15 Days Price Change

Summary

SBI Mutual Fund, India’s largest asset manager, continues to outperform peers with its unmatched scale, strong profitability, and deep retail reach. Backed by the SBI and Amundi partnership, the fund house benefits from global expertise and India’s rising financialisation trend. With robust AUM growth, expanding margins, and a dominant SIP engine, SBI MF is positioned for sustained long-term expansion. Its upcoming 2026 IPO is expected to be one of the sector’s biggest value-creation opportunities.

SBI Funds Management Ltd. (SBIFML), India's largest fund manager by assets under management (AUM), has built upon its more than 36 years of heritage as a success distinction through superior financial performance, penetration into retail channels and a solid commitment to providing market-leading, innovative, responsible and ethical investment products. With an IPO on the horizon in 2026, SBIMF is well ahead of its peers and continues to lead by example through its establishment in the evolving financial services industry in India, as well as being the best position for a long-term investment vehicle and for consistently delivering returns.

FY 2024-25 has been one of the most critical years for SBIFML to expand its platform as both a corporate and investment manager. The company maintained strong profitability while broadening the number of retail investors by successfully launching a diversified range of product offerings, having digitised the investment process through its digital platform and has focused on executing its corporate social responsibility to achieve the mission of financial inclusion. SBIFML has developed a unique value proposition to enable individuals to have a long-term perspective of their financial growth, which has allowed the company to achieve significant milestones each year through investment product innovation, industry-first initiatives and expanding into new markets.

India has recently experienced a significant growth in the number of SIP participants, retail participants in equity and the explosion of passive funds. As the largest mutual fund in India, it was the largest mutual fund in the country that played the largest role in this transformation.

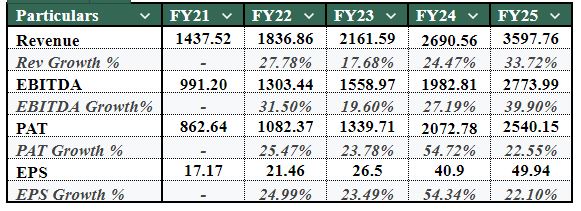

This increase in profitability is representative of a multi-year trend in which SBI MF has demonstrated significant increases in profitability. In FY 21, PAT increased from ₹ 860 crores to ₹ 2,531 crores in FY 25 (an almost 3x increase over 5 years).

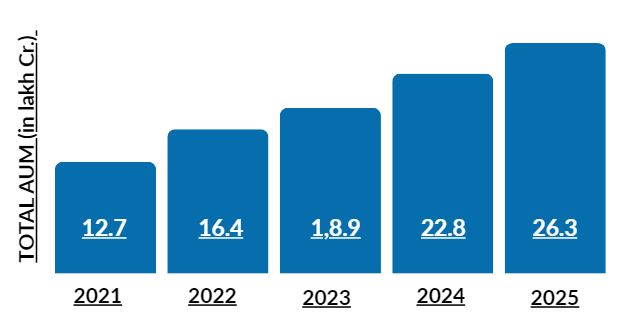

- SBI MF’s total AUM has grown very strongly from ₹12.7 lakh crore in 2021 to ₹26.3 lakh crore in 2025, nearly doubling in just four years, showing rapid expansion and strong investor inflows.

The asset allocation of SBI MF has changed to reflect a greater preference by investors for long-term wealth creation. Asset Mix Change Over March 2020 through to March 2025

The shift in asset allocation highlights the increasing conviction of investors in the growth potential of India and equity markets.

Corporate Structure: The SBI x Amundi Partnership

SBI Mutual Fund (SBI MF) is a joint venture between SBI (62%), India's largest bank, with the largest distribution network, and Amundi (36%), Europe's largest asset manager, who bring its global investment capabilities to the partnership.

The combination of these two organisations brings to the partnership a strong local presence and access to the best investment practices globally, forming a disciplined and research-focused Asset Management Company (AMC) that adheres to a sound governance model.

Subsidiaries and Associates

By conducting business in multiple countries and with different regulatory environments, the Corporate Structure creates a broader platform for investment diversification and presents opportunities to develop new investment products that comply with local regulations.

1. One key development was launching the JanNivesh SIP, which allows investors to invest from as little as ₹250. This initiative focuses specifically on rural and first-time investors by introducing mutual funds into India’s most underserved investment segments.

2. Accessing mutual funds through platforms like SBI YONO, Paytm, Zerodha, Groww, and others provides users with an easy way to do so.

