15 Days Price Change

Summary

Excelsoft isn’t a fly-by-night operator company, but a long-term story in EdTech amid the growing adoption of AI-based digital education.

Excelsoft Technologies Limited (ETL) is a 25-year-old e-Learning provider, operating out of Mysuru, Karnataka. ETL now calls itself an AI-powered vertical SaaS (Software as a Service) provider, but to keep it simple: they’re one of India’s top EdTech names, building digital learning and assessment tools for businesses, universities, governments, corporates, and certification bodies in 19 countries. Over 30 million learners through more than 200 organizations use their platforms each year. ETL’s Main focus is Learning and assessment (L&A) and learning & development (L&D), all running on a cloud-based platform. Globally famous and long-standing big clients include Pearson Education, Inc., AQA Education, Colleges of Excellence, NxGen Asia PTE LTD., Pearson Professional Assessments Limited, Sedtech for Technology Education & Learning WLL, Ascend Learning LLC, Brigham Young University – IDAHO etc.

ETL started out in 2000 as a small software outfit in Mysuru. Instead of sticking to the basics, they kept rolling out new digital & AI-powered products and services, slowly but surely carving a niche in the huge $350 billion global EdTech market. Over the years, ETL has evolved into a comprehensive end-to-end solution provider and has always strived to drive new paradigms in implementing technology in LAD (Learning, Assessment, and Development). ETL ensures adherence with evolving global standards in the EdTech industry and best practices in software technology and engineering, which have helped the company stay relevant while continuously adding value to its clients.

ETL provides AI-powered applications, test and assessment platforms, online proctoring solutions, learning experience platforms, student success platforms, and digital eBook platforms. The company has expertise in pedagogy and sophisticated techs- ensuring the delivery of specific solutions sought by its enterprise clients. ETL is focused on innovation and has successfully developed AI-based products and services, including Large Language Models (LLMs) and small device-specific LLMs, that help to differentiate its products in the digital assessments and proctoring space from other generic players.

AI-powered Apps

Test and Assessment

Online Proctoring

Learning Experience Platform

Student Success Platform

Digital eBook Platform

2000: Dhananjaya Sudhanva founded Excelsoft Technologies Pvt Ltd in Mysuru.

2001–2008: Landed early partnerships with Pearson and McGraw-Hill, built custom e-learning content, and launched their first e learning management systems.

2008: Released SARAS (Scalable Assessment and Response Analysis System)- India’s first major indigenous enterprise assessment platform, which grew more powerful with digital, cloud, and AI features over the next 15 years.

2010–2012: Expanded to the US, UK, and Singapore (as subsidiaries)

2015: Launched EasyProctor, leading the way in AI-based remote proctoring for exams (remote supervising candidates during exam process).

2018: Hit the ₹100 crore milestone in revenue and became net debt-free.

2020–2022: The COVID pandemic & shutdown were a major boon for the company- remote assessment and proctoring were in huge demand; it also doubled down on AI and machine learning (ML).

2023: Rolled out own customized Generative AI suite- AI-Levate, using models like GPT-4o and Claude to automate content and assessments.

2024: Transformed into a public company and brought heavyweight & credible independent directors like S. Ramadorai (ex-TCS CEO) and Lt. Gen. Rajesh Pant (ex-National Cyber Security Coordinator) to strengthen corporate governance, reducing family influence ahead of the planned 2025 maiden IPO.

Late 2025: Heading for a ₹500 crore IPO—₹180 crore as a fresh issue, ₹320 crore as an offer for sale (OFS) by promoter Pedanta Technologies.

Sources: Company RHP

The founder and CEO, Dhananjaya Sudhanva, is a low-profile, no-nonsense technocrat who usually stays out of the limelight but focuses on actual delivery. After the 2024 rejig, the board now comprises three independent directors – including a former TCS CEO – which speaks volumes about their focus on good governance. No flashy startup hype here. The ExcelSoft team has both experience & relevant talents, having built a profitable & sustainable SaaS business model in various countries around the globe for over two decades. For long-term investors, ExcelSoft’s stability and track record are hard to ignore.

Excelsoft’s business model focuses on B2B (Business to Business), not B2C (Business to Consumer); i.e., it deals with institutions & organizations rather than consumers/learners directly. They sell cloud-based LAD platforms to private & public educational institutions, various public departments & PSUs, and corporates/private business houses on a recurring subscription basis.

