15 Days Price Change

Summary

Groww, India’s No.1 retail broker, has rapidly scaled into a market leader with strong revenue growth, retail dominance, and improving profitability. Backed by a diversified business model and industry tailwinds, it is well-positioned as a long-term compounding story. Even under conservative scenarios, Groww’s unlisted shares offer attractive return potential.

Since its launch in 2016, Groww has evolved to become the largest and the fastest-growing online investment platform in India, founded by employees of Flipkart, Lalit Keshre, Harsh Jain, Ishan Bansal, and Neeraj Singh. The company had been established with a vision that is a simplification of investment, since investment was seen to be a complex and expensive endeavour in India. Groww has succeeded in becoming the market leader in the retail investment ecosystem in India by dint of a technology-first and customer-centric approach.

Groww offers an entire range of financial services and products on its mobile app and its website. A retail investor is able to invest and trade in stocks and IPOs, derivatives, bonds, and mutual funds and also avail himself of margin trading facilities and personal loans. The user-friendly interface of the product is based on an in-house technology stack which improves customer experience and promotes its use. This product range not only appeals to new investors but also allows cross-selling, thus increasing the level of interaction with the current users.

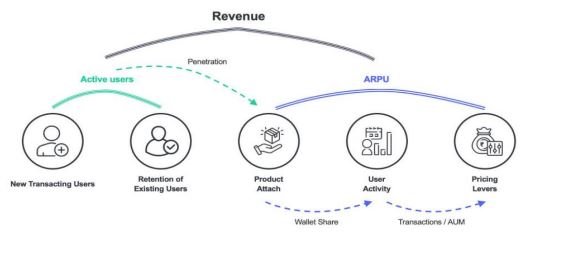

The business model by Groww is based on two key drivers, namely an increase in active users and growth in average revenue per user (ARPU). Whereas acquisition and retention rates are the factors that stimulate user growth, product diversification and user activity improve ARPU.

Cross-sell strategy can be observed by the trends in the adoption of the product on the platform. By June 2025, 48.4% of users invested in stocks, 38.3% invested in stocks and one other product, and 13.3% invested in stocks and 2 or more products. It implies that more than 50% of clients of Groww take several products, which proves the high level of interaction and long-term revenue prospects.

Groww has several sources of revenue:

This diversified revenue model provides stability and scalability as the company expands.

Market Size and Growth Projections: The investment and wealth management industry in India has enormous potential, with the total addressable market (TAM) approximated to be ₹1.1 trillion in March 2025. It is projected that the industry will increase by 15-17% CAGR that will almost be doubled to 2.2-2.6 trillion by March 2030. The structural tailwinds that will fuel this growth will be increased because of investor participation, increase in disposable incomes, increased household investable surpluses, and increased digital penetration throughout the country.

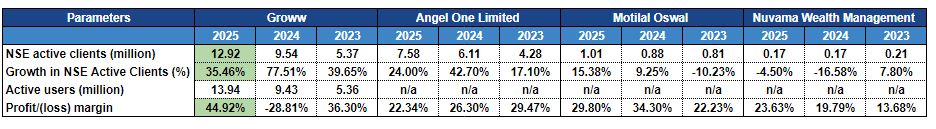

As of June 30, 2025, Groww had approximately 12.6 million active NSE clients, representing a remarkable CAGR of 41.7% from June 2022. This growth has far outpaced the broader industry, which grew at just 7.98% over the same period. Notably, Groww achieved market leadership in active clients by September 2023 and has since consolidated its position as the fastest-growing broker among the top five in India. Beyond equities, Groww has emerged as a major force in the mutual fund ecosystem, processing nearly ₹340 billion in SIP inflows in FY25, equivalent to 1 in every 9 rupees invested via SIPs across India.

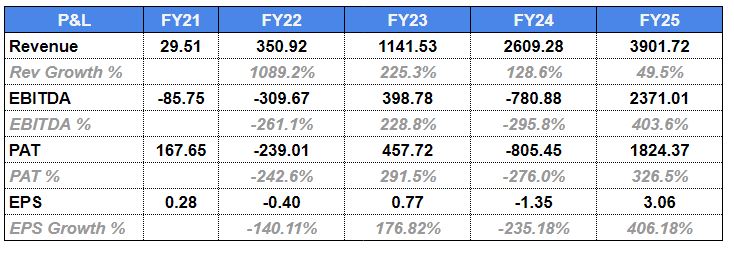

Revenue Growth – Groww has experienced quick growth, with revenues increasing to 3,901.7 crore in FY25, as compared to 29.5 crore in FY21. Although the growth slowed down to 49.5% in FY25 compared to 1,089% growth in FY22, the trend shows that the business has good momentum.

Profitability & Margins –

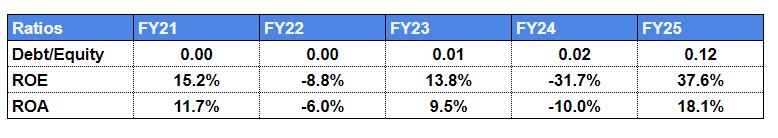

Ratios & Leverage – The debt is low 0.12 in FY25, The recovery of the ratio of returns was high, and the ROE was 37.6% and the ROA was 18.1%, which indicated increased efficiency.

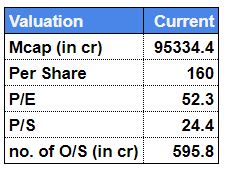

Valuation – Groww has a market cap of 95,334 crores; it has a PE of 52.3x and a PE of 24.4x, which indicates high valuation due to investor confidence.

Despite the high volatility of profitability, Groww has provided high growth and a robust FY25 recovery. Its balance sheet is lean, and its efficiency is rising, which is the supporting factor of its premium valuation, but the execution risks are present due to the volatility of earnings in the past.

In summary: The digital-first business model is accelerating customer growth, higher customer engagement, and better profitability at Groww, which makes it a future leader in retail broking.

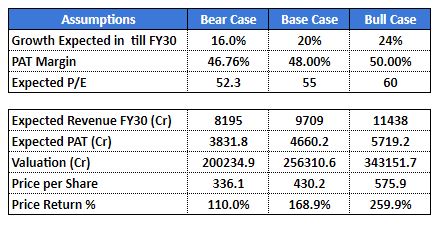

In order to evaluate the potential of Groww by FY30, we have constructed our own projection of projections in three scenarios: Bear, Base and Bull cases, considering important assumptions of growth, profitability and valuation multiples.

This will lead to the possible price per share of 336 in the bear case, 430 in the base case and 576 in the bull case and provides upside returns of 110% to almost 260% by FY30.

Essentially, Groww has high potential for returns even when conservative assumptions are made, and in even more positive growth and profit potential, it has high upside.

To conclude, Groww is an attractive long-term compounding story, as it has a combination of high user growth, profitability, and market leadership in the fast-growing investment ecosystem in India. Groww has unlisted shares which can now be found on Sharescart for investors interested in being a part of this ride.

Good read. But i think the valuation could be slightly higher than expected.

Seems Interesting opportunity in the pre ipo market considering its prominent investors