Company Overview

ESDS Software Solution Ltd. (ESDS) is a company that has established itself as a leader in the new cloud, managed services, and software solutions market in India. Being one of the two in the country to provide the full range of cloud, managed services, data centre infrastructure, and SaaS, ESDS dominates the space in terms of FY24 operations-based revenue. As India develops more rapidly in the digital realm, ESDS has the opportunity to capitalize on the increasing adoption of cloud services in the BFSI, government, and enterprise industries.

ESDS was established as an orchestrated hosting platform but has evolved to be a complete stack, AI-powered cloud and SaaS provider. It has four Tier-3 certified data centres in Nashik, Navi Mumbai, Bengaluru and Mohali that guarantee 99.95% uptime rates and compliance levels.

By September 2024, ESDS had 1,398 clients, including BFSI institutions, government agencies, and special large enterprises. Notably, 75.5 percent of revenues are contributed by existing clients and this indicates a sticky, recurring revenue base.

Business Offerings

1. Infrastructure as a Service (IaaS)- ESDS offers a strong cloud infrastructure portfolio, such as:

- Colocation and Data Centre solutions that would provide secure and reliable hosting environments.

- Cloud services in public, private, hybrid, and community architectures that address the needs of various clients.

- The eNlight Cloud autoscaling software which is patented that optimizes the cost and energy usage through dynamically scaling the resources.

2. Managed Services - ESDS provides full IT support and operational performance through its managed services through:

- Mission critical system end to end infrastructure management.

- State-of-the-art cybersecurity, database, and SAP HANA management software.

- Resilience and agility Backup & recovery DevOps and automation.

3. Software as a Service (SaaS) - ESDS has SaaS enterprise-ready platforms, such as:

- SPOCHUB, a singular SaaS marketplace solution to enterprises and SMBs.

- Cloud native monitoring and security applications including VPNs, firewalls and vulnerability scanners.

4. Government Technology (G-SaaS) - ESDS has leveraged its experience in working with the government in the following ways:

- E-governance, smart city, and smart farming solutions, which allow digitalizing key areas.

- GovCloud and secure infrastructure platforms, which are created in partnership with government agencies and PSUs.

Market Landscape and Industry Growth

There has been consistent improvement in the Indian software development market, with revenues increasing INR 2,695 billion in FY20 to INR 3,404 billion in FY24, which is a steady growth of 6% CAGR. In the future, the industry will grow at the CAGR of 8.2 reaching INR 5,470 billion by the FY30.

At the same time, the cloud market of India itself is expected to expand at an even quicker rate of 15.8% CAGR to ₹1.84 trillion by FY30. Governmental digital programs, the use of AI/ML and the growing need to ensure the safety, scalability, and affordability of IT solutions are some of the factors that drive this growth and where ESDS excels.

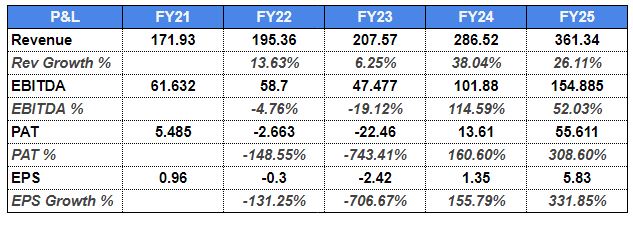

Financial overview

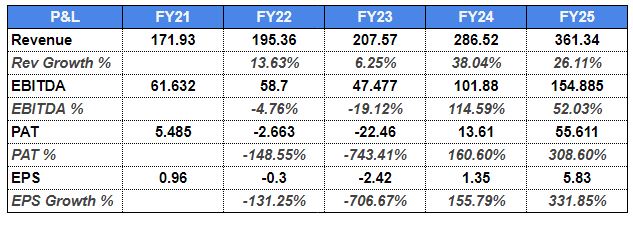

- ESDS has shown a resounding growth in revenues, increasing from ₹171.9 crore in FY21 to 361.3 crores in FY25, and a CAGR of approximately 20%. It was especially rapid in FY24 (38%), with an increase in the use of its cloud and managed services platform.

- On the profitability front, EBITDA has increased many times as compared to the ₹61.6 crore in FY21 to an estimated 154 crore in FY25, with margins of between 36 percent in FY21 to more than 42 percent in FY 25, which is a sign of an operating leverage and efficiency gain.