Generative AI: They build everything from large language models (LLMs) to smaller device-specific models, as well as a whole range of AI bots that personalize content, automate assessments, and simplify the user experience. Their Mysore campus is huge – over 100,000 square feet, employing over 1,100 people, including software developers, EdTech professionals, and AI engineers. They've ensured sustainable green data centers and a streamlined content digitization process.

Sources: Company RHP

Thanks to their SaaS model, subscription-based recurring revenue makes up about 85% of their business; the rest comes from specific vendor project execution (one-time fees). So, basically, if you want a stable, visionary EdTech player with strong management and true global reach, Excelsoft is worth a look. This is not a quick win or publicity-driven story. It's about real, long-term growth – driven by real products, real customers, and an executable, real, skilled & experienced team that gets things done. Excelsoft is not a fake company or scam, as we have seen in many MSME IPOs recently.

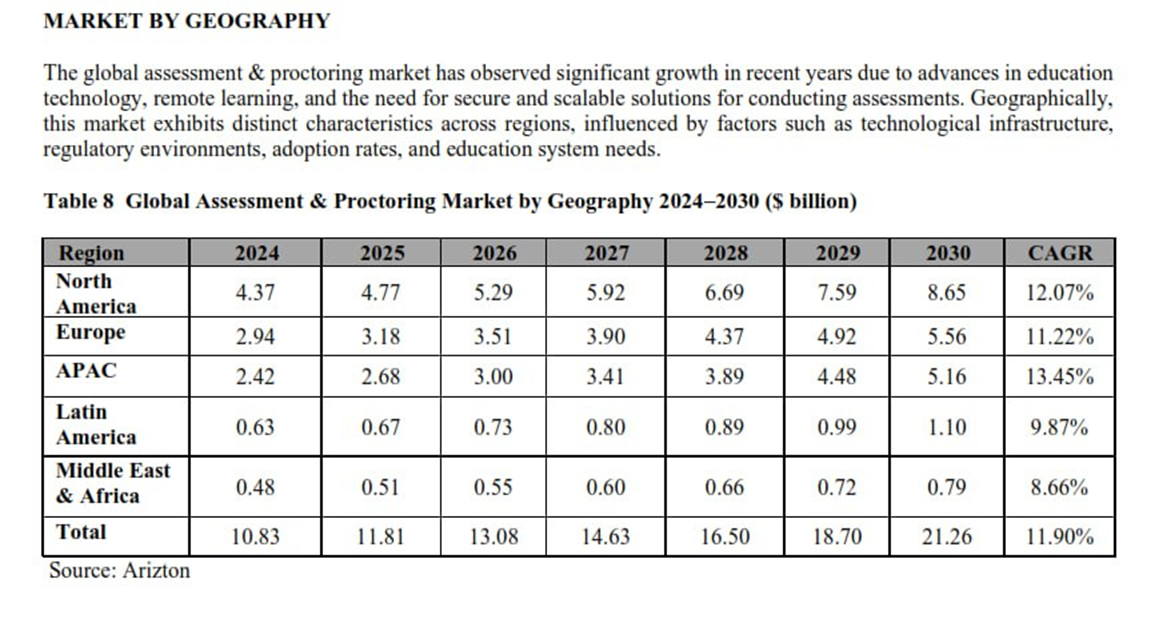

ETL is carving out a solid niche in the $350 billion global e-learning market, which is on track to nearly double to $650 billion by 2030, growing at about 20-30% per year. The acceleration of digital transformation and the shift to remote learning post-COVID have sent demand skyrocketing, and ETL is right in the middle of it.

They cover almost every corner of the e-learning world – content creation, testing, analytics, and delivery – all powered by AI-powered apps. Their suite includes tools like EasyProctor, CollegeSpark, OpenPages, and a Learning Experience Platform (LXP) that is enterprise-ready and designed specifically for businesses for continuous upskilling. As a SaaS provider, ETL has its own AI-powered platforms. Everything runs in the cloud, so customers don't have to install or maintain anything locally – think Google Workspace or Microsoft 365, but for digital education.

