Apollo Green Energy Limited comes from the larger Apollo International Limited which was set up in 1994 by the Kanwar family the promoters of the well known Apollo Tyres brand. While Apollo Tyres changed the automotive industry Apollo International was created to help the group expand into new areas like international trading logistics and supply chain services.

For almost twenty years the company mainly worked as a global supply chain manager and built strong trade links across the Middle East Africa and Southeast Asia. During this time it developed key strengths in cross border logistics financial planning and vendor management. These capabilities later helped the company move into the capital heavy EPC sector. Its shift toward renewable energy was not sudden. It was a planned step driven by the global push to reduce carbon emissions and the Indian government’s strong support for green infrastructure.

As part of this shift the company reshaped its corporate identity. The energy business was renamed Apollo Green Energy Limited to clearly show its focus on sustainability. At the same time the company separated its non core lifestyle and fashion businesses. This move helped simplify the balance sheet and created a clearer and more focused story for future investors in the public markets.

Apollo Green Energy Limited work culture is shaped by the larger Apollo Group idea of creating a positive impact through business. The leadership does not look at profit as the only goal. It also wants the company to play a strong role in improving India’s energy security.

The company’s vision is to become a leader in integrated green energy solutions and to expand the use of renewable energy across India and important global markets while building a strong culture of sustainability. Its mission is to grow entrepreneurship through partnerships and to deliver high quality energy infrastructure that is both economically practical and environmentally responsible.

One important part of Apollo Green Energy Limited philosophy is the Force of Five Values which focuses on leadership ownership and integrity. This mindset matters a lot in the EPC industry where the quality of projects and honest relationships with vendors often decide long term success. The management has also set a clear medium term goal of reaching a project portfolio value of ₹10,000 crores by the financial year 2025 to 26. This target acts as a guiding point for the company as it pushes into new projects asset ownership and advanced energy technologies.

