15 Days Price Change

Summary

Transline Technologies is a fast-growing security and AI solutions provider with strong proprietary products, rising revenues, and industry-leading margins. Positioned in high-growth areas like IoT, smart cities, and digital surveillance, it offers investors a compelling opportunity in India’s digital infrastructure space.

Transline Technology is an emerging technology solutions company that specialises in integrated security and surveillance, biometric authentication solutions and AI software platforms. Building on our own proprietary products (StorePulse (AI video analytics), CamStore (video compression and storage optimisation), and CheckCam (CCTV network monitoring)), they have established scalable SaaS-based revenue flows over and above large project-based system integration contracts. The Founder & MD Arun Gupta, with over 23+ years of experience, has led the expansion to a diversified provider of smart, AI-enabled security solutions with industries which have applications in government, PSUs, smart cities and even enterprises. They have proven their capability to win and deliver high-value, demanding projects due to a collection of successful execution histories exemplified by such high-profile works as the nationwide ICCC of 151 railway stations and centralised biometric ID infrastructures covering law enforcement. As they have a rising customer base, a healthy order book of 1,986.86 million as of March 31, 2025, and growing adoption of their proprietary SaaS platforms, the company is also attracting strong investor interest in its unlisted shares, positioning it well to capitalise on the rising demand in India for smart surveillance and digital security.

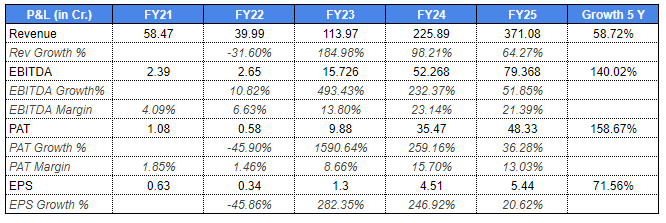

🔹 Transline Technology has recorded an extreme upturn and has become one of the fastest-growing companies in the Indian digital infrastructure market. Following a 32% fall in FY22, the company recovered robustly – revenues doubled in FY23, nearly doubled again in FY24 and are at Rs 371 crore in FY25, implying a 58.7% CAGR over FY21-FY25.

🔹 Profitability has been increasing accordingly. EBITDA has increased 140% CAGR, from 2.4 crore to 79.4 crore rupees, EBITDA in FY 21 and FY 25 respectively, and with margin improving at 4.1 percent to 21.4%. Net profit (PAT) increased by 158.7%, CAGR is up to 13% and PAT margins improved to 13% from 1.9%, demonstrating that the company is a profitable entity.

🔹 Earnings of holders have also been growing at a swift pace. At 71.6% CAGR, the increase in EPS would take it to 5.44 in FY25, up from 0.63 in FY21, given better returns. The ROE increased to 27.1%, and that of the ROA stands at 12.2%, portraying effective utilisation of capital.

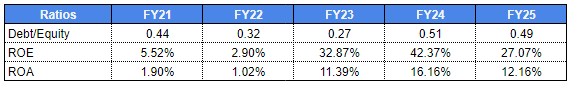

🔹 The company has also enjoyed the benefit of maintaining a balanced structure with a debt-equity ratio of around 0.27x to 0.51x and completed 0.49x in FY25, suggesting an overall sensible use of leverage.

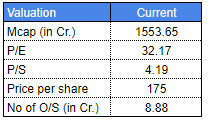

🔹 Transline has a market cap of 1,553 crore, with a P/E ratio of 32.2x, a P/S ratio of 4.2x and a share price of 175 currently. Valuations are at premium levels, but solid growth, margin expansion and efficiency drive support investors.

🔹 Overall, Transline has managed to evolve into a high-growth, profit-making, and capital-efficient corporation, which is well positioned to benefit in India due to the boom in the digital smart infrastructure.

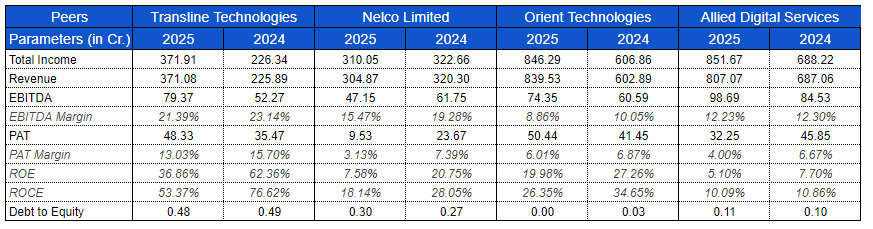

🔹 Transline Technologies has 8-digit profit figures, with the profitability of Transline Technologies rising at a rate that is higher than its reimbursement on returns, which is expected to boost its value to a larger extent. The company achieved 371 crore in revenues in the course of FY25 as compared to Orient Technologies (840 crore) and Allied Digital (807 crore), whereas Nelco had 305 crore. This indicates that although Transline is yet to achieve similar topline heights as fellow industry giants, it has established a good market niche in the midsized market in the digital-infrastructure sector.

