15 Days Price Change

Summary

Lenskart, India’s top eyewear brand, has grown 3.5x in revenue and turned EBITDA-positive by FY24. With 2,500+ stores and major tech investments, it’s now eyeing a $1 billion IPO at a $10 billion valuation. As the eyewear market booms, Lenskart is expanding into Tier 2 & 3 cities while transforming into a tech-first retail disruptor.

Company Overview

Lenskart, India's most popular eyewear brand, offers a variety of products such as sunglasses, contact lenses, eyeglasses, and lens solution. It was founded in 2010 by Peyush Bansal, Amit Chaudhary, and Sumeet Kapahi and has scaled up based on a strong tech-driven omnichannel platform that infuses online convenience with offline experience. Lenskart now caters to millions of customers across India and elsewhere, with in excess of 2,500 stores and more than 5,000 variants of eyewear.

It was anointed a unicorn in December 2019 when industry bigwigs SoftBank, ADIA, KKR, and others backed it. The corporation has a strong technology base, namely in terms of reach, quality, and cost. This approach has made high-end eyewear available to the masses. Lenskart: The company is showing its increasing strength in the organised eyeglasses business, with strong EBITDA margins and a clear international growth strategy.

The Indian eyewear industry is developing. Fixing eyesight is an emerging booming branch of lifestyle. It is expected to increase in value by approximately 100 percent of its FY23 value of $10.4 billion to become $19.6 billion as of FY33, implying a steady compound growth rate of 7 percent.

You might be wondering what is driving this increase. Branded eyewear that is fashionable is gaining popularity. Internet shopping is also rising in addition to demand in Tier 2 and Tier 3 cities. Besides glasses, the present-day customers seek convenience, fashion, and high-tech experiences, such as virtual tries and at-home eye exams. Lenskart is the company spearheading the change.

The large presence that the company has online as well as in physical stores, in-house manufacturing capabilities, and AI tools place is in a good position with regard to the future of the industry. It is not about living and tracking trends; it is about shaping them.

In recent years, Lenskart has shed its start-up bubble to become a sustainable business. This demonstrates a path by which a direct-to-consumer company can expand while also enjoying a healthy profit margin

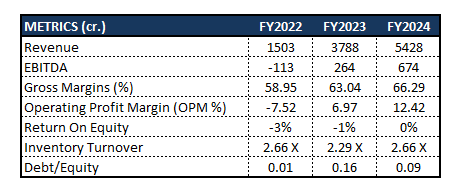

🔹 Lenskart’s revenues increased more than 3.5 times over just two years, from ₹1,503 crore in FY22 to ₹5,428 crore in FY24. But growth decelerated in the fiscal year ending 2024 to 43.3%, down from last year. It may be that this dip is a short-run response on the company’s part to cutting costs, entering new foreign markets, or cutting sinking financial costs. means tighter cost controls and operational efficiency.

🔹 Gross margin slightly moved up from 58.95% to 66.29%, caused by improved supply chain management and a powerful brand pricing power.

🔹 EBITDA turned positive from a loss of -113 crore in FY22 to profitability of 674 crore inFY24.

🔹Another improvement was in the operating profit margin (OPM); it rose from -7.52% to 12.42%, reflecting a clear shift from a growth-at-all-costs model to sustainable profitability.

🔹The debt/equity ratio is only 0.09 in FY24, which shows that it is not reckless moderate financing base, minimal financial risk, and a conservative policy of raising funds

🔹Turnover of their inventory rate was constant at about 2.6 times, indicating good demand cycles. stable product mobility.

🔹ROE shows that the efficiency of capital can be increased despite the profitability increases.

Lenskart is evolving as a disruptor to a financially robust retail technology company. They saw slower growth of revenue in FY24. Which shows a strategic transition period and globalisation and not an indication of danger. With a booming unit economics, enlarging margins, and an impending IPO, Lenskart stands in good stead to remain innovative and long-term value creator

The giant Indian eyeglasses manufacturer Lenskart is planning a huge initial public offering (IPO) estimated to be worth 10 billion dollars and to raise 1 billion dollars. To demonstrate the increasing strength of the Indian consumer brands, in case of success, it might become one of the biggest publicly traded firms in the direct-to-consumer category.

This is a very important cause championed by financial firms locally and internationally, such as Citi, Axis Capital, Morgan Stanley, Avendus, and Kotak Mahindra Capital. Through their participation, it means that investors hold a lot of faith in the long-term goal, business strategy, and leadership of Lenskart.

The IPO gains are likely to underpin the aggressive growth plans of Lenskart, where it is planning to open more than 400 stores. This is particularly true in the Tier 2 and the Tier 3 cities, where people have a rising demand for stylish yet affordable eyeglasses. This is an ideal step towards the objective of the brand to make access to high-quality eyewear in India.

Lenskart does not simply sell eyewear. It is investing massively in innovation and technology. Investments in XR technology startup Ajna Lens last month, as well as ongoing talks to acquire location intelligence company GeoIQ, are just the latest evidence of the hoary ambition of this corporation to be first and foremost a technology company that happens to deal in visual experiences.

The CEO, Peyush Bansal, could also be offered a well-planned stock allocation as a tactical pre-IPO move, which would make him the owner of 1.5-2% more. This is regarded as an act of gratitude to the founder whose leadership has been cemented and who has steered the business to a decade of remarkable growth.

India’s Lenskart is getting close to an initial public offering (IPO), which may become a point of positive change in the face of the consumer technology industry in India. The company is raising high expectations due to its impressive revenue increase, famous investors, and firm grip on the rapidly expanding eyeglasses market segment. Nevertheless, investors ought to go about it cautiously.

Lenskart is yet to be profitable at any point, and the IPO can be very expensive as it grows in size. To top it off, there is the growing competition in the direct-to-consumer industry. To the believers of the story of the Indian consumers and the strong brand of Lenskart, this might be a tempting opportunity. In case you want to invest before the IPO is listed in the stock market, you can buy Lenskart stocks on an unlisted basis at Sharescart.com.