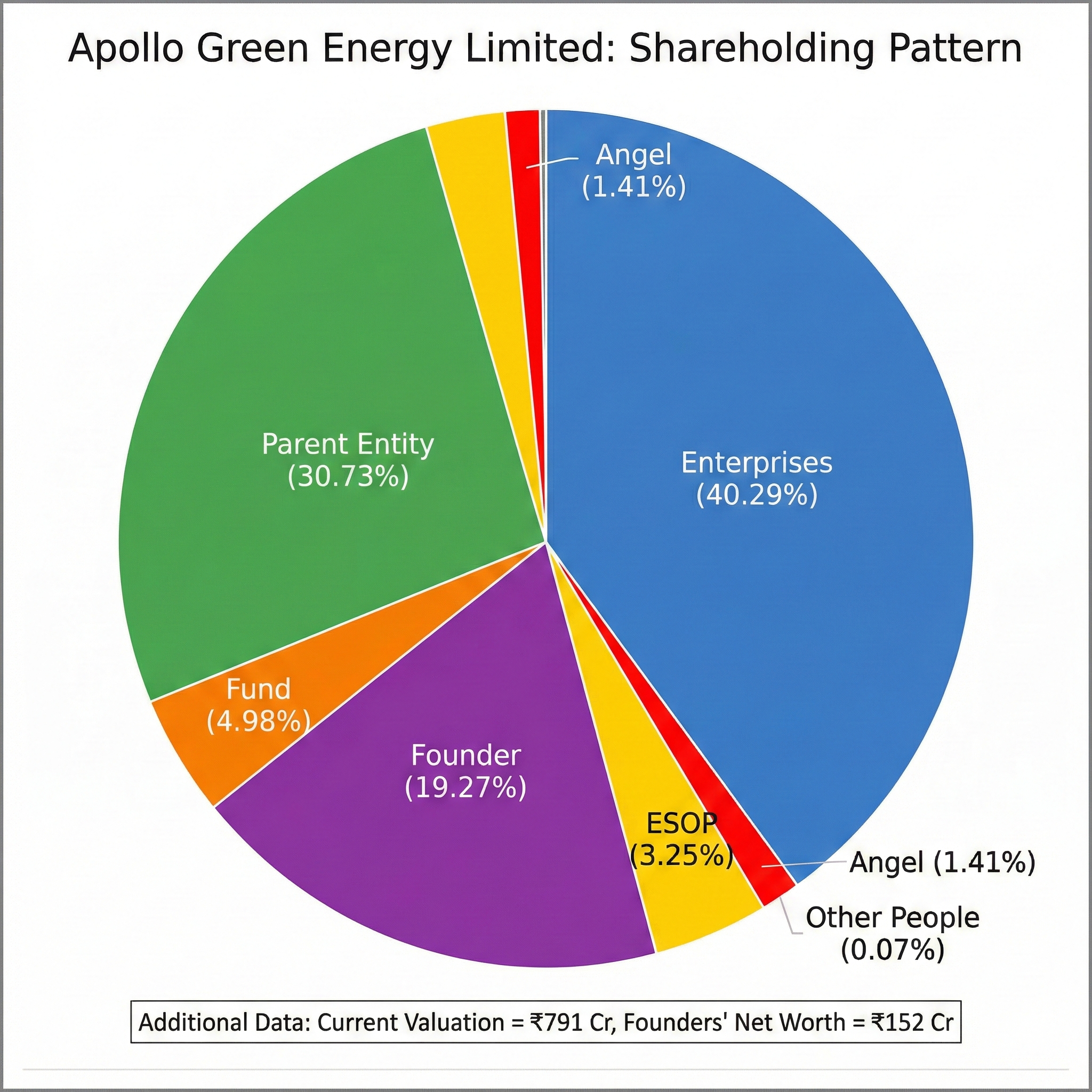

The company works as an important business unit within the Apollo International Group and gains strong support from the parent organization. Many independent renewable startups struggle to build trust when they try to raise capital. the company has an advantage because it uses the Apollo brand reputation to get better financing terms bank guarantees and supplier credit.

The company’s structure is being shaped to support its goals in both EPC projects and asset ownership. Apollo International Group acts as the parent body and provides overall strategic direction along with early stage capital support. To manage risk and capital needs more efficiently the company has created specialized subsidiaries. One key example is AGEL Renewable Energy Limited which is a fully owned subsidiary focused on the Independent Power Producer business. This separation helps with project financing because it allows debt to be tied directly to specific power purchase agreement assets without putting long term asset risks on the main EPC company.

AGEL also keeps an international presence through its subsidiary Apollo International FZC. This unit helps the company enter global EPC markets especially in Africa and the Middle East where the Apollo group already has strong trading relationships.

Business Model Analysis

Apollo Green Energy Limited business model is changing quickly as the company moves from a pure service based EPC setup to a hybrid model that also includes asset ownership and new energy technologies. The company is trying to balance project execution with long term energy assets. Its operations can be understood through three main business areas which are Engineering Procurement and Construction the supply of goods and the growing Independent Power Producer segment.

Engineering, Procurement, and Construction (EPC)

The EPC segment is the main foundation of Apollo Green Energy Limited financial performance and brings in most of its operating revenue. In this business this company works as a specialized contractor for government agencies public sector companies and private developers. It manages the full project journey from the early planning stage to final commissioning.

The EPC work handled by it moves through three key phases. The first is engineering which focuses on site surveys solar studies and plant design. The company uses modern software and skilled engineering teams to design efficient systems that can produce the highest possible energy output from the available land. The second phase is procurement where it sources solar modules inverters and mounting equipment through its strong global supply network. This part runs on high volumes and thin margins so efficient supply chain management is critical. The company also works to manage price swings in raw materials like polysilicon steel and copper which gives it an edge over many competitors. The final phase is construction which includes civil work equipment installation and grid connection. This stage carries practical risks like weather delays local labor issues and land related challenges.

this company has also expanded its EPC portfolio beyond standard ground based solar projects and moved into more complex and higher value work. One area is floating solar where plants are built on water bodies. These projects need special anchoring systems and advanced engineering which creates a higher barrier for new competitors. Another area is flue gas desulfurization projects where AGEL installs industrial systems in thermal power plants to cut sulfur emissions. This shows the company’s strength in heavy industrial engineering and helps it benefit from government rules that push power plants to reduce pollution. It is also active in urban infrastructure projects such as large scale solar street light installations. These projects require careful coordination across thousands of small locations which is very different from managing a single large power site.

