15 Days Price Change

Summary

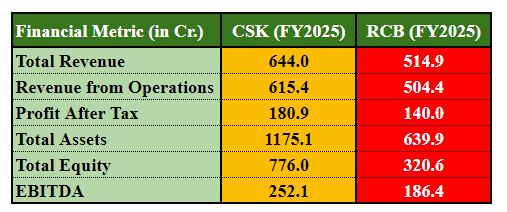

While RCB commands attention and premium pricing, CSK stands out as the stronger financial performer. At an unlisted share price of ₹205, CSK appears undervalued relative to its earnings strength and balance sheet quality, making it a compelling long-term investment. With consistent profitability and a globally respected franchise model, CSK delivers performance where it matters most.

The Indian Premier League (IPL) has developed into one of the world’s most valuable sports ecosystems, and franchises have now begun to be recognised as serious business assets. The Chennai Super Kings (CSK) and Royal Challengers Bangalore (RCB) stand at the top of the league with relative proximity in their popularity, commercial prowess, and cultural impact. However, the more relevant question for a prospective investor is simply, 'Which franchise behaves as the better business?' Which franchise has the more valuable long-run outlook? I have provided a balanced comparison of the two teams with respect to their "business" financial profile, valuation, brand characteristics, and market realities.

CSK is widely recognised as one of the best franchises in terms of on-field professionalism, grounded in a stable profit-producing business model. The team benefits from predictable, strong central rights revenues, disciplined expenditures, loyal fans, and increasingly becoming a larger presence through academies and as a global franchise. Regardless of on-field variation in success, CSK is, as of this writing, remaining profitable — all markers of a strong business model. In FY2025, CSK registered a ₹181 crore PAT, has no debt, and continues to hold ample cash reserves—allowing CSK to be one of the only ongoing global sports franchises that contributes to earnings year in and year out.

In contrast, RCB functions more like a lifestyle brand, powered by community-based digital engagement and culture. From the perspective of the brand, RCB generated brand power as a mobile collection of fans, premium sponsorships, and the cultural power attached to celebrity. Perhaps because RCB is located in Bengaluru — India's tech corridor — RCB attracts a young and affluent consumer group. However, the dollars in the financials for RCB are likely more volatile due to relatively high marketing and player costs. Ultimately, while RCB's brand is powerful and stands on its own merit, the business model sense is mainly built on perception rather than profitability, with fan engagement driving overall performance.

CSK’s valuation reflects existing demand from real investors. The underlying shares have a liquid, unlisted market (currently trading at ₹205/share), which implies a market cap of ₹7778 crore. This number is highly credible since the valuation is based on actual trades, not simply internal assessments. CSK is valued by investors for strong earnings potential, liquidity, and long-term outlook.

RCB, in contrast, eyes a valuation of ₹17,800 crore, based on internal assessments and a brand study. This number accounts for the team’s extensive cultural relevance and lifestyle perception, but there is no underlying market transaction. In other words, RCB’s valuation is based on perception, not on some verified activity by investors. Therefore, it is aspirational rather than market-tested.

CSK enjoys deep-seated loyalty among fans throughout South India, reinforced by a legacy of winning, stable management, and a trusted organisational culture. The brand appeals to fans across age groups, and it maintains deep engagement in the urban and regional markets. It has the traditional stature and character of a powerhouse brand in that its values are stable over the long term.

RCB is a widely recognised digital sports brand worldwide. Its identity is derived from the Bengaluru ecosystem — which consists of young professionals, startups, and digital natives. The reach of its social media presence, merchandise demand, and lifestyle positioning make it a pop-culture phenomenon, where RCB is more reflective of a youth lifestyle brand than a straightforward sports team.

From an investment perspective, CSK and RCB differ distinctly. CSK appeal primarily to investors looking for value. Value investors want predictable earnings, low risk, and strong fundamentals. CSK draws investors with its positive predictable PAT, debt-free balance sheet, and legitimate market valuation, making it a good long-term investment as a compounding asset. RCB attracted a different type of investor, one who judges a brand to be worth the money based on cultural importance, digital reach, and premium status. RCB is worth more based on potential lifestyle branding than on current fundamentals.

RCB enjoys a higher valuation based on several structural advantages.

Despite the strength of the RCB brand, CSK is the fundamentally superior business.

The substantial difference between RCB’s valuation of ₹17,800 crore and CSK’s valuation of ₹8,260 crore tells a different story:

The modern sports valuations tend to favour perception over performance. RCB wins the narrative around brand appeal, youth culture, digital appeal and city identity. CSK wins on business fundamentals of financial discipline, feasibility, profitability and actually ‘investor-backed’ valuation. RCB may hold the reins of digital fandom and lifestyle branding, and CSK has stronger financial viability and investment support.

RCB may be the pricier, hipper story, but CSK is the better business. At the current unlisted share price of ₹205, CSK's implied valuation looks clearly undervalued relative to its earnings power and balance sheet density. Thus, CSK represents a unique investing opportunity in a productive, reputable global sports franchise. In simple terms, RCB wins perception, and CSK wins performance. CSK is the better investment choice for long-term investors. And for investors looking to participate, CSK’s unlisted shares are conveniently available on Sharescart.