Sources: Company RHP

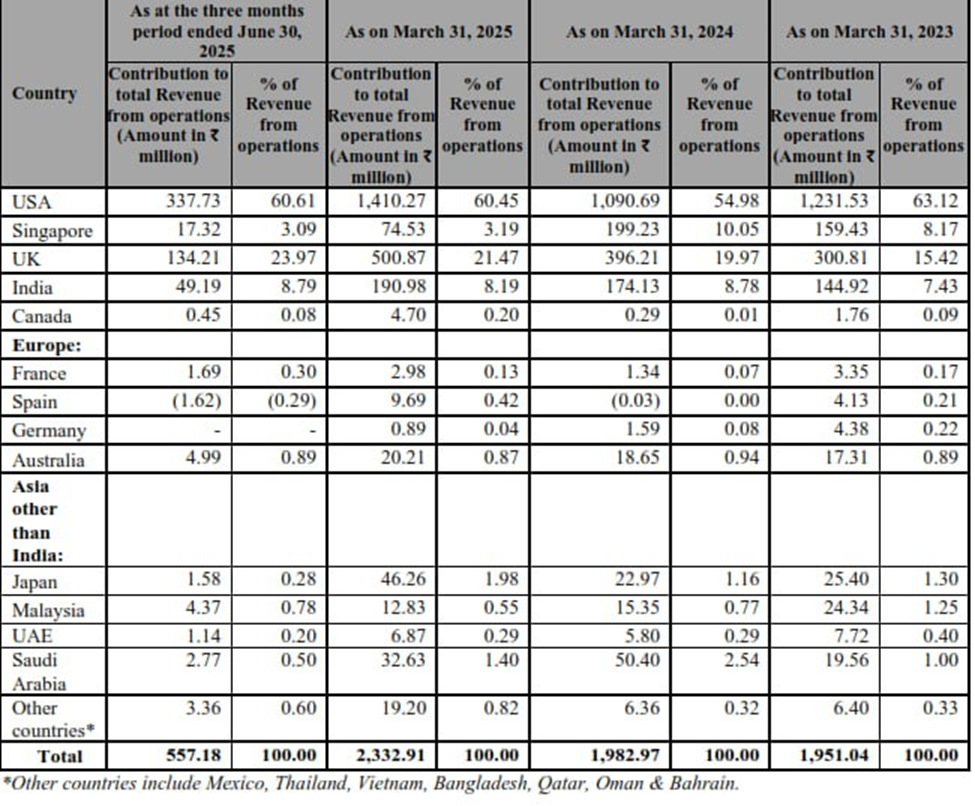

Most of ETL's business comes from outside India – about 91% of its revenue comes from exports, with only 9% from India. They work with 76 major enterprise clients across 19 countries, with the US, UK, Singapore, and India on top, along with Australia, Japan, Saudi Arabia, UAE, and Canada. Their global client list includes giants like Pearson Education, AQA Education, Ascend Learning, and Brigham Young University-Idaho. The US and UK duo make about 85% of the total revenue, with the US at about 60%, which is also a red flag for the company, as too much dependence on two/three institutions globally.

Back home, their Indian clients are mostly in higher education, K-12, and vocational training – both private and public – such as Excel Public Schools and several state education boards. This mix of Indian and global customers keeps revenues stable even during political turmoil, such as the Trump policy uncertainty. India still accounts for a small share of the revenue, around 9%, but it is gaining momentum. The Indian government is pushing for digital education and AI-supported EdTech in the public and private sectors. Not just India, markets across South Asia, Africa, America, and the Asia-Pacific (APC) region are poised for major growth in digital education. ETL has a broad B2B ENTERPRISE customer base ranging from schools and universities to corporate L&D, with long-term contracts ranging from three to five years. This ensures a good level of revenue stability and visibility.

Sources: Company RHP

Over 25 years of credibility, proven track record, and resilient financial & sound operational management, helping to ensure sustainable growth with high margins.

Leading with AI-powered product innovation. Their proprietary platforms—SARAS (an assessment engine), EasyProctor (AI proctoring), and AI-Levate—use advanced language models like GPT-4o and cloud for adaptive learning and bias-free monitoring.

An extensive usage of AI is helping it to cut operating costs by up to 40% and supporting a steady 15% annual spend on R&D, ensuring both quality & quantity.