- SBI Automotive Opportunities Fund – capturing Mobile movement and EV transition in India

- SBI Quant Fund – Focused on multi-factor quantitative investing

- SBI Silver ETF/FOF (Fund of Funds) – Provides investors with commodity diversification

- SBI Nifty IT Index Fund – Provides investors with a focused investment in India's IT Leaders

- 5 Money Market Funds

- 10 Market-Cap Oriented Equity Funds

- 31 Passive/Index Strategies

- 3 Fund-Of-Funds

- 10 Duration-Based Debt Strategies

- 42 Closed-Ended Schemes

The depth and breadth of developed product offerings that SBI has available solidifies the position that SBI is not only the most diversely funded but also offers the most diversified range of investment options to customers in India.

1. Digital transformation is accelerating at a rapid rate. Almost 98 per cent of all transactions are processed digitally (by volume), and 83 per cent of all transactions (by value) are processed digitally.

2. Over the last 12 months, average unique logins from users accessing the InvesTap app and website have increased by 25 per cent.

3. Digital transformation continues to drive a significant increase in investor touchpoints due to partnerships between fintech companies and other brand partners within the mutual funds.

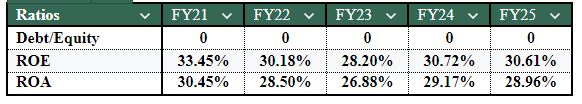

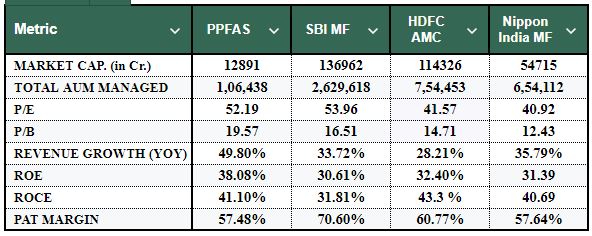

A summary of SBI Mutual Fund's financial performance over the years, as follows:

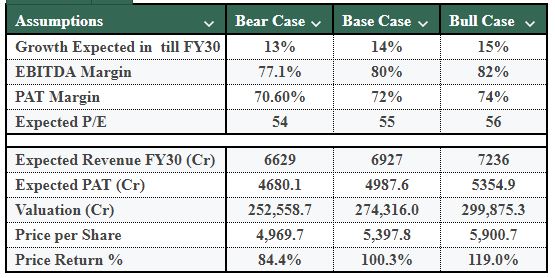

SBI Mutual Fund has created three distinct future projections for the period ending FY30 based on an assumption of conservative to optimistic views: Bear Case, Base Case and Bull Case. The basis for these projections is SBI Mutual Fund's dominant position in the Indian equities market, the increasing trend of financialisation in India over time and the expected ongoing growth trend.

Revenue growth - SBI MF’s revenue growth is based on HDFC AMC’s 18.3% estimate, adjusted for SBI MF’s higher market share, giving 13% in the bear case, and increased in the base and bull cases to reflect its stronger position

PAT Margin Assumptions - Estimated at 70%, 72%, and 74% (Bear/Base/Bull) — driven by efficiency gains and recurring revenue growth.

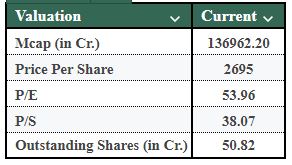

P/E Multiple - Valued at 54x, 55x, and 56x — reflecting stronger profitability and investor confidence in enterprise AI

With all the above assumptions, Projected Financial Outcomes through FY30

SBI MF will continue to deliver strong double-digit annualised returns based on conservative estimates of future market growth through ongoing expansion of assets under management and solid earnings from its managed funds.

In addition to sustainable earnings in the future, SBI MF will remain a highly visible compound growth story for the foreseeable future, even in less-than-ideal economic conditions.

The most successful Asset Management Company (AMC) in India is SBI Funds Management. SBI MF is positioned to take advantage of the next multi-decade opportunity of Financialisation in India due to the unique elements that can be found in the AMC itself. From the strong distribution network via SBI to the first-class governance of a Global Company (Amundi), the diversified range of the product portfolio, the high level of digital facilities, and the excellent and continuing track record of performance from a Financial Perspective, SBI MF can compete against other AMCs in India and be a leader in the new era of Financialisation.

Peering through to 2026, the IPO of SBI MF will not only represent the largest in terms of Assets under Management (AUM) in India, but also the best-positioned, most complete, and scalable AMC, and future-proof. Therefore, for Investors, Policymakers, and Participants within the broader Financial Ecosystem, SBI MF combines the very best with Scale, Resilience, Efficiency, Innovation, and high-margin growth.

With rapid SIP-driven growth and exceptional operating efficiency, it is well-positioned to lead India’s next phase of financialization. While the IPO may come at a premium, the valuation appears justified, making SBI MF fairly valued to slightly undervalued long term. For conservative and long-term investors seeking steady compounding, SBI MF represents one of the most compelling opportunities in the AMC space. Investors can also access this opportunity conveniently through Sharescart.