15 Days Price Change

Summary

India’s power trading sector is evolving fast, with IEX leading, PXIL strengthening, and HPX emerging as a tech-driven challenger.

The upcoming market coupling in 2026 will create a level playing field among all exchanges. With strong backing from BSE, PTC, and ICICI Bank, HPX is well-positioned to capitalise on this shift.

Hindustan Power Exchange (HPX) quickly emerged as one of India's most promising and technology-powered power exchanges, launching a new phase in the development of the country's electric power market. Established in 2018 and receiving final approval from CERC in 2022, the performance of HPX in FY 2023-24 is its first full year of operation, and it is an unqualified success.

HPX offers a transparent, efficient, and real-time digital platform for power trading, allowing power generators, distribution companies, and end-users to trade power easily. It aims to improve price discovery, manage demand and supply efficiently, and enhance the overall robustness of India's power ecosystem.

The exchange is promoted by three established, credible entities, namely PTC India Ltd, BSE Investments Ltd, and ICICI Bank Ltd. These promoters provide exceptional industry experience, financial clout, and technical skills.

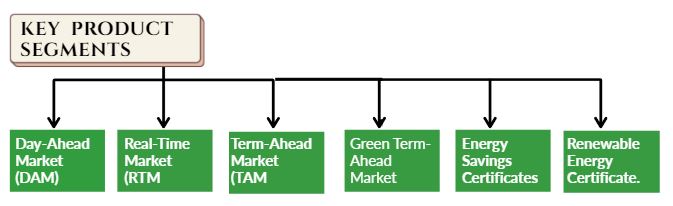

HPX offers a wide range of market segments, including:

These diverse offerings position HPX as a comprehensive power trading platform aligned with India’s renewable energy and sustainability goals.

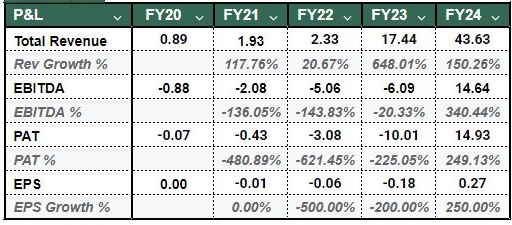

HPX has enjoyed an impressive financial journey.

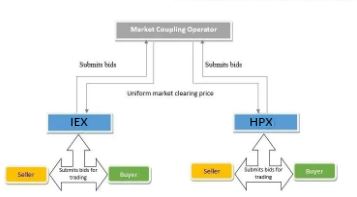

The most significant structural shift in India's power market is fast approaching market coupling, is likely to be operational by 2026. In a market coupling paradigm, a single market coupling operator (MCO) will establish uniformity for the market-clearing price of electricity across all exchanges – IEX, PXIL, and HPX.

What It Means – Simply put, every single exchange will trade at the same price – removing the price discovery advantage IEX has held since inception.

Smaller, yet nimbler exchanges like HPX and PXIL will now have equal footing in the market, as volume-based competition will now emerge, and innovation-led differentiation can take place, eliminating the legacy-style players from the dominance position.

HPX is much better positioned to seize market coupling due to its institutional heritage and future-ready technology stack:

As a result of their respective histories, the trio provides HPX with an unprecedented combination of market expertise, operational flexibility, and fiscal credibility, thus making it the best-positioned exchange for the forthcoming evolution in the sector.

HPX is not just the first to change—it was built for it.

With the impending market coupling reform, strong financial growth, and a solid promoter ecosystem, HPX is leading the way in a monumental strategic moment for India's energy landscape. Once the market becomes coupled, it will be about who is innovative, fast, and adaptable first. In that race for innovation, speed, and flexibility, HPX appears to be far in front and leading.

|

Metric |

IEX |

PXIL |

HPX |

|

Revenue (₹ Cr) |

449 |

54.2 |

43.6 |

|

Revenue Growth (4-Yr CAGR) |

~9% |

23% |

>150% |

|

PAT (₹ Cr) |

351 |

21 |

14.9 |

|

PAT Margin |

~78% |

39% |

34% |

|

ROE |

31% |

24% |

26% |

|

Debt/Equity |

0.01 |

0.16 |

0.00 |

|

Market Share |

~90% |

~8% |

~2% (rising fast) |

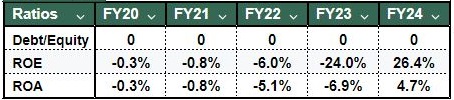

HPX: The Star on the Rise — Successful profitability and sound ROE in its first year of full operations indicate sound execution and scalability to date. HPX also competes in niche segments with a >33% share in the term-ahead market.

IEX: The Market Leader — Continues to lead with unchallenged liquidity and profitability. However, changes to marketing coupling may threaten its pricing advantage.

PXIL: The Stable Player — PXIL has improved two years in improving its operations, but growth and innovation are lagging behind HPX's rapid scaling.

HPX’s Advantage: HPX has a superior position with backing from BSE technology, a depth of market from PTC, and financial stability from ICICI, melding the best of institutional governance with start-up nimbleness – a perfect combination for the next phase of market liberalisation.

Although IEX continues to dominate the market in terms of profits due to unmatched scale & operational efficiency, we see HPX evolving into an increasingly credible and differentiated competitor that is quickly gaining traction in terms of revenue growth, early-stage profitability, and technological advancement.

If HPX continues to gain momentum in the same growth trajectory, its timid emergence can evolve into a credible third front to shake up the competitive dynamic in India as soon as Market Coupling takes place.

As the Indian power system transitions towards a more transparent, market-driven, and green system, HPX will represent a credible alternative for what remains at this point in time an "oligopoly", so to speak, between the other incumbents of IEX and PXIL.

And while it has the right promoter base and financial resources (by no means an easy find!) to add venturesome stature to its headwinds, HPX is also squarely aligned with reforms to India's energy leadership.

Overall, HPX is a future-ready exchange that can strategically rethink and redefine how power is traded in India. So in conclusion, IEX is ahead, while PXIL is the middle ground, and HPX is built for the future. HPX shares are now available for investment on Sharescart, giving investors a front-row seat in India’s next power market evolution.