Global blue-chip clients: 76 clients in 19 countries, including giants like Pearson and AQA, reaching more than 30 million learners.

Operational efficiency: Mysore has a comparatively lower cost of living than Bengaluru or Mumbai; this is helping in lower HR and other operating costs.

Small city/town Mysuru also has less IT congestion than big cities. ExcelSoft platforms run cloud-native on AWS and Azure with almost 100% uptime.

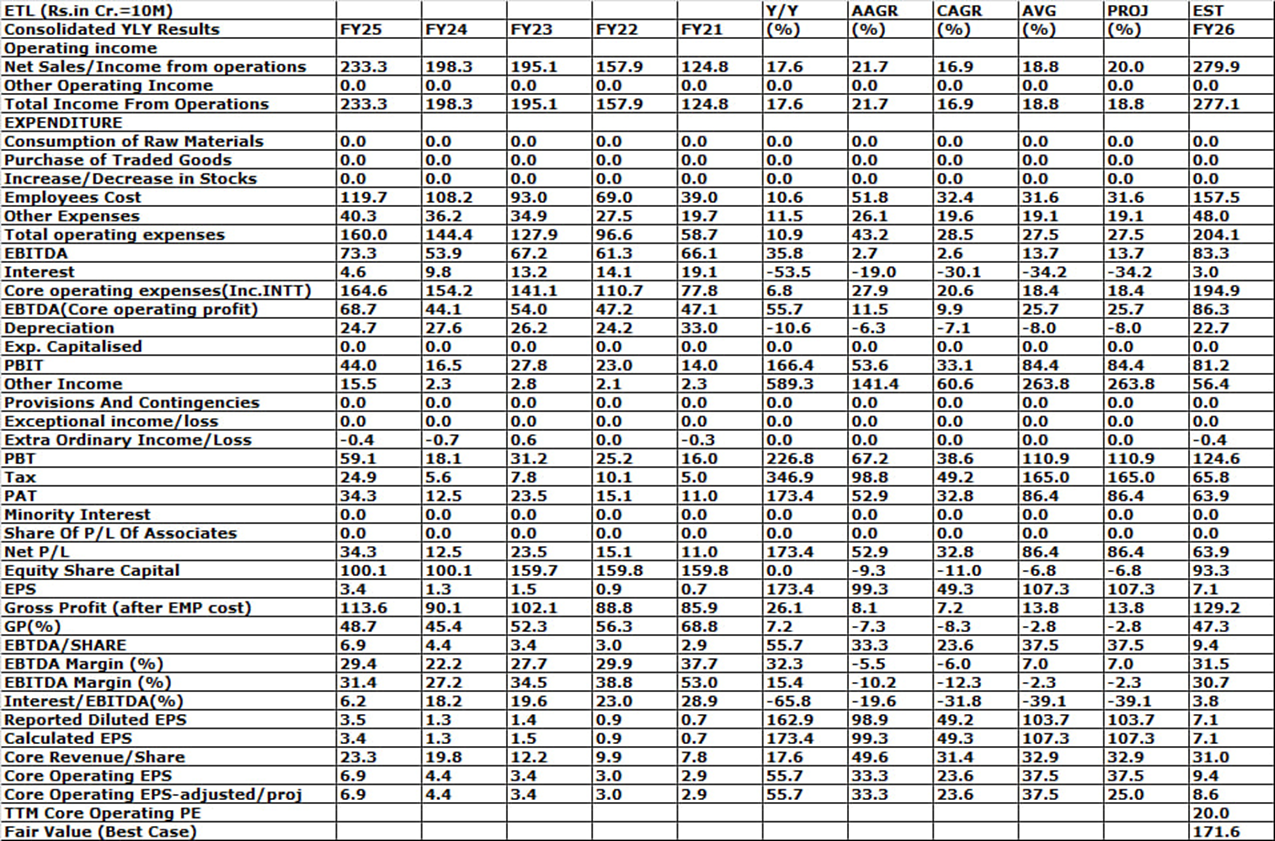

Strong and steady growth: Over the past five years, revenues have grown 20% per year, with core operating EPS growing 25% annually.

Looking ahead, ExcelSoft expects to maintain this momentum, driven by AI adoption and global & local expansion.