- Although the company incurred losses in FY2023 because of one-time expenses and scaling challenges, it turned around in FY24 with a PAT of 13.61 crore and it recorded 55.6 crore PAT in FY25, a significant increase of 308% on the previous year.

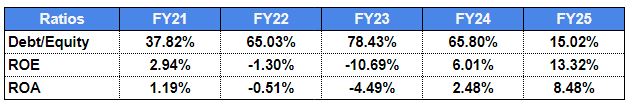

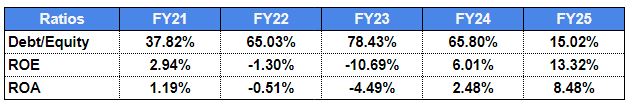

- Balance sheet Debt/equity has gone down significantly to 15% in FY25 compared to 78.4% in FY23, which indicates deleveraging and increased financial discipline. The turnaround is also indicated in returns, where ROE reached 13.32% as well as ROA at 8.48% by FY25, whereas both ratios are negative in FY2023.

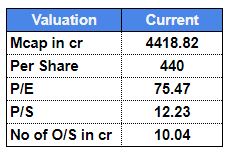

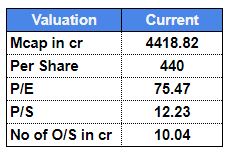

- On the valuation side, ESDS has a current market cap at ₹4,418 crore, having a P/E ratio of 75.47x and P/S ratio of 12.23x indicating good valuation based on forecasted growth and increasing profitability.

In brief, ESDS is moving out of an investment-loss stage into a high growth and profit path, which is backed by operating leverage, balance sheet augmentation and increasing cloud adoption demand in India.

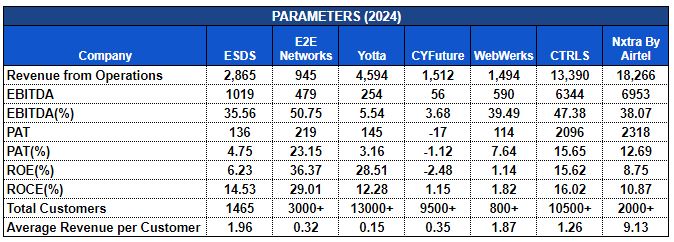

Peers Comparison

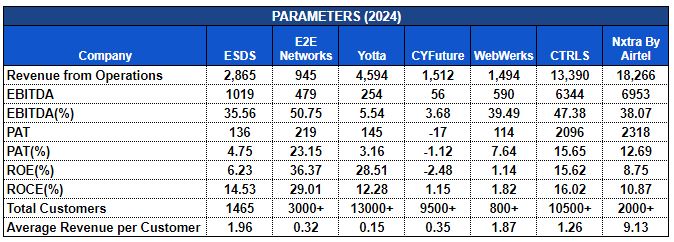

- In FY24, ESDS reported revenue of 2,865 million, ranking just below the larger data centre/cloud providers of Nxtra by Airtel (18,266 million) and CTRL S (13,390 million), but above smaller niche providers such as E2E Networks (945 million) and CYFuture (1,512 million). ESDS is performing well in profitability, although its premium line is mid-size, with an EBITDA margin of 35.6% it is leading many of its competitors except the high-margin giants E2E (50.7%) and CTRL S (47.4%).

- A similar picture is on net profitability. ESDS provided a PAT margin of 4.75%, which is healthy relative to some of its peer companies that reported a loss (CYFuture -1.12%), but low relative to highly profitable companies like E2E (23.15%) and CTRL S (15.65%). Its returns are still low at ROE of 6.23% and ROCE of 14.53%, which shows its continuous investments in growth, where E2E has 36.37% ROE showing its asset-light model.

- The metric of customers indicates another strength. With 1,465 customers, it is smaller than Yotta or WebWerk in pure number, but has one of the highest revenues per customer (1.96 million) in the peer group, just after Nxtra with 9.13 million, which suggests it is more engaged with its customers and holds more share in their wallets

Altogether, ESDS is in the middle between big and small, it has the largest-in-the-industry operating margin and high per-customer monetization, but it keeps expanding to the size of the biggest competitors.

Future Growth Drivers

- Data Centre Expansion - ESDS is also expanding its infrastructure using next-generation GPU and cloud units and increasing computing and storage capacity to provide greater efficiency, reliability, and cost optimization.

