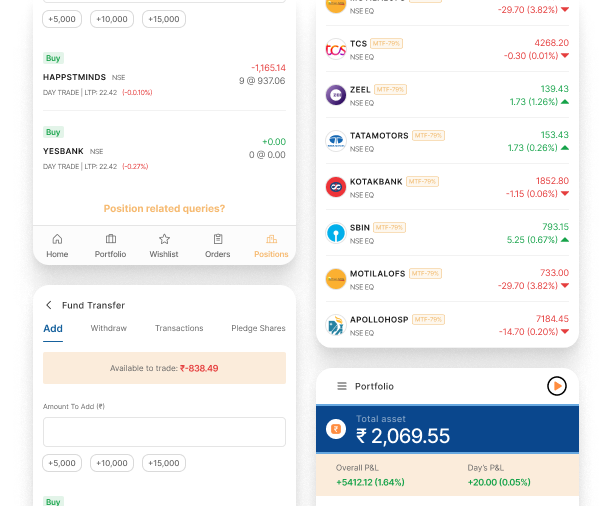

All your investments bundled – Stocks, ETFs, IPOs, F&O & Mutual Funds

Open Demat Account

Place big equity delivery orders on 900+ stocks

Interest starting

Holding period

Buy & sell quickly with smart filters

Place 1-click orders from watchlist

Order from live TradingView charts

Open your Demat Account today and get instant access to stocks, IPOs, and more.

Place Basket & GTT orders, AMO & more

A Demat Account is an account that holds your shares and other securities in electronic form. Instead of paper certificates, your investments are stored digitally, making it easy and safe to trade.

You need a Demat Account if you want to invest or trade in the stock market because it is mandatory to have one to buy and sell shares in India. It ensures that your securities are safe from theft, loss, or damage, and also eliminates the need for handling paperwork. Apart from safety, it also brings convenience as you can manage all your shares, bonds, mutual funds, and ETFs in one account without any hassle.

A Demat Account provides safety by eliminating the risks of misplaced or forged share certificates, which were common in the past. It also saves time as buying, selling, and transferring securities happens electronically in just a few clicks. Since there is no paperwork involved, the process becomes much more convenient. Another benefit is that you can monitor all your investments in one account and easily track their performance.

A Demat Account works very much like a bank account, except that it holds securities instead of money. When you purchase shares, they are credited to your account, and when you sell them, they are debited. This electronic system makes the transfer of securities quick and seamless, reducing settlement times compared to the older paper-based system.

Yes, there are different types depending on who is opening the account. A regular Demat Account is for residents of India and is the most commonly used. For Non-Resident Indians (NRIs), there are two types: a Repatriable Demat Account, which allows transfer of funds abroad, and a Non-Repatriable Demat Account, where the funds must remain in India.

Open your Demat Account today and get instant access to stocks, IPOs, and more.

Get Started Today