Independent Power Producer (IPP) – The Strategic Pivot

While EPC projects generate immediate cash flow this business is naturally cyclical and margins often get squeezed because of intense competitive bidding. To manage this risk the company has started shifting toward becoming an Independent Power Producer and focusing more on asset ownership.

The Rationale for Asset Ownership

Annuity Income

Unlike EPC revenue which comes as a one time payment IPP assets create recurring income for up to 25 years through long term power purchase agreements. This steady income helps stabilize cash flow and improves the overall valuation of the business.

Depreciation Benefits

Owning energy assets allows the firm to use accelerated depreciation as a tax shield. This reduces the effective tax burden coming from its profitable EPC operations.

Execution

A dedicated renewable energy subsidiary has been formed with a goal of building a 1 gigawatt portfolio. The group plans capital spending of around ₹500 to ₹1500 crores to support this growth. Early projects include power purchase agreements under the PM KUSUM scheme with Jodhpur Vidyut Vitran Nigam Limited which shows a cautious and structured entry into the IPP segment through government backed tenders.

Supply of Goods (Trading)

Strategic Role

In earlier years this segment played an key role in keeping the business running at scale. It generated strong working capital turnover and large top line revenue which helped the company qualify for bigger banking limits.

Financial Impact

This is a high volume business but margins are extremely thin and usually stay below 5 percent EBITDA. As the company moves closer to its planned IPO the heavy share of revenue from this segment has pulled down the overall margin profile. Ongoing internal restructuring is aimed at gradually reducing its importance and shifting focus toward higher margin green energy operations so the financial story looks cleaner and more attractive to investors.

Emerging Technologies: Green Hydrogen and Storage

To protect its long term growth and avoid depending only on the solar EPC market the company is actively exploring new energy opportunities.

Green Hydrogen

In line with India’s National Green Hydrogen Mission the company is building capabilities in electrolyzer deployment. The strategy is to partner with global technology providers and create production infrastructure that can serve industrial users especially in the refinery and fertilizer sectors.

Battery Energy Storage Systems BESS

As more solar power enters the grid the need for reliable and dispatchable renewable energy is rising quickly. The business is adding battery storage solutions to its EPC offerings which allows it to compete for complex round the clock tenders. These projects usually offer higher tariffs than standard solar installations.

Waste to Energy

The company has signed agreements with state authorities such as the Rajasthan government to develop waste to energy and Bio CNG plants. This move supports national cleanliness programs and also helps diversify revenue beyond pure electricity generation into municipal waste management services.

Industry Research and Macroeconomic Context

To properly judge the company’s future potential it is important to look at the bigger economic cycle behind India’s energy transition. The business does not operate on its own. Its performance is closely linked to government policies global commodity trends and the regulatory environment of the Indian power sector.

The 500 GW Ambition: A Trillion-Dollar Opportunity

India has announced one of the most ambitious climate goals in the world which is to reach 500 gigawatts of non fossil fuel power capacity by 2030. By 2025 the country’s installed renewable capacity is only around 180 to 200 gigawatts. This means more than 300 gigawatts still need to be added in the next five years. In simple terms India would have to install about 50 to 60 gigawatts every year which is far higher than the past average of about 15 gigawatts.

This scale of expansion requires an estimated capital investment of more than 500 billion dollars. For EPC companies this creates a huge business opportunity. In a typical solar project around 60 to 70 percent of the total cost flows through the EPC contractor for equipment and construction work. Because of this the overall market opportunity over the next decade runs into trillions of rupees.

Policy Tailwinds and Regulatory Framework

The Government of India has created a strong policy framework to push renewable energy growth and the company benefits directly from these measures.

Production Linked Incentive PLI

The PLI scheme for high efficiency solar modules is designed to build strong domestic manufacturing capacity. Even though the business mainly focuses on EPC work this scheme helps ensure a steady supply of locally made modules. That is important because of the approved models and manufacturers rules and it reduces dependence on unstable imports from China which helps stabilize the supply chain.

