15 Days Price Change

Summary

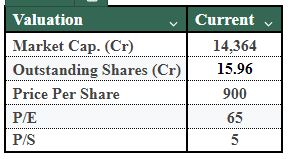

Fractal Analytics offers strong exposure to the expanding enterprise AI market but remains an execution-driven story. Its future performance depends on scaling product revenues, managing talent and client risks, and maintaining profitability post-IPO. While the growth potential is significant, investors should assess valuation and monetisation visibility carefully. The stock is also available on Sharescart for interested investors.

Fractal Analytics Limited is a premier global company offering Data, Analytics, and Artificial Intelligence (DAAI) solutions. The idea that gave birth to Fractal originated from the desire to help enterprises make better decisions, informed by data. The business sits across AI, engineering, and design thinking. The solutions it offers include AI consulting, data engineering, decision intelligence, and analytics to help clients drive business value from data and to help scale AI across the enterprise.

Fractal operates under two main segments:

Fractal cultivates long-term, high-value relationships with clients (top client engagement has spanned multi-year timelines). Fractal combines domain specialists, prompt engineers, data engineers, human-centred design teams, and clients' capabilities in order to ensure innovative solutions are actually adoptable and lead to measurable business impact.

Fractal envisions powering every human decision in the enterprise in a responsible way using AI. Specifically, Fractal's mission is to enable enterprises to leverage their data as a sustainable competitive advantage by embedding AI across all layers of the decision-making process

The DAAI Market Opportunity - Enterprise adoption of AI and analytics is accelerating across industries, from CPG and retail to healthcare and BFSI. The third-party DAAI services market also continues to grow – organisations continue to outsource the development and deployment of advanced models for enterprise adoption. Fractal combines consulting, foundation models and a product platform (Cogentiq) to target the end-to-end needs of large enterprises going through AI transformation.

Competitive Landscape - A fractal business firm holds two archetypes:

Fractal's hybrid model, which combines deep consulting with proprietary IP and foundation models, seeks to capture value in strategy, implementation and product adoption. This enables Fractal's business model to sit comfortably between generalist IT firms and pure software vendors. However, this model requires rigorous investment in talent development, R&D capability and selective M&A.

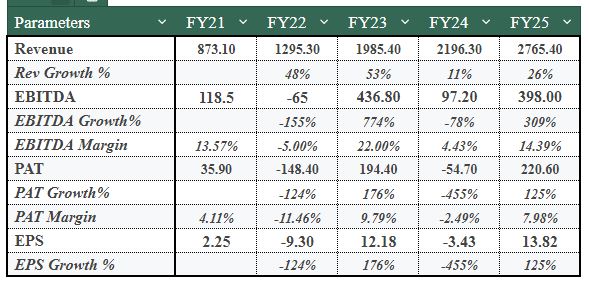

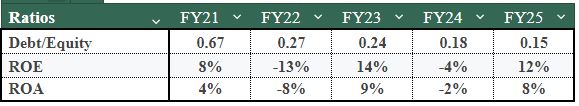

Overall Summary: Fractal has transitioned from a volatile business to being a steady operator, driven by consistent revenue growth, profit normalizing towards industry average rates, strong cash flows, and a balance sheet all establishing Fractal as a leader in AI-led analytics that is poised for scalable growth.

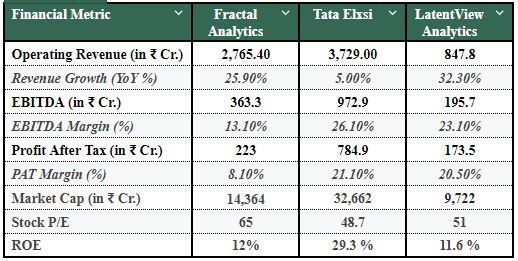

Fractal has been compared to both Tata Elxsi (design and engineering leader, high margins) and LatentView (analytics consulting delivery, profitable growth). The key differences include:

1. Large Organisations' AI Adoption - Large organisations are still in the early adoption phase of AI. Fractal's approach towards MWCs and the transition of use cases to platformised offerings (CogentIQ provides future high-margin recurring revenue fragments).

2. Foundation Models and Products (Fractal Alpha) - Proprietary models (Kalaido.ai, Vaidya.ai), if monetised, lead to software-like, scalable revenue and higher margins relative to pure services.

3. Cross-selling within Existing Wallets - Established, deep client relationships (top 10 clients: 53.8% revenue in FY25) provide cross-sell and growth opportunities through functions and geography.

4. Scale via Strategic M&A - Targeted acquisitions can yield domain expertise and accelerate product roadmaps and geography, but the ability to integrate is imperative.

5. Partnership with Hyperscalers and Platforms - Partnerships can accelerate solution delivery, expand distribution, and reduce infrastructure friction for clients.

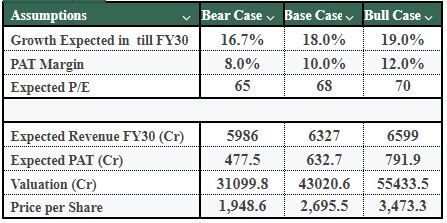

Revenue Growth Estimates

The forecast employs three growth trajectories—16.7% (Bear), 18% (Base), and 19% (Bull) CAGR — which are derived from industry projections along with Fractal's competitive advantages in AI-led products, global enterprise clients, and scalable platforms. This assumption is the basis of the estimates for Fractal's FY30 revenue potential across all cases.

Margin Expansion Estimates

PAT margins are estimated to gradually increase to 8% (Bear), 10% (Base), and 12% (Bull), reflecting the combined effects of efficiency gains, operational leverage, and increasing mix of recurring and IP-led revenues. Margins directly influence the estimated profitability (PAT) projection for FY30.

Valuation Multiple Estimates

The P/E multiples in use—65x, 68x, and 70x—are derived from expected improvements gained through efficiency from scale, profitability, and investor confidence in enterprise AI. The P/E multiple takes the estimated profitability and applies it in a turn of the projected earnings to estimate the future value under each scenario.

Bringing together the revenue growth rates, modest margin expansion, and assumptions about the valuation multiples, the model presumes an FY30 value of ₹31,099 Cr (Bear) to ₹55,433 Cr (Bull). Even in the case where the estimates are more conservative, there is significant upside, while the base case suggests a creation of value in a fully grown franchise through the key drivers of sustained revenue growth and margin expansion, bolstered by strong AI-driven demand.

Fractal Analytics has a strong specialist offering in a rapidly growing enterprise AI market. The company has demonstrated strong top-line growth, strong client relationships, and an ambitious strategy of combining consulting expertise with proprietary platform and model IP. The IPO appears well timed to de-leverage the balance sheet, increase product and R&D investment, and provide liquidity to shareholders.

That said, Fractal’s investment thesis is predicated on execution in its ability to convert product development and foundation models into materially scalable and higher margin revenue path; articulate its ability to mitigate talent and client concentration risks; and avoid purchase accounting-related goodwill impairments as the company integrates future acquisitions From the standpoint of investors, Fractal represents a growth-oriented opportunity, but one requiring execution value to be added. Fractal will be appreciated by investors looking for exposure to enterprise AI’s still very long runway, but must be viewed through careful examination of valuation, as normalized profitability (and eventual product monetization after the IPO) all need to be established. This share is currently available for investors through Sharescart, making access seamless for those looking to participate in Fractal’s growth story.