15 Days Price Change

Summary

PolicyX, founded in 2013, is a fast-growing, IRDAI-approved digital insurance platform offering life, health, and motor coverage through a transparent, advisory-led model. With lean operations, strong profitability, and a 54% YoY revenue growth, it’s emerging as a credible challenger to PolicyBazaar. Backed by high ROE, zero debt, and plans for AI-driven expansion into Tier-2 and Tier-3 cities, PolicyX is well-positioned to capitalize on India’s rapidly evolving insurtech market.

.jpg)

PolicyX, founded in 2013 by Mr Naval Goel, is an IRDAI-approved and one of India's most credible digital insurance platforms. Companies headquartered in Gurugram provide end-to-end digital solutions for customers to select, compare, and purchase insurance policies across various segments, including life, health, and motor segments. Over the past 13 years, PolicyX has positioned itself as a customer-first brand that combines the reliability of expert-led advisory services with the efficiency of technology.

PolicyX is an online insurance aggregator, which plays the role of mediating between the insurers and the seekers of policies. Its revenue model is majorly based on commission as a result of selling policies, renewal of policies, cross-selling policies and lead-based partnerships with insurance companies. It has recently entered the B2B business, which caters to corporate clients. Unlike many digital platforms, they rely heavily on automated sales funnels.

PolicyX has an advisory-based strategy (personalised advice with in-house experts) in place instead of aggressive selling along with lifetime claim guarantee and spam-free service without gimmicks. This ensures that trust is increased, the level of misselling is minimized as well as the conversion and retention rate (90%) which reinforces its image of being transparent and committed to the sales.

India's online insurance market is witnessing strong tailwinds, driven by increasing digital adoption, financial awareness and the government push toward financial inclusion. Insurance penetration in India is only 4 per cent of GDP which is significantly low compared to the global average of approximately 7 per cent; the market potential is also huge. Competitors of PolicyX like PolicyBazaar, Coverfox and InsuranceDekho are well established players in the market, but they are known by their heavy spending in the market, unlike PolicyX, which is characterized by customer oriented service offering, lean operations and an organic growth plan that does not involve excessive spending in the market.

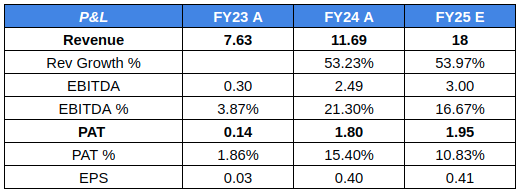

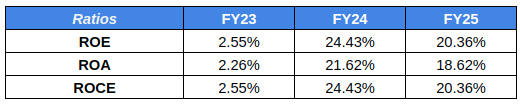

PolicyX demonstrates a high growth in revenue, massive increase in profitability, and a steep increase in EPS in FY24 after which earnings are expected to remain steady in FY25.

The company has demonstrated strong revenue growth, increasing from 7.63 Cr in FY23 to 18 Cr in FY25, with a consistent growth rate of 54% YoY.

EBITDA rising from 0.30 Cr to 3 Cr and PAT increasing from 0.14 Cr in FY23 to 1.95 Cr in FY25, reflecting operational efficiency.

Before normalising in FY25, margins picked up in FY24, with EBITDA margin at 21.3% and PAT margin at 15.4%.

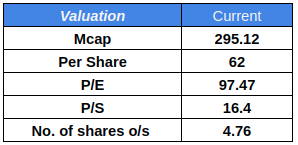

At the current valuation of 295.12 Cr. and the share price of 62, the company trades at a P/E of 97.47 and a P/S of 16.4 with 4.76 crore shares outstanding, reflecting high growth expectations from the market.

In the future, PolicyX will have an expansion in its presence in Tier-2 and Tier-3 cities, taking advantage of the unserved layers of population. The company will also invest in AIs-based recommendation tools in order to improve the accuracy of policies matching and experience among users. Having a solid base in terms of trust, advisory services, and efficient operations, PolicyX could take advantage of the following stage of the Indian insurtech market development.

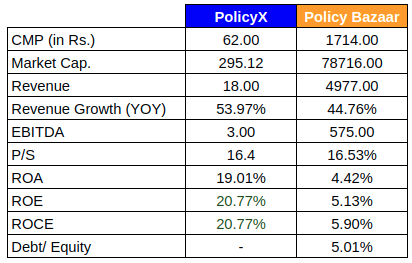

PolicyX and Policy Bazaar are indias leading digital insurance plateform, but they differ significantly in scale , financial performance, and operational efficiencies.

Scale & Market Presence: PolicyBazaar dominates market with market capitalization of ₹78,716 crore where as to PolicyX’s ₹295 crore. Revenue for PolicyBazaar stands at ₹4,977 crore, while PolicyX generated ₹18 crore although PolicyX is growing faster with a YoY revenue growth of 53.97% versus PolicyBazaar’s 44.76%.

Profitability & Margins: PolicyX an EBITDA of ₹3 crore on a much smaller revenue base and high return ratios — ROA of 19.01% and ROE of 20.77%, compared to PolicyBazaar’s ROA of 4.42% and ROE of 5.13%. Which indicates a very strong return compared to Policy Bazaar.

Valuation Metrics: PolicyX has no debt, while PolicyBazaar has a debt-to-equity ratio of 5.01%, which could impact its financial flexibility.

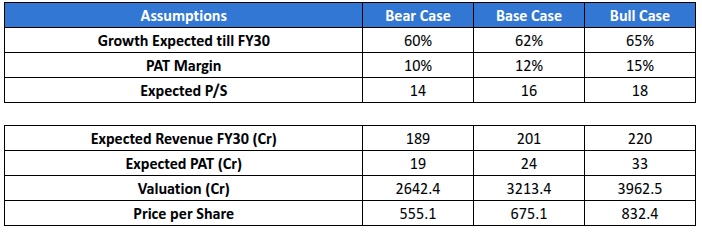

PolicyX will reach its break-even point of 189-220 crore revenues and 19-33 crore PAT by FY30 due to a solid growth rate and increasing digital presence. The company has a strong long-term potential with valuations of ₹2,642.4 crore over a bear situation with a share price of 555.

PolicyX, a popular, high-potential, and unlisted online insurance player, which can be offered at SharesCart, is becoming a strong competitor in the Indian insurtech sector with strong growth rates, efficient operations, and high profitability rates. With a 54% YoY revenue growth, no debt to equity, and penetration of Tier-2 and Tier-3 cities, PolicyX has a high likelihood of generating long-term value to investors, as an attractive opportunity at the initial stage of development, prior to a potential future listing.