15 Days Price Change

Summary

NCDEX, India’s leading agri-commodity exchange, has received SEBI’s nod to enter the equity segment under key conditions. While currently loss-making in its core operations, NCDEX’s expansion plans and monopoly in agri-derivatives position it as a high-risk, high-reward bet for long-term investors.

The National Commodity & Derivatives Exchange (NCDEX) is the most competent online commodity exchange available in India whose principal business is agriculture-based derivatives. It was commissioned in 2003, is under regulatory control of SEBI, and offers a venue through which price discovery takes place on a transparent level and risk management of agricultural markets is provided.

The Important Highlights:

🔹 94 to 97 percent agri-commodity derivatives market share.

🔹 Provides futures contracts for various farm products such as chana, guar, soybean, mustard seed, and jeera, among others.

🔹 Incorporated in Mumbai with a national presence in farmer producer organisations (FPO), traders and processors.

🔹 Vital in aiding the agriculture value chain in India and particularly in ensuring that farmers can price better.

🔹 Marketed by the agencies such as LIC, NABARD, NSE, and the banks of the state.

NCDEX has gotten an in-principle approval by the Securities and Exchange Board of India (SEBI) to start its equity and equity derivatives segment. The acceptance was communicated through a SEBI letter dated 29 July 2025, but the segment is subject to fulfilling some requirements before it can launch.

The Conditions of NCDEX of SEBI

NCDEX needs to uphold its volume of activities in commodity trading to maintain its core agri-derivative unit, which constitutes approximately 94 percent of its operation.

Before the launch of the equity segment, it is necessary that the exchange should have its technology infrastructure in place and fully compliant. These systems include trading, clearing and settlement systems.

SEBI has directed NCDEX to first launch its equity products through the cash segment and not to start by offering derivatives

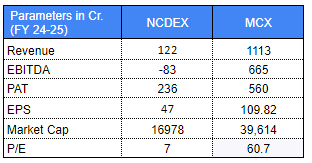

To better understand NCDEX's positioning in the commodity derivatives space, it's essential to compare it with its largest peer—Multi Commodity Exchange (MCX). While NCDEX leads the agricultural commodities segment, MCX is the dominant force in non-agri derivatives, holding over 90% market share in that space. This contrast offers valuable context: NCDEX operates in a niche but critical part of India’s commodity ecosystem, whereas MCX caters to a broader range of metals and energy contracts. By comparing the two, investors can gauge NCDEX's growth potential, strategic focus, and how it differentiates itself in a market heavily led by MCX.

MCX is a company with passive, steady profitability, whilst NCDEX is a turnaround and growth story with more risk.

🔹MCX has a revenue of 1113 Cr, which is approximately 9x the revenue (122 Cr) of NCDEX obtained by virtue of its wider coverage of commodities other than agriculture business.

🔹EBITDA Negative at -83 Cr

This indicates that NCDEX incurs losses in its main activities. It has a higher operating cost (staff, tech, administration, and marketing costs, as well as clearing costs) than operating revenue through commodity trading.

🔹NCDEX reports a positive PAT of ₹236 crore

This is not the result of a business turnaround but extraordinary income as a result of asset sales:

1. Sale of Stake in Power Exchange India Ltd (PXIL): 14,700 lakh (~ 147 Cr) profit.

2. Revaluation gain on retained PXIL share after it stopped being an associate -> 22,890 lakhs (~229 Cr).

3. Disposal of share in National E-Repository Ltd (NeRL) – 14.43 Cr profit.

4. Other smaller exceptional gains.

These nonrecurring gains inflated the net profit even though they had a bad operating performance.

🔹A high P/E of MCX suggests a dividend on reliable, repetitive profits on diversified, high-volume goods trading, meaning investors are prepared to compensate predictability and dominance. While NCDEX at low P/E meaning The profitability in FY25 was pegged on the sale of stakes, and the core business is loss-making.

In the eyes of the investor, NCDEX at the moment is not about what it currently earns but what it can become. Indeed, the negative EBITDA in FY 25 indicates that the core business is haemorrhaging, but the profits that it reports are mainly one-time sales of stakes – i.e., they are not sustainable.

However, NCDEX is an uncommon monopoly since it holds more or less 97 per cent of the agri-derivatives market in India and the monopoly within a regulated sphere is very difficult to emulate. The support given by heavy companies such as NSE, LIC and NABARD gives an excellent dose of credibility and financial security.

When an investor is looking ahead, it is the diversification strategy that is promising: leaving the seasonal agri-dependencies behind, the company is turning to equities derivatives and weather-linked products, which may generate stable, growing income. Add to this the policy impetus to modernise agri markets and climate risk management, and you have a potentially long-term growth trigger. Nevertheless, this remains a high-risk, high-reward game; you’re essentially betting on NCDEX’s ability to fix its operational inefficiencies and successfully execute its expansion, not on the health of its current financials.

The need to invest today or wait depends on the risk appetite of any individual. The long-term returns of such an investment on this change-driven stage have the potential of being larger than the risks. The act of waiting can also reduce the risk by giving a clearer realization of the success of the new segments, though it may mean the missing of the opening intervals. Since financial objectives differ for investors, investors need to conduct good due diligence according to their own financial objectives. Since NCDEX is an unlisted company, it can be accessed through the private unlisted share market such as Sharescart and therefore timing and entry would need to be all more strategic.