15 Days Price Change

Summary

Billionbrains Garage Ventures Ltd, the parent of Groww, stunned the markets with a stellar listing—shares surged 37% post-IPO, lifting its market cap beyond ₹83,000 crore. Despite a steep pre-listing GMP fall, strong fundamentals, profitability, and investor trust turned sentiment around, marking Groww as a standout success in India’s cautious IPO landscape.

Billionbrains Garage Ventures Ltd, the parent company of Groww, was founded in 2016 by ex-Flipkart executives Lalit Keshre, Harsh Jain, Ishan Bansal, and Neeraj Singh. Groww has quickly become India's largest and fastest-growing digital investment platform. The company was founded on the simple vision of making investing easy, transparent and accessible – an industry that has traditionally been perceived as complex and intimidating. With a technology-led, customer-first approach, it has become a market leader in India's retail investment space and has enabled millions of new investors to take part in the country's economic growth story.

India's largest stockbroking platform has astonished the markets with a strong post-listing performance, completely reversing pre-listing scepticism and re-establishing investor confidence in profitable fintechs.

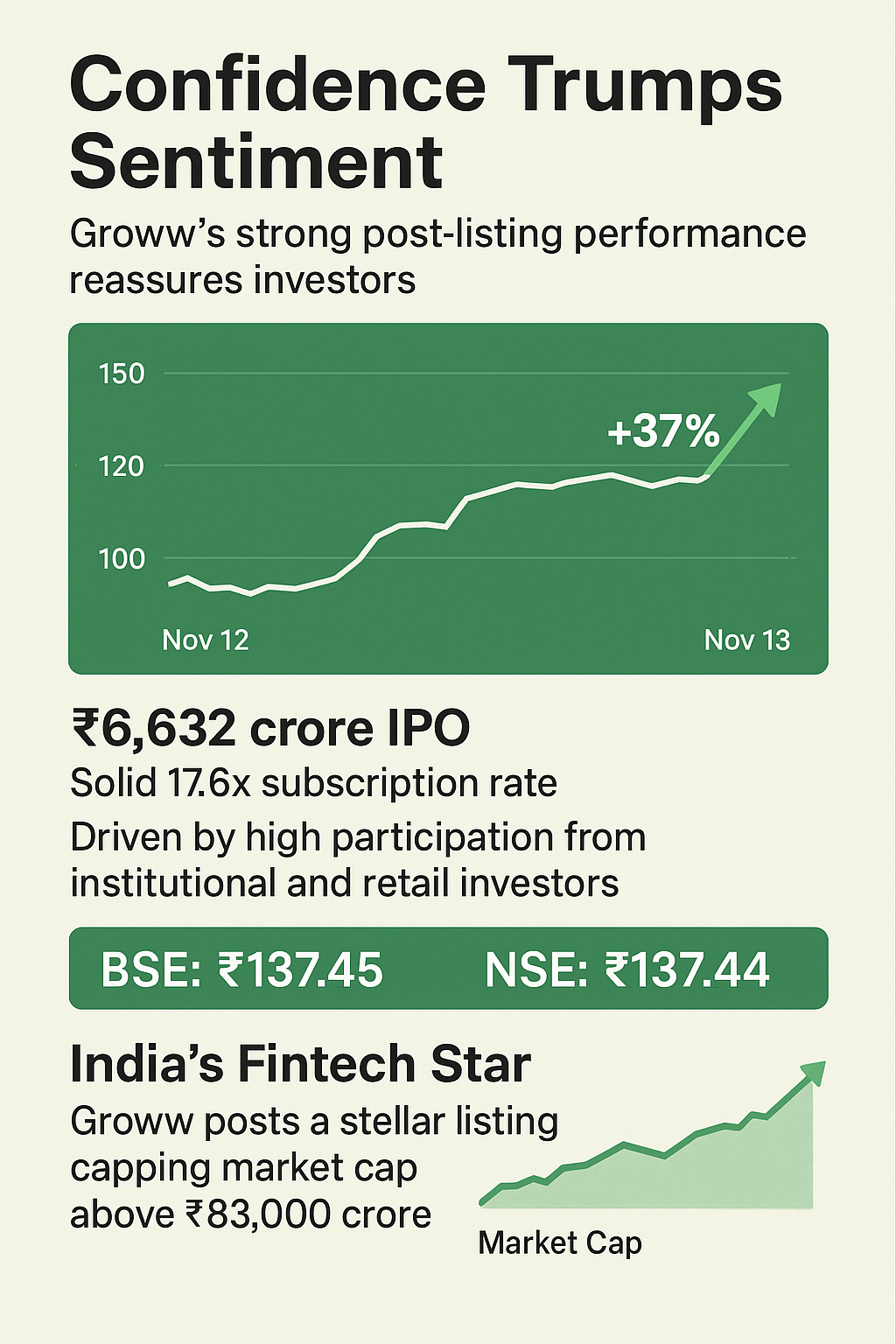

Just before its market launch, Groww’s grey market premium (GMP) had collapsed almost 76%, from ₹16.5 to ₹4, projecting a weak listing. However, the company’s shares were listed with a 31% premium on November 12 and quickly extended this to trade 37% above their issue price the day after.

On the BSE, Groww shares surged to ₹137.45 apiece on November 13, while on the NSE, they ended at ₹137.44, moving the company’s market capitalisation past ₹83,000 crore, all extraordinary, given the gloom surrounding India's IPO market.

The ₹6,632 crore IPO of Billionbrains Garage Ventures has seen a solid 17.6x subscription rate, driven by high participation from institutional and retail investors. The Qualified Institutional Buyers (QIB) sector was subscribed 22.02x, and the retail portion received a strong 9.43x reaction.

Despite this strong interest, the steep drop in GMP before listing raised some eyebrows. However, the fundamental balance sheet of Groww showed superior profitability, fast user growth, and a scalable business model, all of which outweighed short-term sentiments.