PM KUSUM Scheme

This program focuses on solar powered agricultural pumps and runs as a decentralized and subsidy driven initiative. Participation in component A of this scheme which involves setting up small solar plants on unused farm land allows the company to access a large and spread out market with strong government support.

Green Energy Corridors GEC

Transmission is one of the biggest challenges for renewable energy projects. The Green Energy Corridors project is meant to strengthen the grid and move power from renewable heavy states like Rajasthan and Gujarat. Timely progress in the second phase of this project is important so that new plants in these regions can operate smoothly without the risk of power curtailment.

Basic Customs Duty BCD

The introduction of a 40 percent customs duty on imported solar modules increased project costs in the short term. At the same time it encouraged the growth of domestic manufacturing. EPC companies have had to adjust their procurement strategies by moving away from cheap imports and securing long term supply deals with Indian manufacturers to protect their margins.

The "Execution Crisis" in Indian Renewables

Even with strong growth targets the renewable energy industry faces real ground level problems and these risks directly affect the company’s operations.

Land Acquisition

In India land laws are controlled by individual states and getting large connected land parcels for solar parks is often very difficult. Problems with ownership records resistance from local communities and environmental approvals can delay projects for months or even years. For an EPC company these delays tie up working capital and reduce expected returns.

The Tender to PPA Gap

A growing issue in the sector is the gap between winning a project in an auction and actually signing the power purchase agreement. Some state distribution companies delay signing agreements because they expect tariffs to fall later. This puts projects in uncertainty and slows down execution. Recent regulatory efforts to penalize such delays are positive but the system is still evolving.

Grid Connectivity

As more renewable power is added the electricity grid faces stability pressure. At times operators ask solar plants to stop supplying power which leads to revenue losses. The company’s move toward battery storage is a way to manage this risk because stored energy can be supplied when the grid is ready to absorb it.

Operational Performance and Project Portfolio

Apollo Green Energy Limited’s transition from planning to real execution can be best measured through its order book and project delivery track record.

Order Book Dynamics

As of the end of the 2024 financial year and early 2025 the order book of Apollo Green Energy Limited has grown to around ₹3500 crores. This figure is an important indicator of future revenue. With FY24 revenue close to ₹1179 crores the book to bill ratio is about 3 times. This means it has strong revenue visibility for the next two to three years assuming projects are executed on time.

Composition of the Order Book

Utility Solar

Most of its portfolio comes from large utility scale solar projects mainly located in Rajasthan and Uttar Pradesh.

Institutional Clients

A significant share of orders comes from central public sector companies such as NHPC. Working with these clients improves payment security compared to some state distribution companies. At the same time margins tend to be lower because of competitive tendering.

New Segments

The inclusion of flue gas desulfurization projects and urban infrastructure such as solar street lighting adds diversification. This helps it reduce dependence on only solar EPC work and protects the business from slowdowns in any single segment.

Key Project Highlights

NHPC Floating Solar Kerala

This major project involves a 50 megawatt floating solar installation built on a water body. Floating solar requires water resistant components and flexible anchoring systems. Successful delivery strengthens its qualification profile for future complex tenders.

FGD Implementation

The ₹700 crore flue gas desulfurization project highlights strong engineering capability in heavy industrial work. It positions the company to compete for many similar upgrade projects planned for older coal power plants.

Bihar Street Lighting

Installing and maintaining around 1.4 lakh solar street lights is a large logistical task. This project shows its ability to manage distributed infrastructure which can also support future areas like electric vehicle charging networks.

State Level Projects

Long term contracts and agreements with municipal authorities in Rajasthan Maharashtra and Uttar Pradesh help it maintain a steady presence in regional infrastructure development.

