15 Days Price Change

Summary

Modern Portfolio Theory (MPT) helps investors balance risk and reward through smart diversification. Instead of relying on a single asset, MPT spreads investments across different classes to reduce volatility and protect capital. This becomes especially powerful when dealing with unlisted shares—high-growth opportunities that often carry higher risks due to limited information, uncertain valuations, and low liquidity. By combining them with safer assets, investors can capture upside potential while safeguarding their wealth. Platforms like Sharescart make it easier to access these opportunities, enabling systematic and data-driven investing for a more secure financial future.

Every investor faces the same puzzle: How do I obtain decent returns without taking too much risk?

like driving a car – you want to reach your destination early, but you also want to stay safe on the road. Investing works in the same way. The return is a reward for bearing the risk, but the trick is to find the right balance between risk and return.

This is where Modern Portfolio Theory (MPT) comes in. Developed by Harry Markowitz in 1952, MPT gave investors a scientific method to build smarter portfolios- ones that don’t just chase returns, but also protect against unsystematic risk.

MPT says: Don’t put all your eggs in one basket.

Instead, put your money in different types of investments. By adopting this, even if one investment does badly, others can balance it out .

The primary concept is diversification- not randomly, but if you diversify your portfolio in a structured way that will maximize your potential return for the risk you are taking.

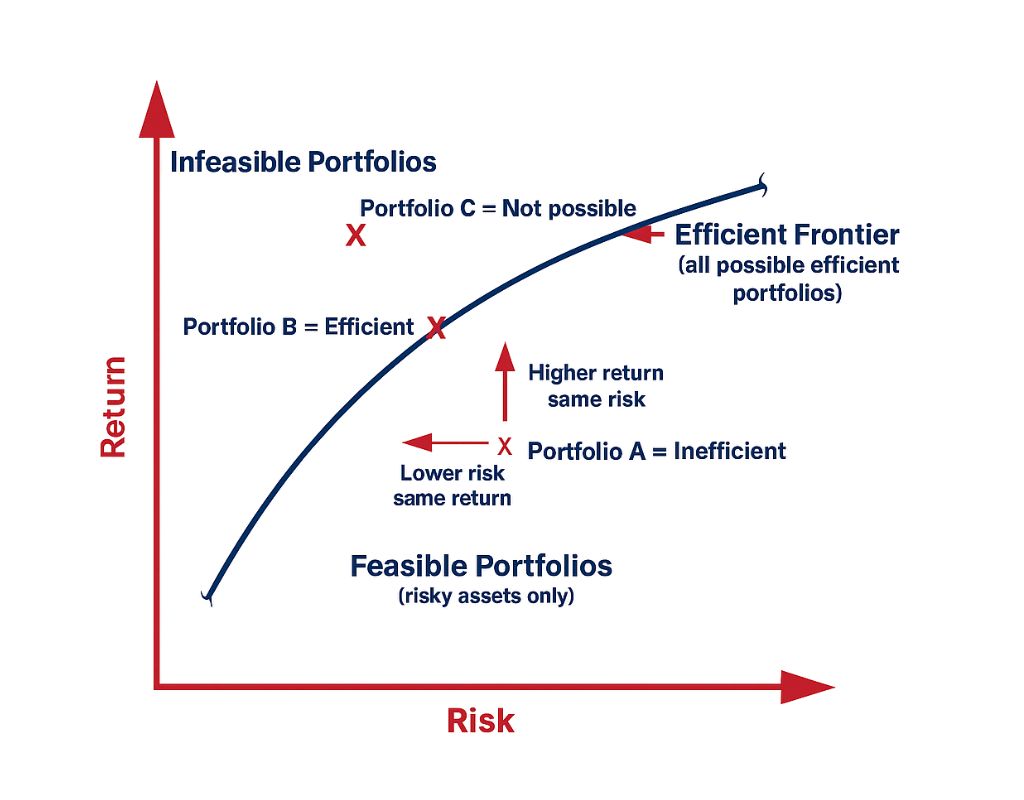

At the heart of MPT lies the Efficient Frontier—

Imagine a curve representing all portfolios that deliver the maximum possible return for a specific level of risk or, conversely, the lowest risk for a given return, known as the Efficient Frontier.

Example:

Portfolio A (below the curve): Too much risk, with insufficient reward, as another portfolio with a different asset mix could yield higher returns for the same risk.

Portfolio B (On the curve): Well-Balanced—this is the ideal scenario which you want, an investor is earning a balanced return.

Portfolio C (Above the curve): A realm of fantasy, offering unrealistic expectations, as it promises higher return than optimum portfolio return for bearing the same level of risk.

1. Diversification: Allocate your funds across various assets to prevent simultaneous increases or decreases in value.

2. Risk Aversion: MTP assumes that investors are more risk averse, as when presented with two portfolios yielding identical returns, they will opt for the one that entails less risk.

3. Expected Return: Weighted average of anticipated returns on investments, determined by its asset composition.

4. Portfolio Risk (Variance / Portfolio Standard Deviation): Not just individual asset risk, but how the asset behaves together (their ups and downs may cancel out ), further helps in reducing unsystematic risk

5. Correlation: It is the extent to which asset returns move together, Lower or Negative correlation reduces overall portfolio risk.

6. Risk-Return Trade-off: Greater returns are typically associated with increased risk. MPT helps you in determining the level of risk you are willing to accept.

What is unlisted shares?