🔹 The difference with Transline is that it is profitable. The EBITDA margin of the company stood at a substantially high figure of 21.4% compared to 15.5% of Nelco, 8.9% of Orient, and 12.2% of Allied Digital. This is also reflected in bottom lines, with a PAT margin of 13.0%, the best in the peer set. By contrast, Nelco is at only 3.1%, Orient at 6.0 and Allied at 4.0. It is evident that Transline has been in a position to translate revenues into profits in comparison to its rivals with greater effectiveness.

🔹 The advantage is reconfirmed by the return ratios as well. The ROE of 36.9% is far exceeding the peers-Nelco 7.6 % and Orient 19.9%, and Allied Digital 5.1%. Its ROCE of 53.4% is over twice that of Orient (26.4%) and more than a few times that of Nelco (18.1%) and Allied (10.1%). These data highlight the effectiveness of the capitalisation and the capability of the company to create high returns to the stockholders as well as returns on invested money.

🔹 On the leverage front, Transline has a gearing ratio of 0.48x, higher than most players- Nelco at 0.30x, Orient with no debt and Allied at 0.11x. Although this shows that Transline would use debt financing more than its competitors have done, the leverage is within a manageable level and well below dangerous levels, considering that the profitability and returns are strong and provide the company with more cushions.

🔹 In conclusion, Transline Technologies has not yet elongated its revenue to those of the greatest competitors in its market, but it can be observed that it surpasses its competitors in margins and profitability. This places the company in a strong, efficient and rapidly growing position in the Indian digital infrastructure scene with a financial picture a little less high-priced in terms of returns on a per dollar invested basis than many of its bigger rivals.

Moving forward, Transline is poised in the high-growth industries of video surveillance, internet of things (IoT), SaaS and smart city solutions. With its premium valuations already capturing its potential, its growth will likely remain a high-return story in the coming five years

Transline Technologies no longer has to work just to pursue growth, but now it is even able to predict it with as clear a vision as possible. The company prospects in the future are enticing in all aspects, as it bases this on three scenarios.

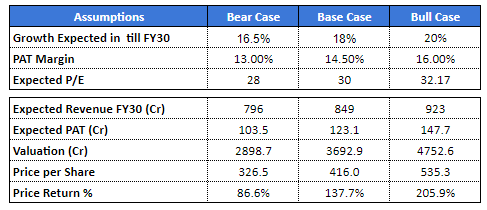

In the base case, even with consistent growth at 18% per year, the numbers can catapult to almost 849 crores of revenues by FY30, an associated profit of 123 crores, and an 138 percent price gain potential. Even assuming that growth slows to 16.5% -- a bear case scenario - investors would still get a nearly 87% return. The most thrilling direction, however, is the bull case: should Transline attain the growth rate of 20%, it can pass 923 crore in sales, 148 crore in profits, and record a staggering 206 percent gain.

This is not just some positive thinking but proceeds out of the reality of Transline successfully growing their top line, increasing their margins, and beating the competition successfully. Investors are in a rare role where any move, be it cautious or pugnacious, is profitable on the path to 2030.

1. Growth Rate: The growth rate assumed in the bear case is 16.5 percent as per the growth rate indicated by Frost & Sullivan in the industry. In the Base and Bull Cases, the growth will be higher than industry levels at 18% and 20% respectively, suggesting Transline will capture more market share.

2. P/Es Multiples: Multiples are modelled to shift as much as market sentiment – 28x Bear Case (slower growth), 30x Base Case (steady outperformance) and 32x Bull Case (stronger growth and renewed investor confidence).

3. PAT Margins: The Bear Case implies that margins will be flat, the Base Case is 14.5%, and, in the Bull Case, the expansion to 16% will enable margins to continue rising.

Transline Technologies comes out as the most proficient and profitable company in its niche that has risen to the ranks after once being a struggling mid-tier company. Delivering a growth rate of revenue close to the 59% CAGR mark over the period of five years, the company has a strong EBITDA margin profile of more than 21% and a high return on equity of 62% show that the company has an excellent performance compared to its larger peers. Its advantaged positioning in high-growth areas, such as artificial intelligence (AI), the Internet of Things (IoT), smart cities and digital surveillance, represents a structural upwind that can drive stronger than industry growth. To investors, the multiple scenario analysis shows 2-3x potential long-term upside over a five-year period, with low risk on the downside due to solid fundamentals and a reasonable level of leverage.

Transline Technologies is not the largest player in its industry, but it is proving to be the most agile and profitable. With industry growth tailwinds, expanding margins, and high returns on equity, the company sits at an inflection point. For aggressive investors, it presents a compelling growth story with multi-bagger potential over the next 5 years. Conservative investors, however, may prefer to wait for consistent quarterly performance before entering, given the current premium valuations.

Individuals who wish to invest in unlisted shares in India may find Transline in the unlisted market and buy it via Sharescart, a reliable unlisted shares buyer and seller in India. This presents an interesting opportunity to investors wishing to take part in future upside before a possible listing.