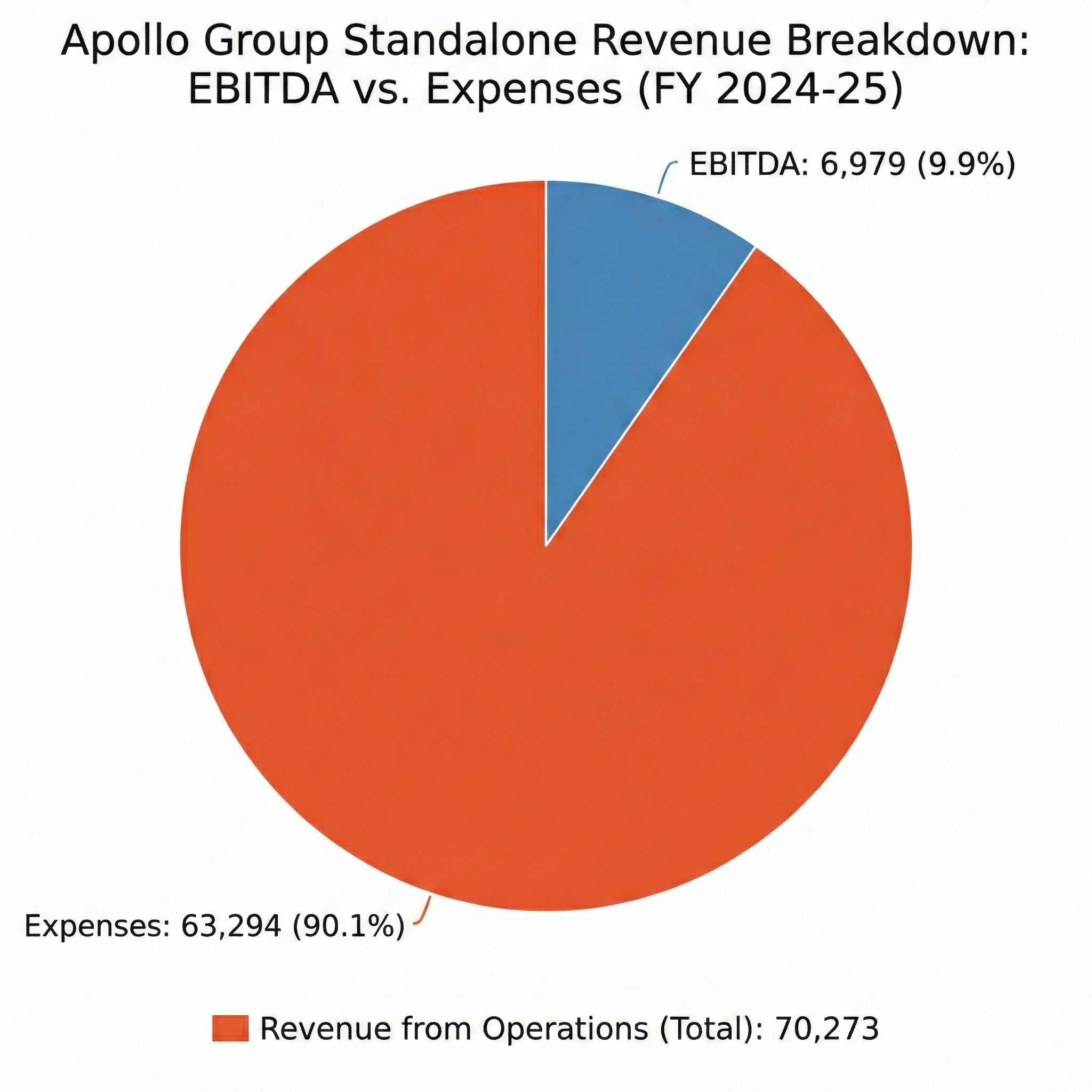

Financial Analysis

The financial picture of Apollo Green Energy Limited shows a company in a fast growth phase while dealing with a common infrastructure challenge. It has to balance rapid revenue expansion with stable margins and tight working capital control.

Revenue Trajectory The Growth Engine

Apollo Green Energy Limited has recorded strong revenue over the last three financial years which supports its aggressive expansion strategy.

Profitability and Margin Profile

EBITDA Margins

In earlier periods its EBITDA margins were under pressure and stayed around 3 to 5 percent in FY23. This was mainly because of the large share of revenue coming from the low margin trading segment.

