15 Days Price Change

Summary

Apollo Green Energy is emerging as a promising EPC and renewable asset developer in India’s ₹30 lakh crore clean energy race. Backed by Apollo International, it’s expanding into in-house solar manufacturing, battery storage, and green hydrogen with a ₹4,500 crore investment and IPO planned in 2025. With strong financials, low debt, and a growing order book, it stands out in India’s fast-growing renewable sector.

India's shift to renewable energy is no longer solely about the Ambanis and Adanis. Apollo Green Energy is one of a new group of agile, focused players that are subtly making significant strides.

With the support of Apollo International Group's legacy, this little-known business is now putting itself in a position to contribute more to India's clean energy goals. Apollo Green is taking the initiative, from EPC contracts to developing its own renewable assets, and it might be worth keeping an eye on before the markets take notice.

India has set a massive target of producing 500 GW of renewable energy by 2030, and we’re already the third-largest renewable energy producer globally.

This momentum is being fueled by powerful government-backed initiatives like:

The ₹19,000 crore Green Hydrogen Mission

PLI scheme for solar modules

Development of multiple Renewable Energy Parks across Gujarat, Madhya Pradesh, and Odisha

Additionally, India's Net Zero by 2070 target, the EV push, and increasing ESG pressure on corporates are accelerating sector-wide demand. While global renewable capacity is growing at a CAGR of 14–15%, India’s pace is even faster.

And the biggest beneficiaries? On-ground players who are building and scaling sustainably — like Apollo Green Energy.

Apollo Green Energy began as an EPC player, which means that they assist in the planning, construction, and upkeep of sizable wind and solar projects. They have a solid reputation for on-time delivery and have completed contracts in the public and commercial sectors over the years.

However, the major change? Moving toward a developer model, they are now establishing their own renewable energy assets rather than only building for others.

This shift is significant. This implies that Apollo Green will receive ongoing income from the power they produce in addition to contracts.

Apollo is expanding according to a well-defined plan:

AGEL Renewable Energy Ltd., a new business, was established with the goal of installing 1 GW of clean energy capacity

Inked a Memorandum of Understanding with the Odisha government to invest ₹4,500 crore in infrastructure for battery storage and green energy

Intentions to diversify into rooftop solar for businesses and MSMEs, as well as hybrid projects (solar + wind)

Plans to leverage the upcoming IPO to invest in advanced technologies like tracker-based solar and green hydrogen, as well as build in-house solar module manufacturing capacity and install pollution control systems like FGD

Without sacrificing their capital-light approach, the goal is to delve farther into the energy ecosystem — from generation to storage to manufacturing to project development.

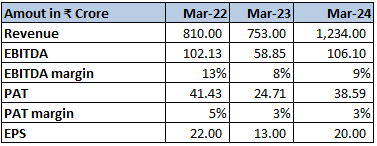

Apollo Green Energy has shown a strong recovery in FY24, with revenue jumping to ₹1,234 Cr, a 64% increase YoY, after a dip in FY23. EBITDA has also doubled compared to FY23, showing improved operational efficiency. However, PAT margins remain low at 3%, highlighting pressure from interest, depreciation, or tax costs. EPS has rebounded to ₹20 in FY24, up from ₹13 last year — a positive sign for potential investors ahead of the IPO.

While Apollo Green’s ROE of 7% is slightly below the industry average of 9%, its ROCE of 11.8% stands out — indicating efficient capital usage. With a Debt-to-Equity ratio of just 0.73, the company is far less leveraged than industry peers, showcasing a strong balance sheet. Its P/E ratio of 86.7 sits below the industry average, suggesting better valuation comfort compared to high-multiple stocks like NTPC Green or Adani Green.

The energy sector in India offers enormous potential. Through 2030, the nation must build 35–40 GW of renewable capacity annually, and EPC + developer hybrids are in a prime position to meet this goal.

Apollo Green's timing is appropriate for a few reasons:

Battery storage and hybrid energy solutions are being strongly promoted by the government

Domestic renewable players are benefiting from import duties and PLI schemes

Green energy has become financially viable, not just environmentally necessary

Government mandates and corporate ESG compliance are increasing demand

Upcoming IPO in 2025 could serve as a major growth catalyst to fund expansion and tech upgrades

Apollo International's group support provides long-term stability

Years of EPC experience lead to lower execution risk

Asset-light model with limited debt exposure so far

Strong state-level partnerships and MoUs

Now venturing into high-margin, recurring revenue from owned assets

Scaling into asset ownership comes with long-term obligations like project funding, asset maintenance, and PPAs

The success of the IPO, expected by end-2025, will depend on market timing and investor sentiment

Like many clean energy firms, Apollo’s future is closely tied to policy consistency and government subsidies

Apollo Green isn't currently in the news. However, the best investments are frequently found by identifying companies that are quietly growing, expanding, and operating.

Apollo Green Energy appears to be well-positioned to ride the next wave of India's green power growth thanks to its strong track record, expansion into owned assets, and ₹4,500 crore investment in Odisha. Additionally, early investors in the unlisted sector may have a front-row seat if the IPO launches in FY26.

This is a company worth looking at before it goes public if clean energy is a long-term theme in your portfolio.

Apollo Green shares are now offered on platforms like Sharescart in the pre-IPO market.

If you prefer watching over reading, I’ve created a detailed YouTube video explaining Studds Accessories’ business, financials, peer comparison, and IPO opportunity in a simple and engaging format.

Watch here: YouTube Video Link

Don’t forget to like, share, and subscribe if you find it helpful! 💬 Feel free to drop your questions or views in the comments.