Unlisted shares—companies whose shares are not trades in secondary market They are intriguing due to their potential for rapid growth, but they come with risks because:

• There's limited information accessible.

• It can be hard to determine accurate valuations.

• They have lower liquidity, making it tough to buy or sell quickly.

This is where MPT excels: by combining unlisted shares with other more secure assets, you can leverage growth opportunities without placing all your bets on a single high-risk investment.

Balance Risk and Reward: Access high-growth potential while managing risks effectively.

Minimize Volatility: combine different types of assets so your portfolio will be protected from market fluctuations.

Unique Opportunities: Gain access to specialized companies prior to their public listing.

Capital Protection: Safeguard your investments by combining high-risk ventures with stable assets.

Smarter Decisions: Eliminate uncertainty—investing becomes systematic and data-driven.

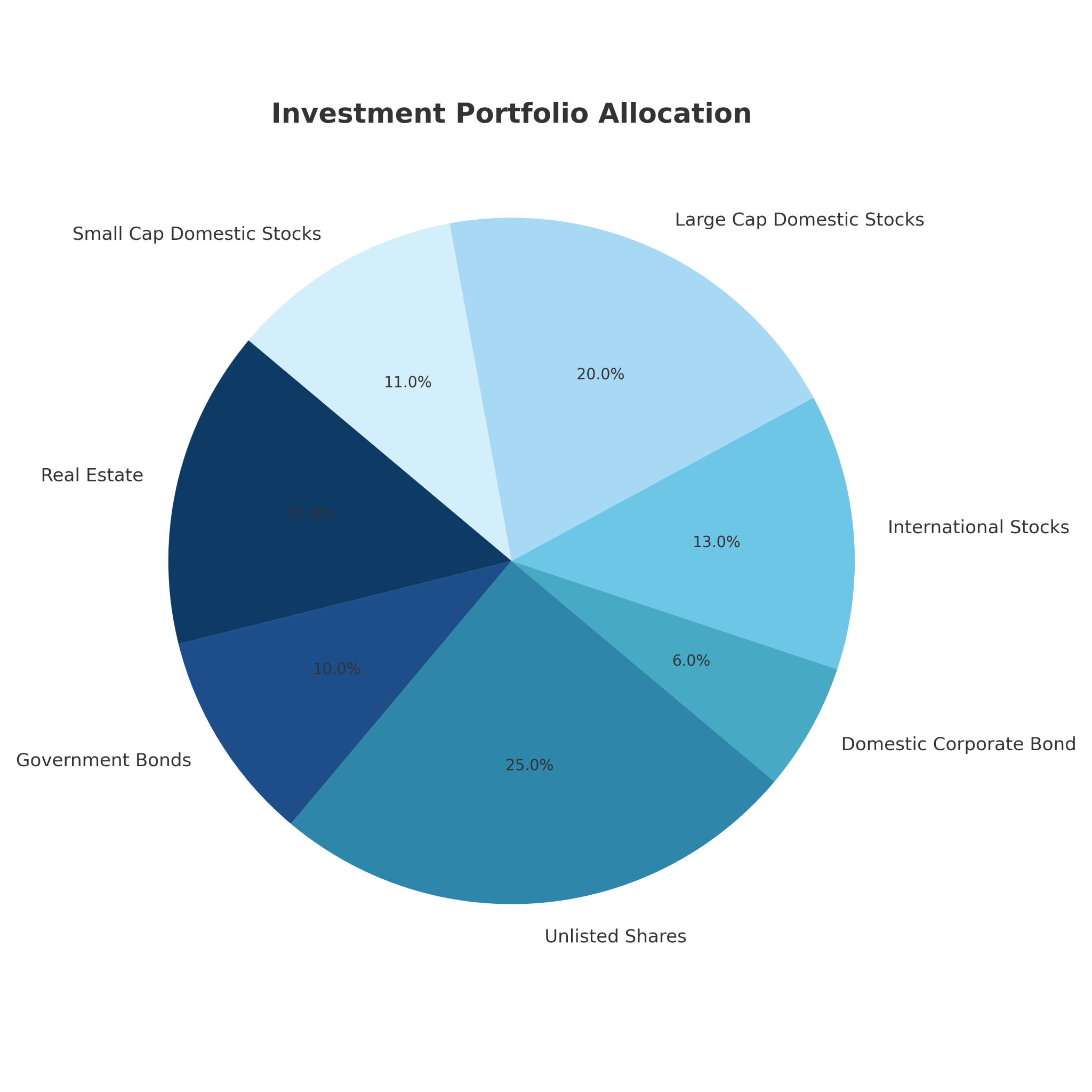

1. Diversify: Don't only buy listed stocks, bonds, or mutual funds combine them with unlisted shares.

2. Check correlation: Choose assets that do not all fluctuate in the same manner.

3. Determine your risk tolerance: Are you conservative, balanced, or aggressive? Construct your portfolio according to your risk appetite.

4. Conduct regular reviews: Modify your porefolios asset mix as market conditions change or your risk taking capacity changes.

Modern Portfolio Theory is not only for large fund managers—it applies to everyone seeking to invest wisely. In the case of unlisted shares, where risks are naturally higher, MPT serves as a protective measure. It enables you to explore new opportunities while ensuring that you do not experience significant losses.

Consider it as the construction of not merely a portfolio, but a safety net for your financial future. Platforms like Sharescart make access to unlisted shares easier, helping investors apply MPT principles more effectively.

Great👍

This is wonderful, well curated and researched.