Margin Expansion

During the first nine months of FY24 margins started improving and moved closer to 8 percent. This improvement comes from a higher contribution of EPC projects which carry better margins.

Future Outlook

As Apollo Green Energy Limited adds more IPP assets and battery storage services its overall EBITDA margins are expected to expand into the mid teen range over time. IPP assets typically generate very high margins. In the short term however EPC competition will likely keep margins in the single digit range.

3-Year Financial Summary Table of Apollo Green Energy Limited

(All figures in INR Lakhs, unless otherwise noted)

| Metric | FY 2024-25 | FY 2023-24 | FY 2022-23 |

| Revenue from Operations | 70,273 | 1,14,848 | 65,381 |

| EBITDA (Earnings Before Interest, Tax, Depreciation) | 6,979* | 9,235 | 6558 |

| Profit Before Tax (PBT) | 4,383 | 3,214 | 3749 |

| Net Profit (PAT) | 3,489 | 2,957 | 3007 |

| Balance Sheet Metrics | |||

| Total Assets | 1,30,076 | 1,20,163 | 93115 |

| Total Debt (Borrowings) | 41,804 | 32,674 | 23600 |

| Total Equity (Share Capital + Reserves) | 50,269 | 36,284 | 30521 |

| Ratio Analysis | |||

| Net Profit Margin (%) | 4.96% | 2.57% | 0.046 |

| Return on Equity (ROE) (%) | 6.94% | 8.15% | 0.0985 |

| Debt-to-Equity Ratio | 0.83 | 0.9 | 0.77 |

Source - https://apollo-greenenergy.com/annual-reports

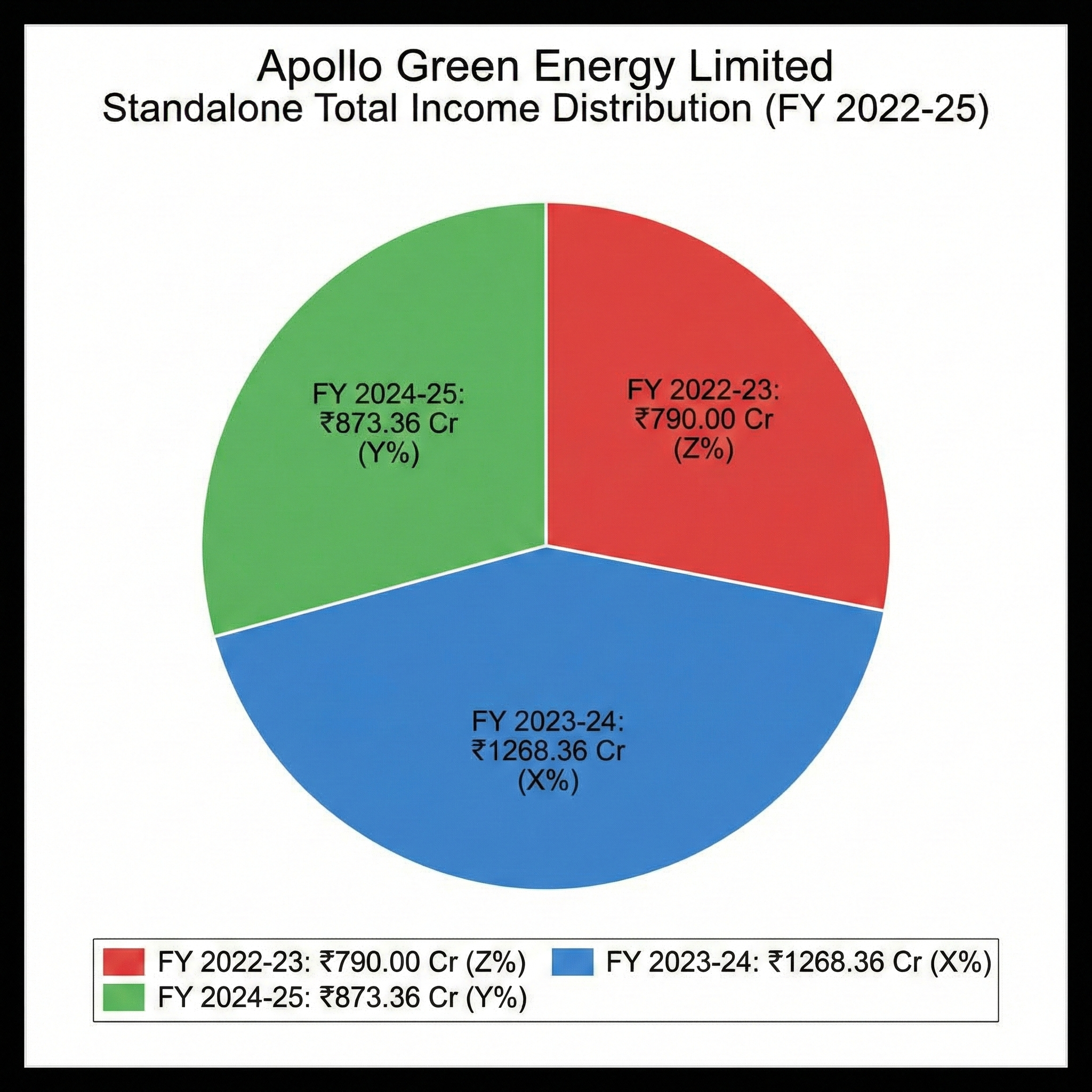

Total income in the piechart below :

Balance Sheet Health and Capital Structure

For any infrastructure company the balance sheet is often the biggest factor that decides long term survival. The same logic applies to Apollo Green Energy Limited.

Leverage

Apollo Green Energy Limited follows a fairly conservative capital structure. Its debt to equity ratio is reported in the range of about 0.6 to 1.02 times. This is much lower than many infrastructure companies that often operate with leverage of 3 to 4 times. Because of this it still has enough financial room to raise additional debt for its planned ₹1500 crore IPP investment without putting heavy pressure on its credit profile.

