15 Days Price Change

Summary

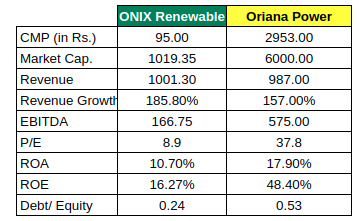

ONIX Renewables has quickly scaled from a small EPC player to an integrated renewable platform with strong growth, rising profits, and low debt. With approx ₹14000 crore order book, a 1.9 GW pipeline, and a ₹25,000 crore capex plan, the company is targeting 10 GW by 2030. Despite being unlisted and much smaller than Oriana, ONIX’s faster growth and low 8.9× P/E give it far higher upside, making it a standout pick in the Sharescart unlisted market.

Traditionally in the fast-changing environment of the Indian renewable sector, the focus on the market has been concentrated on large-listed players. However, once in a while, an organisation rises silently, performs steadily, and suddenly finds itself in the middle of a change that is monumental to it.

Also, one such story is ONIX Renewables.

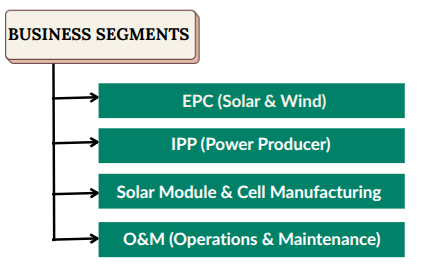

ONIX was established in 2007 as a typical EPC participant, but now, it is on the verge of becoming a 10 GW unified renewable energy powerhouse, having manufacturing, EPC, IPP, and O&M capacities. Its performance in the past three years is not only of growth but also of momentum, discipline and strategic focus.

ONIX’s revenue is driven mainly by its EPC business, supported by growing manufacturing output and steady IPP income. The EPC segment contributes the largest share through ground-mounted, rooftop, and hybrid solar projects, boosted by strong execution under schemes like PM-KUSUM. Manufacturing revenue is rising as capacity expands from 100 MW toward 1,200 MW, improving margins through backward integration. The IPP segment adds stable, long-term PPA-based cash flows, strengthening overall revenue visibility and balance sheet resilience.

Such a multi-segment structure enables ONIX to manage quality and minimise costs and margin pools at each stage of the value chain.

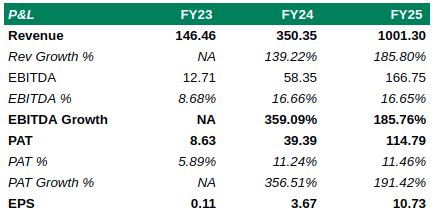

ONIX increased its revenue by a record of 146 Cr to 1001 Cr over a period of two years and expansion of the profitability with a growth in the EBITDA of 185% to 167 Cr and PAT of 191% to 115 Cr.

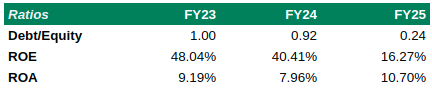

Balance sheet improved significantly, and Debt/Equity has been lowered to 0.24x, and total assets crossed 1,072 Cr.

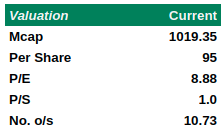

Even though ONIX has been growing rapidly and shows good margins, its share price is low at 8.9x P/E which means that it can be re-rated substantially.

The Turning Point: An Order Book That Changes the Stakes.

By FY26, ONIX found itself with:

₹14489 crore Unexecuted order book

1.9 GW solar pipeline

Increasing EPC and transmission requirements by states.

Increased need of hybrid and storage-backed projects.

Such visibility is not common in the renewable industry.

Platform-Level Loyalty: ONIX is establishing the type of trust that turns a company into a contractor into a place where they renew the contract.

Vision: 10 GW Green Energy Empire – The company has no longer been thinking in MG but working in GW.

₹25,000 Cr Investment Road Map: A 3-year commitment capex plan to speed up scale.

7 GW Capacity Build-Out: Rapid growth of renewable generation resources.

5 GW Manufacturing Scaling: Building a stronger backward integration in solar module and component manufacturing.

Prepare to shift to a 10 GW integrated renewable ecosystem by 2030.

Oriana today operates at a far larger scale — a ₹6,000 crore market cap, industry-leading ROE, and strong EBITDA — creating a clear gap between the two companies. But this gap is exactly what makes ONIX interesting: with a much smaller base, 185% revenue growth, low debt, and an attractive valuation, ONIX has far more headroom to scale.

What strengthens this outlook is ONIX’s upcoming ₹25,000 crore capex plan, its shift to gigawatt-level projects, and the build-out of 7 GW renewable capacity plus 5 GW manufacturing. As the sector moves toward integrated green energy platforms, ONIX stands at an early but powerful inflection point — where the gap may shrink faster than expected.

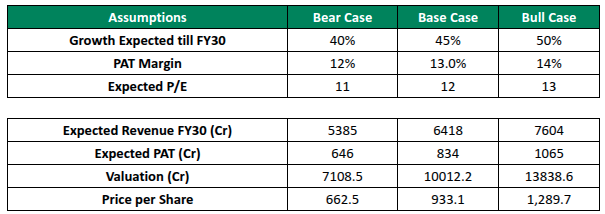

ONIX is positioned for strong expansion as EPC execution, MSKVY 2.0 orders, and upcoming manufacturing capacity drive revenue growth of 40–45% annually through FY30 (including a one-time FY26 spike). PAT margins are expected to improve from ~11% to 13% (base case) with scale benefits.

With ONIX trading at just 8.9× P/E whereas industry multiples are 35–45×, the stock has clear high growth potential. FY30 assumptions of 11–13× P/E imply a valuation range of ₹7,100–13,800 crore, translating to a possible price of ₹660–1,290 per share, making ONIX a high-growth, high-upside renewable opportunity.

ONIX Renewables has grown very fast. It was an EPC contractor. Now it has become a renewable platform with high growth, better profits, and low debt. It has approx ₹14000 crore order book, a 1.9 GW pipeline, and a ₹25,000 crore capex plan. The company is reaching the 10 GW scale by 2030.

ONIX is unlisted but has much more potential than Oriana. That is because ONIX is growing fast, with a small base and an 8.9× P/E. This is why it is selling fast on the Sharescart unlisted market. If there are no changes in execution, ONIX will soon become India’s next big green energy player.