Groww has become India's largest stockbroker with a 26%+ market share and 12.6 million active clients as of June 2025.

Its invested product offerings – equities, derivatives, bonds, mutual funds, and margin trading – have made it a consumer's investment platform with India's growing retail investing department.

With top-tier investors such as Peak XV Partners (formerly Sequoia India), Tiger Global, Satya Nadella, CEO of Microsoft, Ribbit Capital, and ICONIQ, Groww has reported strong financials year-on-year. The IPO proceeds are aimed at driving business growth through technology upgrades, expansion of lending and margin trading segments, strengthening brand visibility, and enhancing overall financial stability.

Groww's excellent debut sharpens the focus even more on the number of high-profile IPOs earlier this year – Lenskart, Studds, and Orkla India – that all listed below expectations. According to Bloomberg data, Groww is rated the second-best performing IPO above $500m in India this year. The company's success highlights a broader market theme – investors continue to reward profitable, tech-enabled companies with visibility around growth, while IPO mania remains selective.

Analysts view the performance as a watershed moment for the fintech IPO space. The company is focused on increasing its NBFC (Groww Creditserv Technology Pvt Ltd) arm and margin trading business (Groww Invest Tech Pvt Ltd) into a full-fledged player in the long run.

While short-term traders may look to book some profit given its rapid rise, long-term investors remain structurally bullish on the digital investing boom in India.

Groww’s ride from a decreasing grey market premium to a 37% jump post-listing reflects the market’s belief in its fundamentals. The listing proved to be beyond subdued expectations and also demonstrated India’s market for high-quality, profitable fintechs at scale. Earlier, its shares were actively traded on the unlisted platform Sharescart before the company made its strong debut on the stock exchanges, a listing that surpassed subdued expectations and underscored India’s market for high-quality, profitable fintechs at scale.