Credit Ratings

CRISIL has maintained its ratings at CRISIL BBB Stable for long term facilities and CRISIL A3 plus for short term borrowings. An investment grade rating at the BBB level or higher is essential for participating in large central government tenders. Keeping this rating stable is very important for its access to low cost working capital.

Working Capital

The EPC business requires large amounts of working capital. Bank guarantees security deposits and inventory such as solar modules can lock up significant cash. Its ability to control the cash conversion cycle will remain one of the most important operational indicators to track.

Peer Comparison

Table : Comparative Benchmarking

|

Metric |

Apollo Green Energy (Unlisted) |

Sterling & Wilson Renewable (Listed) |

Gensol Engineering (Listed) |

Tata Power Solar (Sub of Tata Power) |

|

Business Focus |

Solar EPC + Emerging IPP |

Pure-play Solar EPC |

Solar EPC + EV Leasing/Mfg |

Integrated (Mfg + EPC + IPP) |

|

Revenue (FY24) |

~₹1,179 Cr |

~₹3,035 Cr |

~₹996 Cr |

~₹16,000 Cr+ (Segmental) |

|

EBITDA Margin |

~5% - 8% |

Turning Positive (~1-2%) |

~25% (High due to EV leasing) |

~15-20% |

|

Order Book |

~₹3,500 Cr |

~₹8,000 - 9,000 Cr |

~₹1,783 Cr |

>₹10,000 Cr |

|

Market Cap |

~₹900 Cr (Est. @ ₹80/share) |

~₹14,500 Cr |

~₹3,200 Cr |

Part of Tata Power (~₹1.4L Cr) |

|

P/E Ratio |

~20x (Implied) |

Negative/High (Turnaround) |

~60x |

~35x (Parent) |

Sterling and Wilson Renewable Energy is one of the largest players in the sector with a huge order book and a strong global presence. In recent years it has faced serious financial stress because of debt pressure and large indemnity payouts to promoters. Apollo Green Energy Limited is much smaller in comparison but it offers a cleaner balance sheet position. It does not carry the same legacy debt burden which makes it look like a simpler and more focused growth story for investors.

