current P/E ratio at 38.5x while we continue to monitor operational metrics

Assuming conservative growth, NSE's revenue and profit may almost double by FY30 (14-16% CAGR in revenue and 12-15% CAGR in earnings).

In a bull case scenario, with better market activity and international take-ups driving the stock market, valuations may expand and continue to provide upside of as much as 90% from where we are today.

Let's now bring some reality into the situation.

If an investor had invested ₹10 lakh into NSE securities in 2020, that investment, given a consistent compounded growth rate of ~14.3% CAGR per year, would take the value of the investment to roughly ₹19.5 lakh by FY25.

Now moving further out, considering FY30's projections:

The same ₹10 lakh investment made today in FY25 could also mean a value of ₹19lakh by FY30—on the basis of a 14% CAGR driven by an orderly expansion of the market participation, a focus on stable profitability while investing, and catalyst-driven growth from innovation.

In summary, NSE remains a growth story and compounding machine delivering value while maintaining almost zero debt and unrivalled market leadership.

Ownership in the NSE indicates strong support from some of the most prestigious institutions in Indian finance:

These established institutions with their varied holdings in NSE demonstrate a commitment to NSE’s conduct, integrity, and future value. This confidence is not merely symbolic — it creates institutional credibility in NSE’s capacity for investors, as well as the essential middleman in India’s capital markets.

The NSE is more than a stock exchange — it is the institutional and structural backbone of India’s financial ecosystem. NSE’s leadership as a market exchange, technological superiority, and financial strength serve as all-important factors in its current valuation in a way that makes it indispensable for the economic growth of India as a nation.

For investors, the NSE demonstrates a rare combination of stability and scalability, making it a value-for-life enterprise. Not only is NSE a leader in today’s market status, but it is also positioned to maintain that leadership status for decades to come, while conserving and compounding returns for its shareholders in the role the NSE is expected to take into the future. This share is available through Sharescart, and you can visit our website to invest.