Core operating margins remain around 30%, and a low debt-to-equity ratio keeps the balance sheet healthy for any future inorganic and even organic expansion.

AI leadership: ExcelSoft’s proprietary language models (LLM/SLM) and generative AI keep it different from typical EdTech players, enabling top-level analytics, personalization, and strong customer retention.

Diversified global marketing helps to avoid geopolitical risks and excessive dependence on the US and UK.

Scalable SaaS model: With 85% of revenue from subscriptions, ETL enjoys predictable, recurring revenue and low costs for customer retention.

Export-heavy model: 90% of revenue comes from exports/FX, so a rising USD/INR exchange rate could be good news for their bottom line in the coming days.

Customer over-concentration is a major concern. The top 10 customers bring in 65% of ExcelSoft's revenue, and losing someone like Pearson could wipe out 25% of earnings at once. Pearson alone is responsible for approximately 59% of US revenues. Such dependence on only a handful of customers and developed markets like the US and UK leaves the company exposed to the whims & fancies of someone like the current US President Trump, and his chaotic policies.

There is also a heavy tilt towards the US (61% of revenues) and the UK (24%). Any geopolitical turmoil or trouble there can have a huge impact on revenues.

Uncertainty over US policy, particularly with Trump's "MAGA" approach, is another risk. There is talk of a 25% tax or tariff on remote services coming to the US from 2026. Since about 60% of ETL's revenue comes from the US, this is a real threat. Also, any cuts or restrictions in US education spending could spell trouble for all e-learning players, including FTL.

Talent is another important point. The company has a 12% attrition rate among AI experts, and being based in Mysuru doesn't exactly help in attracting top talent. Moreover, Excelsoft's FY25 revenue (₹249 crore) is much lower than rivals like MPS Ltd (₹727 crore). They need to work on a larger scale.

There is also a risk of falling behind in the technology curve. The EdTech industry is evolving rapidly, and AI is not immune to bubbles. ExcelSoft must continue to invest in research and innovation to stay ahead of the tech curve.

The increasing competition from giants like Google Classroom AI is hard to ignore.

AI and other tech Regulation is also becoming stricter. New data privacy laws in the EU and India could increase compliance costs by 10-15%, especially for products that handle sensitive biometric data.

Finally, from the promoter side, there is a big OFS (offer for sale) of ₹320 crore, which is 64% of the issue, and Pedanta Technologies' stake has come down from about 95% to about 59%. If investors think the promoters are losing confidence, sentiment could take a hit, even if the OFS cash may be used to pay down debts and also for expansion & diversification to some extent.

The EdTech sector is exploding, both globally & locally. Excelsoft has the opportunity to grab a meaningful global market share worth $650 billion by 2030, growing at 25% per year. Right now, ExcelSoft has a minuscule ~ 0.01% market share, pulling in just $30 million in revenue against a $350 billion market. There's a lot of ground to cover, and it has to scale up significantly.

After the IPO, the company will have ₹180 crore to play with. It's funding a major expansion in Mysuru (think 30% more workforce), major IT upgrades (doubling our data capacity), and a real marketing push in APAC and the Middle East. ExcelSoft is targeting 40% more revenue while pursuing at least 25 new clients.

AI and digital upskilling are also on the rise. Enterprise learning and development alone is a $10 billion opportunity. Integration with VR, edge computing, and adaptive assessment keeps us ahead. It’s partnerships – such as with IIT Ropar's AI Lab – and potential mergers or acquisitions into content startups have driven the growth potentially even higher, shooting a 25-30% CAGR.

India's EdTech market is changing. Now valued at $10 billion, and with Byju's makeover and new regulations, B2B SaaS is in a strong position. Also, VCs are moving funds from China – around $10-15 billion – thereby boosting domestic innovation.

There is momentum regarding stability, also. ExcelSoft's energy-efficient data centers check the right boxes for global ESG mandates, and investors are looking for companies making a real impact in education.

Chinese EdTech is not a threat at the moment. Their system is closed – no commercial push, no monetization allowed – so Indian players like ExcelSoft have more room to move.

Technology is moving rapidly, and major macro changes – such as a deep US & global recession – could affect digital and AI spending.

