15 Days Price Change

Summary

Power Exchange India Limited (PXIL) is a leading power trading platform in India, backed by strong financials, efficient operations, and a solid risk management framework. With rising electricity demand and green energy tailwinds, PXIL holds promising long-term growth potential.

One of India's top power trading platforms, Power Exchange India Limited (PXIL), was established in 2008 and provides an electronic marketplace for effective electricity transactions. Under the Power Market Regulations, it was established as a public-private partnership to foster competition, price discovery, and transparency in the power industry.

By linking power generators, distribution companies (DISCOMs), industrial consumers, and other players, PXIL plays a crucial role in the Indian electricity market. Its primary purpose is to enable effective, transparent, and competitive electricity trading across various time horizons and energy types.

The Central Electricity Regulatory Commission (CERC) oversees the platform's operations, guaranteeing adherence to national electricity trading regulations and upholding the integrity of the market.

PXIL provides trading in a number of segments, meeting the needs of both conventional and renewable energy sources.

🔹 Day-Ahead Market (DAM): Participants can purchase or sell electricity for the next day using this, which is based on market-clearing prices.

🔹 Term-Ahead Market (TAM): Provides flexibility to handle short-term power needs by enabling electricity contracts up to 11 days in advance.

🔹 Renewable Energy Certificates (REC): By trading in green energy credits, entities can comply with their Renewable Purchase Obligations (RPO).

🔹 Energy Saving Certificates (ESCerts): These are traded under the Perform, Achieve, and Trade (PAT) program and encourage industries to use less energy.

Driven by favorable regulatory trends and growing demand, Power Exchange India Limited (PXIL) has produced a robust and steady financial performance.

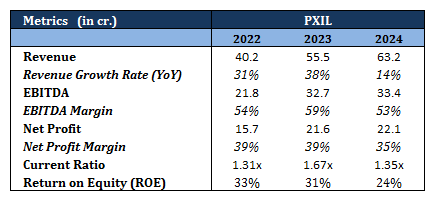

1. Strong Revenue Growth: Revenue increased by 38% in FY23, and it even rose from ₹40.2 Cr in FY22 to ₹63.2 Cr in FY24, demonstrating strong platform adoption.

2. Excellent Profitability: Over three years, EBITDA increased from ₹21.8 Cr to ₹33.4 Cr, with consistently high margins ranging from 59 and 53%, indicating cost effectiveness.

3. Stable Net Margins: In FY24, net profit increased to ₹22.1 Cr, and margins remained stable at 39%, indicating operational strength.

4. Healthy Liquidity: The current ratio (1.31x–1.67x) stayed high, guaranteeing sound short-term financial stability.

5. Resilient Yet Moderating ROE: Although ROE slightly decreased from 33% to 24%, it still shows effective capital use.

It is impossible to overlook IEX, the market leader and closest comparable, when assessing PXIL's potential, as they both operate under the same regulatory framework, cater to similar stakeholders, and form the foundation of India's short-term power trading ecosystem. IEX is subject to dual regulation from CERC and SEBI, whereas PXIL is only subject to CERC regulation. Increased transparency and increased investor confidence in IEX are the results of this dual oversight.

🔹 Technological Advantage: IEX has a more sophisticated and real-time bidding system than PXIL, which uses a more simplistic trading platform.

🔹 Listing Status: While IEX is a publicly listed company on the NSE and BSE, making it easily accessible to retail investors, PXIL is only available in the unlisted market.

🔹 Revenue Model: PXIL makes money from access fees and transactions. IEX, on the other hand, uses a volume-based revenue model that enables it to grow efficiently as trading activity rises.

🔹Their market share reflects this difference. With over 90% of the Indian power exchange market, IEX has established itself as the industry leader, while PXIL only has a small 5–10% share

· Favourable Demand Outlook - PXIL is positioned for long-term volume growth in the power trading segment due to the growing electricity demand brought on by electrification, industrial growth, and the growing EV ecosystem

· Tailwinds from Green Energy Targets - Short-term and real-time power trading is a key area of focus for PXIL, and it is anticipated that India's ambitious goal of 500 GW of non-fossil fuel capacity by 2030 will greatly increase demand for it.

· Attractive Valuation Relative to Peers - With a substantially lower implied valuation in the unlisted market than the listed incumbent, IEX, PXIL offers substantial upside potential in the event of an IPO or growth in market share.

· Healthy Margins and Efficient Cost Structure - PXIL has shown strong operating margins despite having a smaller market share, supported by an effective business strategy and a variety of revenue sources from access and transaction fees.

Key Financial Risks for PXIL

1. Risk of Credit

Trade receivables and financial instruments expose PXIL to credit risk. It maintains safeguards like the Settlement Guarantee Fund (SGF) and collateral deposits, ensures timely invoicing, and adheres to a cautious credit policy in order to lessen this.

2. Liquidity Risk

Access to credit lines, marketable securities, and adequate cash reserves all help to mitigate the risk of failing to fulfill short-term obligations.

3. Risk of Settlement and Clearing

There are significant risks associated with any interruption in trade settlement. PXIL uses strict member eligibility requirements, default funds, and margin policies to address this. By requiring members to deposit margins, counterparty default risk is decreased.

4. Risk of Capital Management

Through retained earnings and share capital, PXIL maintains capital adequacy, supporting future growth and acting as a safety net against unanticipated risks.

PXIL's emphasis on operational stability and financial prudence is reflected in its robust risk management framework. PXIL is in a strong position to continue leading the power exchange market by actively reducing important risks, such as credit exposure and settlement delays, and keeping sizeable capital reserves. These safeguards not only protect operations but also boost investor confidence in the sector's long-term growth as it develops.

The stock is currently available in the unlisted market through Sharescart.com. PXIL's strong risk management and leadership in the power trading industry make it a potential asset for long-term investors.