- AI/ML-Driven Innovation - ESDS is enhancing customer experience by combining AI-driven onboarding, automation, and vertical-specific cloud solutions and allowing businesses to embrace sophisticated digital workflows.

- Sustainability & Green Cloud - The firm is making progress towards fully transitioning to renewable energy and eco-friendly data centre operations, in keeping with the international ESG guidelines and appealing to sustainable technology-oriented clients.

- Public Sector Partnerships - ESDS is enhancing its presence in the government ecosystem with e-government projects, smart city implementations, and secure GovCloud, and is enabling massive digital transformation.

- Strategic Tech Alliances - Cooperation with Dell, SAP, and developing AI/IoT vendors will allow ESDS to provide an integrated, state-of-the-art solution that will grow its ecosystem and increase the value of clients.

- SMB Cloud Adoption - With scalable pay-as-you-use frameworks, ESDS is tapping into the rapidly expanding SMB market in India by providing cost effective scalable cloud solutions to suit the varied business requirements.

Forecasting

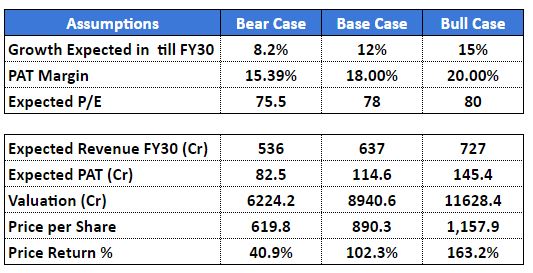

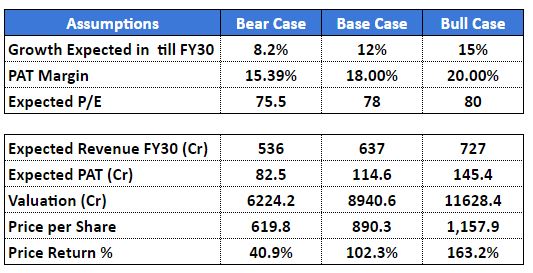

To ensure the possible growth, profitability, and market valuation of ESDS Software Solution Ltd. by FY30, our appraisal is established on three scenarios (assumptions), including bear, base, and bull cases.

- In bear case, we suppose that revenue increases at 8.2% CAGR, PAT margins remain at approximately 15.4% and P/E multiple is 75.5x. This translates to a projected revenue of 536 crore, PAT of 82.5 crore and valuation of 6,224 crore which equates to a 41 percent price runoff.

- The base case is a more aggressive adoption curve that has a growth in revenue of 12 percent, a growth in PAT margin of 18 percent, and a minimal increase in P/E to 78 times. Under this, revenue will be 637 crore, PAT 114.6 crore, and providing a value of 8,940 crore, which gives a good upside potential of 102 percent.

- In bull scenario where the adoption of clouds and operating leverage advantages are accelerated, it is estimated that revenue might scale to 15% CAGR with PAT margin increasing to 20% and P/E ratio of 80x. This means revenue of ₹727 crore, PAT of 145.4 crore and a probable valuation of 11,628 crore which will see a healthy 163 percent profit.

Simply put ESDS projections indicate that it has a high growth potential with even low-growth scenarios indicating positive returns with more aggressive execution and industry-specific wind might provide multi-bagger returns by FY30.

IPO Outlook

ESDS Software Solution will issue 6,000 million via fresh issues of equity shares. The proceeds will be used in:

- Black Box Data centre expansion (cloud infrastructure, Gpu servers, networking upgrades)

- General corporate purposes

The IPO will increase the visibility of ESDS and brand presence and increase its liquidity.

Conclusion

ESDS is a differentiated cloud and managed services provider in India, with niche services such as community cloud coupled with a high level of operating leverage. The company has been able to show a steady increase in revenue, margin growth, and roadmap to scale profitably. As the Indian cloud market is set to grow very fast, ESDS stands to seize long-term markets.

ESDS is a very attractive opportunity to investors, though, both under the most conservative assumptions, returns are positive, and under more optimistic conditions, the returns are multi-baggers. ESDs can be viewed by investors with a medium-long-term investment horizon as an attractive growth play in the digital transformation of India. This share is available with Sharescart, and you can visit Sharescart to buy it.