Competition is fierce. ExcelSoft is competing against global giants like Coursera Enterprise, Docebo, and ProctorU, along with strong Indian competitors like MPS Ltd, HeurixDigital, and Mercer-Metal. Chinese AI EdTech is also cheaper by 20-30%, putting pressure on pricing, especially in APAC. Blackboard and Pearson are expanding, and their offerings match ExcelSoft’s.

Staying relevant is a challenge. AI evolves rapidly, and if ExcelSoft lags, its devices/products become obsolete faster. Plus, privacy laws keep changing – think GDPR fines – and compliance can be costly.

If supply chains become disrupted, ExcelSoft may face delays in the upgrade of its Mysuru facility.

The global economy is shaky. If there is a recession, EdTech budgets get cut. Changes in US policy – especially under Trump – could have a huge impact on us, since about 60% of revenue comes from there.

The majority of ExcelSoft’s revenue (~78%) comes from publishing and testing, which are vulnerable during difficult times when digital adoption by customers slows.

New AI products are released, and the team continues to release updates.

There has been a change in leadership - new faces on the board, strict governance all around.

They are working closely with schools, colleges, and big companies to spread their educational and training materials.

SEBI gives green signal to ₹500 crore IPO (they had planned for ₹700 crore for the first time in March 2025). This move shows that they are keeping their focus and keeping things flexible.

Excelsoft Technologies Limited (ETL) hit the Indian IPO market on November 19, 2025. The price band is set between ₹114 and ₹120 per share. The IPO itself is a mix: ₹180 crore in new shares (so there will be some equity dilution) and ₹320 crore as an offer for sale (OFS), which gives an exit route to promoters and early investors.

So, why now? EdTech is exploding in India and around the world. Digital learning and AI-powered education are no longer just trends – they have become the new normal. These days, an AI bot can teach, evaluate, and even guide students, replacing the old-school reliance on teachers & private tutors/coaching centres, or textbooks/reference books. ExcelSoft wants to ride this wave by raising funds to upgrade and expand its digital and AI infrastructure, thereby ensuring it remains ahead of the competition.

Before the IPO, promoters held 94.6% of the company. Even after selling a significant stake, they will maintain a tight grip on control at 59.09%, which signals that they believe in what they are building. The official prospectus lays out a clear game plan: invest in new features and technology, boost operational strength, and accelerate its digital edge. Ultimately, they want to streamline backend operations – cutting delays by 40% – and increase new customers from 10-15 to more than 25 per year. Target? Become a true global SaaS player in digital education.

Here's how they will use the Rs 180 crore ExcelSoft raised:

· About Rs 72 crore will be spent to expand the Mysuru facility – buying more land, constructing a new building, and adding space for more staff and R&D laboratories.

· Rs 40 crore has been set aside to upgrade the power infrastructure in the Mysuru facility to ensure that power never goes off, which is critical for cloud operations and data centres.

· Rs 55 crore will help strengthen their digital infrastructure, especially the

ETL aims to raise ₹180 crore to boost and upgrade its digital and AI infrastructure to ensure it can meet demand and stay ahead. Right now, the promoters hold 94.6% of the company, and even after this IPO, at 59.09% they will continue to have a firm grip on core management – indicating that they are confident about the direction things are going.

· Expand the Mysuru facility. They will buy more land and build a new building, mainly to house more workforce and to build their R&D laboratories. About Rs 72 crore may be spent here.

· Rs 40 crore could be set aside to upgrade the power infrastructure in Mysuru to ensure that power never goes off, which is critical for cloud operations and data centres.

· Rs 55 crore will help strengthen their digital infrastructure, especially to handle more AI tools and larger data loads.

· The remaining Rs 13 crore will cover working capital, help both organic and inorganic growth, and fund marketing in new markets such as the Middle East and Southeast Asia.

· As far as Rs 320 crore from OFS is concerned, that money mainly goes to the selling shareholders and promoters. They can use it as per their discretion – most probably to pay off company/personal debt or to fund further expansion, but that's entirely up to them.

· In short, ExcelSoft IPO is all about growing faster, modernizing operations, and acquiring a larger share of the fast-growing Edtech industry.