Vs Gensol Engineering

Gensol Engineering is the closest peer in terms of size and operating flexibility. It trades at a premium valuation mainly because it expanded into fast growing areas like electric vehicle leasing and manufacturing. Apollo Green Energy Limited is following a similar diversification path by moving into green hydrogen and battery storage. This strategy is aimed for entering new technology driven segments that can support higher valuation multiples.

Vs Tata Power Solar

Tata Power Solar operates at much larger scale as part of Tata Group and benefits from integrated manufacturing of cells and modules. Apollo Green Energy Limited cannot match this scale. Instead it can competes through faster execution and cost efficiency especially in mid sized projects where a large organization like Tata may face higher operating overheads.

Valuation and IPO Outlook

The IPO Roadmap

Timeline

Management has indicated a possible IPO timeline in the first quarter of 2026. Work on the draft prospectus is reportedly in progress.

Objective

The main aim of the IPO is to raise funds for the planned ₹1500 crore expansion into IPP assets and also to give early investors a liquidity event.

Size

The exact issue size has not been announced yet. Based on the company’s expansion goals the fundraising is expected to be significant and will likely include both a fresh share issue for capital spending and a promoter stake sale.

Leadership and Corporate Governance

In the infrastructure sector the quality of leadership often decides long term success because companies must handle both technical execution and regulatory complexity.

Raaja Kanwar Chairman and Managing Director

Professional Summary

Raaja Kanwar is an experienced business leader and entrepreneur with a strong track record of managing diversified businesses. He is the Chairman and Managing Director of Apollo Green Energy Limited where he leads the company’s overall strategy in renewable energy and infrastructure.

Education and Background

He completed his management education at Drexel University in the United States which gave him a solid base in international business and corporate leadership.

Leadership and Strategic Focus

As a key promoter of the Apollo Group he has helped shape the company’s expansion into energy while using the group’s experience in global trade and operations. His leadership covers sectors such as logistics trading and large project execution which gives him a broad cross industry view. This experience supports innovation and operational efficiency in the energy business. He has also co founded ventures outside the energy sector which shows his ability to build and scale companies.

Key Achievements

He has guided the strategic move of the group into renewable energy and infrastructure. Under his leadership Apollo Green Energy Limited has strengthened its presence in solar and hybrid energy projects as part of its growth path.

Role Orientation

His leadership style focuses on long term transformation with the goal of expanding the company’s role in sustainable energy. He emphasizes efficiency innovation and an entrepreneurial approach to management.

|

Risk Category |

Risk Factor |

Probability |

Impact |

Mitigation Strategy |

|

Operational |

Land Acquisition Delays |

High |

High |

Focus on state-sponsored solar parks where land is pre-cleared; diversifying across 8 states. |

|

Financial |

Interest Rate Volatility |

Medium |

High |

Maintaining low D/E ratio (0.6x); refinancing operational assets to lower-cost green bonds. |

|

Market |

Commodity Price Inflation |

High |

Medium |

Pass-through clauses in EPC contracts; long-term supply agreements with module manufacturers. |

|

Regulatory |

Tariff Renegotiation / PPA Delays |

Medium |

Severe |

Shifting mix towards Central PSU (NHPC/SECI) tenders which are safer than State Discom PPAs. |

|

Governance |

Leadership Exit / Key Man Risk |

Low/Med |

High |

Robust succession planning; professionalized board with independent directors. |

Conclusion

Apollo Green Energy Limited represents a typical infrastructure scale up investment story. It is moving away from a mixed trading background and building a focused identity as a renewable energy developer. Its main strengths include strong promoter backing a solid ₹3,500 crore order book and a disciplined balance sheet. At the same time there are visible risks such as thin operating margins project execution challenges linked to land and grid issues and some uncertainty around leadership continuity. For long term investors the company offers exposure to India’s green energy expansion without the very high valuations seen in some large listed peers. If Apollo Green Energy Limited manages a smooth IPO and successfully expands into the higher margin IPP business the stock could see a meaningful re rating over the medium term. The coming 12 months shaped by the IPO process and the delivery of major NHPC projects will act as an important test of its transformation.