15 Days Price Change

Summary

NSDL is the backbone of India’s capital markets, enabling secure and seamless digital transactions through its demat and settlement services. As India’s investment ecosystem expands, NSDL is set to benefit from rising demat accounts, IPO activity, and regulatory digitization. With strong fundamentals, essential infrastructure status, and an upcoming IPO, NSDL stands as a silent yet powerful force in India’s financial growth story.

You’ve probably used it… but have you really looked at it?

NSDL (National Securities Depository Limited) is where your investments live — quite literally.

It is the first and biggest depository in India, and it holds your bonds, shares, mutual funds, and exchange-traded funds (ETFs) in demat format. NSDL handles the backend work whenever you apply for an IPO, purchase or sell stocks, or get dividends

Think of NSDL as the digital vault of India’s financial markets.

Prior to the establishment of NSDL in 1996, shares were traded on paper, when the delays, forgeries, and delivery risks were common.

It was entirely digitized by NSDL.

Physical certificates were eliminated.

Enabled real-time settlements

Made trading more transparent

Made investing more widely accessible.

Outcome? A safer, quicker, and cleaner market—and a huge starting point for the current surge in retail investing.

You know what has changed in India in the last 5 years?

Over 15 crore demat accounts (CDSL + NSDL) have been opened

SIP inflows have reached all time highs

IPO participation, bonds, REITs and InvITs have skyrocketed

Regulatory pressure for transparency and digitization

At the heart of all of this is NSDL.

It serves as the digital backbone of India's capital market system and is more than just a vault.

This is a brief overview of NSDL's function within the ecosystem:

|

Service |

Description |

|

Demat Services |

Hold shares, mutual funds, bonds in digital format |

|

Transaction Settlements |

Ensure smooth transfer of securities during buy/sell |

|

Corporate Actions |

Automate dividends, bonus issues, stock splits |

|

e-KYC & PAN Verification |

Used by brokers, AMCs, fintechs for onboarding |

|

IPO Allotment |

NSDL processes and credits IPO shares |

|

Value-Added Services |

E-voting, consolidated account statements, insurance depository, academic documents etc. |

NSDL is more than just securities. It is subtly constructing India's digital backbone through its subsidiaries:

NSDL Database Management Limited (NDML)

👉 GST Suvidha Provider services, e-KYC, PAN verification, NPS record-keeping, and e-insurance repository.

NSDL Payments Bank Limited

👉 A licensed payments bank specializes in digital financial services

NSDL is now a fintech and government digital partner in addition to being a securities custodian.

NSDL IPO Rumors – Finally Approaching

Finally, after years of waiting, NSDL is getting ready for its initial public offering!

In July 2023, it submitted its Draft Red Herring Prospectus (DRHP) to SEBI.

By September 2024, SEBI approved it.

NSDL now has until July 31, 2025, to conduct the offering after the IPO timeline was extended owing to unstable market conditions.

In this initial public offering (IPO), which will be an Offer for Sale (OFS) of roughly ₹3,000 crore, current owners such as IDBI Bank and NSE would sell a portion of their interests rather than issuing new shares.

Early access tip: Astute investors can get early access to NSDL shares since they are currently trading on the unlisted market.

NSDL makes a lot of money from low-cost, high-volume activities even with controlled pricing.

|

Revenue Stream |

What It Means |

|

Transaction Charges |

Collected from brokers and depository participants (DPs) |

|

Account Maintenance |

Annual fees per demat account |

|

Issuer Services |

Charges for IPOs, bonuses, splits, etc. |

|

e-KYC & PAN Services |

Used across BFSI industry |

|

Govt Projects |

e-Insurance, academic certificates, NPS recordkeeping |

In summary, each time India invests, NSDL profits.

From FY20 to FY24, NSDL's sales increased fourfold, while the company's income and profit increased continuously. The business is still quite profitable even though its margins have decreased. Strong momentum is already evident in the 9M FY25 figures, which point to another successful year. This demonstrates NSDL's capacity to grow alongside India's investment boom.

For institutions, NSDL is the largest and most prominent player, but among retail investors, its rival CDSL has established a substantial presence.

|

NSDL |

CDSL |

|

|

Year Established |

1996 |

1999 |

|

Promoted by |

NSE |

BSE |

|

Primary Focus |

Institutional + High Value |

Retail Investors |

|

Demat Accounts (March 2025) |

3.94 crore |

15.29 crore |

|

AUC (Assets Under Custody) |

₹464 lakh crore |

₹705 lakh crore |

|

Number of Depository Participants |

294 |

574 |

Key takeaway:

CDSL benefits from the surge in retail investment in India

Large institutions and overseas investments are powered by NSDL

In simple words:

"CDSL serves quantity, NSDL guards quality."

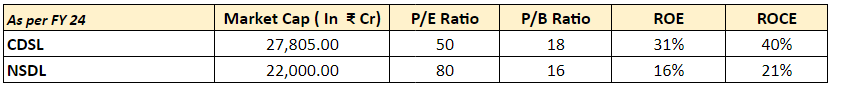

CDSL trades at a comparatively cheaper valuation and has better profitability measures, including greater ROE and ROCE. NSDL fetches a higher P/E, suggesting market expectations of stability and long-term growth, even though it is older and serves larger organizations. Retail is dominated by CDSL, although NSDL's institutional depth and future prospects provide it a competitive edge.

The Financialization Wave in India

A growing number of people are switching from gold and FDs to bonds, mutual funds, and stocks.

Government & SEBI Push

NSDL's services are favored by push mandates for demat in unlisted dealings, e-KYC standards, and bond digitization.

Product Variety

NSDL is constructing multi-sector infrastructure, ranging from e-Insurance to educational record-keeping and GIFT City growth.

Momentum for IPOs

More IPOs translate into more demat accounts and more income.

Critical Infrastructure Function

Similar to clearing houses or exchanges, NSDL is a market-driven utility.

High Barriers to Entry

In India, there are just two authorized depositories. difficult to interrupt or replace.

High Leverage, Low Capex Model

Scaling is simple once infrastructure is established. Margin magic is what that is.

Huge Trust Base

NSDL is backed by trusted institutions like IDBI Bank (26.10%), NSE (24%), HDFC Bank (8.95%), and the Government’s SUUTI (6.83%), reinforcing its credibility and stability in the financial ecosystem.

Strong Fundamentals

Stable, profitable, and characterized by long-term tailwinds.

On social media, NSDL won't be trendy.

You won’t hear flashy promises of "10x in 2 years."

Rather, a basic corporation is quietly driving the ₹450 lakh crore capital market engine in India.

NSDL's growth will be steady, stable, and profitable as India's equity culture develops.

It's not glitzy. It is necessary. And for long-term investors, those are occasionally the best options.

If you prefer watching over reading, I’ve created a detailed YouTube video explaining Studds Accessories’ business, financials, peer comparison, and IPO opportunity in a simple and engaging format.

Watch here: YouTube Video Link

Don’t forget to like, share, and subscribe if you find it helpful! 💬 Feel free to drop your questions or views in the comments.