To be honest, it seems like ETL has a solid plan. Once the IPO is over, they are ready to ramp up operations and expand sustainably. The Mysuru facility will be expanding, and it's not just for show – they're adding dedicated AI labs that will reduce the development cycle from 18 months to 9 months. It is a very big thing. Also, they are looking for new things like VR-powered assessments. On the technology side, they are upgrading their IT systems to handle double the data, which opens the door to larger markets – think corporate compliance training, which is worth $10 billion. Since ETL doesn't have much debt, it can deploy some of those funds into marketing. ExcelSoft is targeting more than 100 major enterprise customers by 2027 and is also eyeing partnerships with platforms like LinkedIn Learning.

Looking ahead, ExcelSoft management is also targeting 25-30% compound annual revenue growth from 2028 to 2030, with 35% EBITDA margin (vs 31% in FY25)- thanks to economies of scale. Globally, vertical SaaS players like Excelsoft are now relying on AI, leading to a 30% reduction in costs in learning and development. All signs point to a company that is poised for sustainable growth in the coming years.

Sources: Company RHP

Source: Company data and internal research

Sources: Company RHP

Source: Internal Research

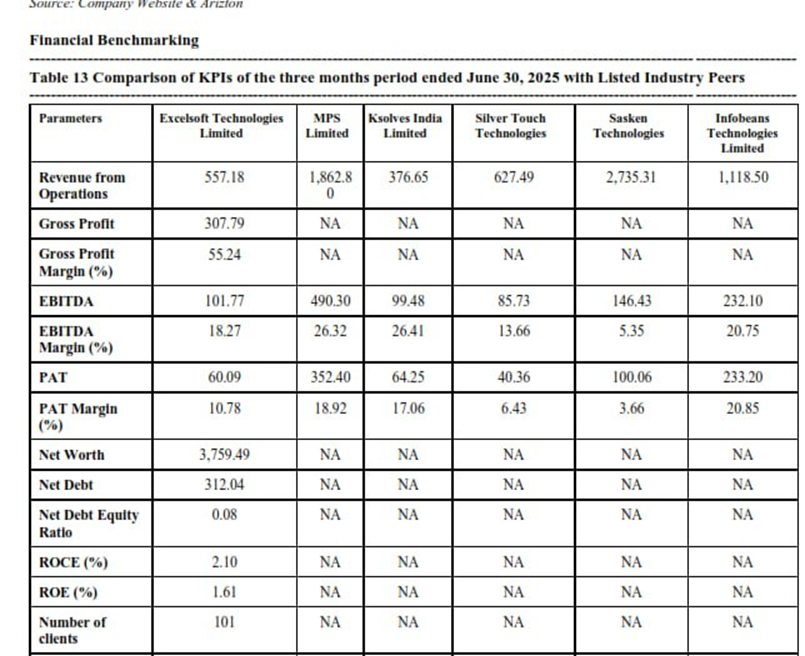

Revenue is growing at a solid rate of 19% per year from 2021 to 2025, and they are targeting 20-30% growth going forward. Management is a little more optimistic, talking about 25-30%. For FY25, core EPS stands at Rs 6.90, with an average return ratio of 37.5%. The management expects it to be around 25% CAGR for FY26-28. The IPO price has been set at Rs 120, which implies a core PE of around 17. For comparison, the sector's average PE is 25, and the company's own average is 22.

Looking further, you get a PE range anywhere from 15 to 30, as the worst-case scenario. If they keep around 25% EPS CAGR per year, you're looking at 8.60 to 13.40 EPS between FY26 and FY28 (after accounting for new shares issued post-IPO-EQ. dilution).

Reasonable price target? Think 154 for FY2025 will increase to 302 by FY28.

Excelsoft looks like a net positive for long-term investors. They have clear strengths – a real AI edge, strong financials, and the EdTech sector is undergoing a real renaissance. Yes, there are risks, especially given their heavy dependence on the US and UK markets and a concentrated client list. But it is not a flashy consumer app like Byju's. ExcelSoft is a B2B heavyweight, offering critical SaaS solutions for enterprise learning and development. If you're after quick profits, look elsewhere. This is a company building wealth over time, just as AI-powered digital education is gaining momentum.

v ExcelSoft Technologies IPO: Subscribe at Rs 120 and/or further buy/accumulate around 100-90 post listing, if it tumbles for any reason.

v Targets: short term 154, medium to long term 193, 241, and possibly 302 by FY: 26-28